Written by the Mackenzie Fixed Income Team

Key Highlights

- The Canadian economy has been slowing, with rapid inflation reduction and a vulnerable housing market, while the U.S. shows recent signs of weakness.

- Diverging risks in Canada and the U.S. may lead to differing policies, with potential opportunities in Canadian fixed income.

- Preference for Canadian investment grade corporates on the front end of the curve, and U.S. Treasuries over Canadian federal bonds at the long end.

- Emerging market central banks face limited rate-cutting capacity, risking local currency devaluation and inflation.

- Strategy adjustments include derisking Mexican exposure, exiting UK gilts, and preferring higher-yielding sectors while using CDX options for risk management.

