Written by the Mackenzie Fixed Income Team

Key Highlights

- Central banks worldwide are initiating rate cuts, with the US likely to follow soon. The US consumer’s behavior is crucial for market dynamics, with deviations potentially indicating vulnerabilities and the need for monetary intervention.

- We anticipate that the Bank of Canada is less concerned on the potential impact of lower rates on the housing market and is likely to reduce rates up to the upper limit of the neutral rate range at 3.25%.

- Preference for nominal duration in North America and slight rotation towards US duration as more rate cuts are priced in Canada especially at the long end of the curve.

- We have reallocated our exposure from New Zealand to the UK, driven by relative valuations. Additionally, we have closed our short positions in Japanese Government Bonds, which we have maintained across our mandates for nearly two years.

- Rising geopolitical tensions and expensive credit valuations lead to trimming our emerging market exposure and applying CDX options to hedge credit spread risks.

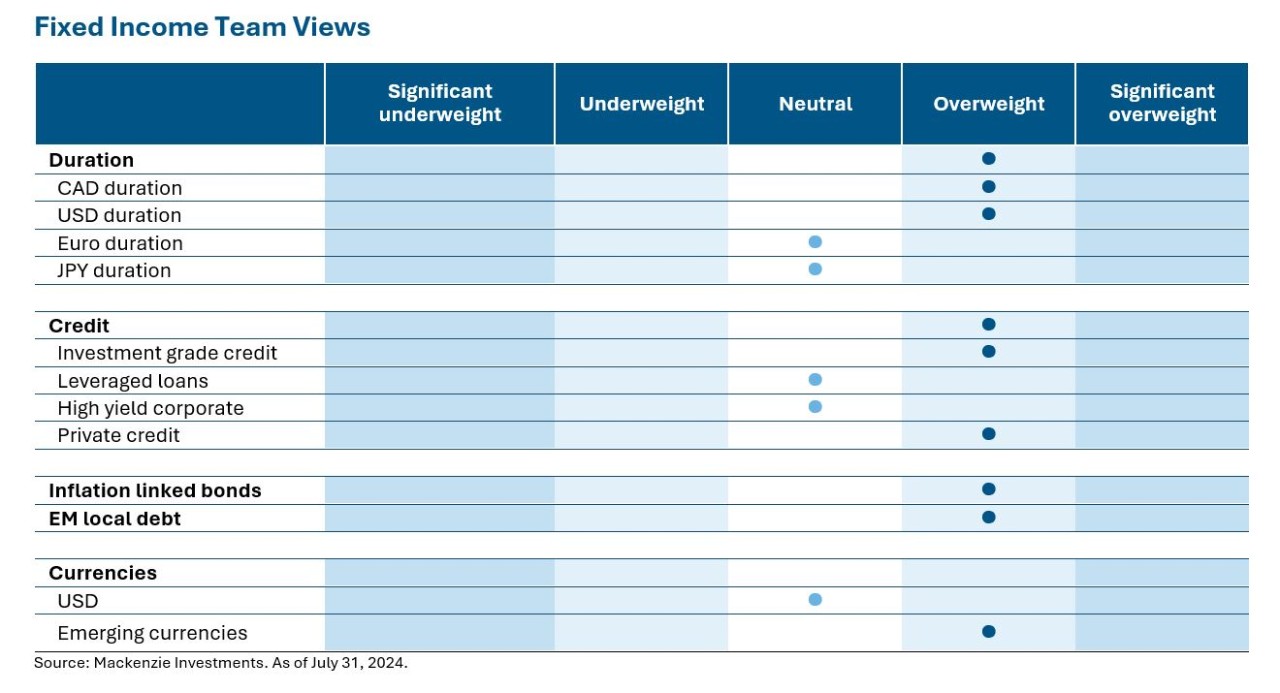

Fixed Income Team Views

Central Bank Watch

US Fed (Fed)

Treasuries witnessed a rally (yields lower, prices higher) as US June inflation – headline and core, surprised with a lower than forecast print of 3% and 3.3% respectively, keeping alive expectations that interest rates could fall faster than policy makers forecast. While employers have continued to add more than 200,000 jobs a month this year on average, the unemployment rate ticked up to 4.1% in June from 3.7% in December. Taken together, that suggests that the size of the workforce is growing, partly due to increased immigration, but that demand for labor is easing. The Fed held rates in July and expressed increased confidence in the disinflationary outlook and outlined the necessary inflation and labor data for a potential September rate cut.

Bank of Canada (BoC)

Canada consumer prices declined in June and slowed to 2.7% y/y on declining gasoline and recreation services — sixth straight month that headline inflation has been within the BoC target range of 1% and 3%. This comes amid a rising unemployment rate, which reached 6.4% in June, or a 29-month high, as growth in the labor force, fueled by immigration, outpaces job creation by a wide margin. BoC reduced its policy rate by 0.25% for a second consecutive meeting to 4.50% and signalled further easing marking a shift in risk sentiment towards Canada’s inflation outlook. Officials listed weaker-than-expected household spending as a main downside risk, pointing to upcoming mortgage renewals as a threat to consumption growth.

European Central Bank (ECB)

The European Central Bank kept rates unchanged and emphasized at its July gathering that it cannot commit to another interest-rate reduction in September citing concerns of a resurgence in inflation. Services inflation failed to decline in June after having jumped to 4.1% in May from 3.7% in April. Euro-area inflation unexpectedly quickened to 2.6% y/y in July, an outcome that may make the ECB warier about cutting interest rates further. At the same time, it seems to be retaining the view that wage growth in the euro area will slow, keeping a cut at the Governing Council's next meeting in September on the table.

Bank of Japan (BoJ)

The BoJ unexpectedly raised its benchmark interest rate by 0.15% to 0.25%, further unwinding the monetary-stimulus policy it has pursued for most of the past quarter-century. The bank announced plans to gradually halve its government bond purchases to ¥3 trillion per month by early 2026. This move, driven by rising inflation in Japan, signals a shift back to what officials consider a more standard monetary policy. Since the BoJ ended negative interest rates and relinquished control over bond yields in March, Japanese government bond yields have been steadily increasing. Leading up to the policy meeting and during the month Yen appreciated from 160.88 to 149.98 yen to a dollar.

Emerging Markets (EM)

Appetite for EM local debt weakened amid volatile FX in high yielding LATAM countries led by election result surprises We see MXN under pressure while US recession concerns are rising. On top of carry trade unwinds, political risks related to potential constitutional reforms in Mexico and the US election are additional headwinds. Brazil held its benchmark Selic unchanged for the second straight month at 10.50%, flagging new risks to its consumer price outlook. South Africa Government Bonds have rallied sharply reflecting improved market sentiment after a government of national unity (GNU) and cabinet were formed. Richer levels may cause investors to turn more level sensitive as the ZAR has outperformed most EM peers in both spot and total-return terms since early June.

Duration and Curve Positioning

With central banks worldwide initiating rate cuts, including New Zealand’s recent move, it appears likely that the US may follow this trend soon. For a significant shift in market dynamics, the next critical factor to observe is the US consumer. Any notable deviation from market expectations could suggest emerging vulnerabilities, highlighting the potential need for monetary intervention. Several economists have revised their forecasts, now anticipating a 50-basis point cut by the Federal Reserve in September. However, this is not our primary expectation currently. While lower inflation may have solidified a 25-basis point cut, we remain unconvinced about the likelihood of a 50-basis point reduction. The upcoming retail sales and labor data will be pivotal in assessing the resilience of the US consumer and determining the future course. We continue our like for nominal duration in North America, but as more & more rate cuts are priced in Canada, we are slightly rotating towards the US duration. On emerging markets, Fed’s coming policy change alone won’t be enough to reinvigorate easing cycles considering woes including resilient service costs and political tensions. With rising geopolitical tensions globally in the face of elections, we have actively derisked our open emerging market exposure. As part of our risk management toolkit, as credit valuations remain expensive, we utilize CDX options to hedge the risk of widening credit spreads. We reflect our neutral view on loans as we see a good opportunity to receive higher coupons & favour higher quality loans in the current economic cycle.

Investment Grade Corporates (IG)

US IG and Canadian IG corporates returned 2.4% and 2% respectively as yields dropped ~35 bps. The performance was driven by rates rally on rising policy rate cut expectations fueled by lower rise in inflation. While the macro environment was relatively volatile the credit markets felt immune with spreads relatively unchanged for the month at 97bps and 130bps accordingly. On the primary side the CAD market saw a relatively steady pace of issuance volume at $7.55bn with the Banks being the most represented (49%).

High Yield Bonds (HY)

High-yield bond yields collapsed in July and spreads widened amid accelerating retail inflows, lighter capital market activity, and as the past months’ economic data and messaging from the Fed bolstered bets for a rate cut in September. High-yield bond yields decreased 32bp and spreads widened 12bp in July to 7.71% and 363bp, respectively. The HY index gained +1.92% in July with CCCs (+3.80%) outperforming. The HY index is providing a +4.84% gain in 2024. Depending on the path of future economic releases and risk sentiment, we believe that spreads could widen because of the growing uncertainty and volatility that needs to be priced into the markets. With that being said, we don’t believe we’ll see the peak spreads encountered in past economic cycles due to; the recency of the most recent default cycle in 2020, strong corporate fundamentals, and overall higher quality ratings mix in below-investment grade credit.

Leveraged Loans (LL)

US leveraged loan gained 0.68% in July after hitting a rough patch in June, as loans continue to benefit from higher base rates — all of this year’s return has come from coupon-clipping. The tech rout affecting broader financial markets weighed down returns last month, given the sector’s large footprint in the loan asset class, especially within the B-minus cohort. On a bright note, repricing and refinancing activity tapered off in July as focus shifted to much-needed LBO and M&A financing, although the massive supply/demand imbalance persists.

Bond Stories

Investment Grade – Aroundtown

Aroundtown is a diversified real estate company, primarily focused on Germany, with a property portfolio valued at approximately €25 billion. The portfolio includes offices, residential properties, hotels, and retail assets. However, its office portfolio is under secular pressure due to the shift towards hybrid work, raising concerns about the long-term value of office real estate. This has caused their bonds to trade at wider spreads compared to peers. Despite these challenges, we remain confident in our position. In recent quarters, the company has successfully completed several disposals and demonstrated its ability to navigate the primary market, issuing new senior bonds and executing a hybrid exchange and a tender offer for its senior bonds due 2025-2026. These actions have enabled Aroundtown to reduce debt ahead of schedule, leading to significant spread compression in their bonds.

High Yield Bond – CommScope

CommScope is a provider of networking infrastructure equipment, primarily to North American and European customers. Its main business segments include Connectivity & Cable (CCS), Outdoor Wireless Networks (OWN), Networking, Intelligent Cellular and Security Solutions (NICS – includes DAS) and Access Network Solutions (ANS). The company has struggled with declining revenue in 2023 but announced strong results and an asset sale of its OWN and DAS segments to Amphenol for $2.1 billion with their Q2 2024 results. The likelihood of a Liability Management Exercise (LME) has decreased and stronger recovery estimates for the debt lifted the secured bond price by 10 points and the unsecured bond price by 30 points.

Leveraged Loan – Gray TV

Gray Television is a television broadcast company that owns and/or operates big four affiliate TV stations and digital properties in 113 TV markets. Gray’s stations were ranked 1st in 79 markets and 1st or 2nd in 102 markets. Gray has been growing through acquisitions including Quincy Media for $925 million, Raycom $3.7 billion in 2019, and Meredith Corp’s Local Media business for $2.8 billion in 2021. The company has managed with relatively high leverage in recent years, but they were able to refinance their 2025 and 2026 debt maturities and more recently have been buying back 2027 bonds at a discount. The company continues to signal a slow and steady approach to deleveraging as opposed to the legal maneuvering of a Liability Management Exercise (LME). In the near term, political advertising spending in the United States is likely to drive the quarterly results and sentiment toward the name. Secured term loan and bond prices were up 2 points and unsecured bond prices were up 10 points heading into the Q2 results.

ESG - Ziggo

VodafoneZiggo was formed as a 50/50 joint venture between Vodafone’s Dutch mobile business and Liberty Global’s Dutch cableco Ziggo in 2016. The group provides fixed, mobile, and integrated communication and entertainment services to consumers and businesses. The group’s revenue mix by product is split cable 62% and mobile 38%. The company continues to perform well in the Dutch market and the unsecured bonds were up 3 points recently on strong results. The company has sustainability goals including a reduction of emissions from Scope 1, 2, and 3 activities. Their green bond progress report from the 2020 green bond issuance points to proceeds allocated primarily to energy efficiency across their fixed and mobile networks. These networks represent 90% of their energy usage. The green bond progress report fixed network showed a 30% reduction in energy use and a 17% reduction in emissions. The mobile networks showed a 32% reductio in energy use and a 44% reduction in emissions.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of June 30, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of June 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.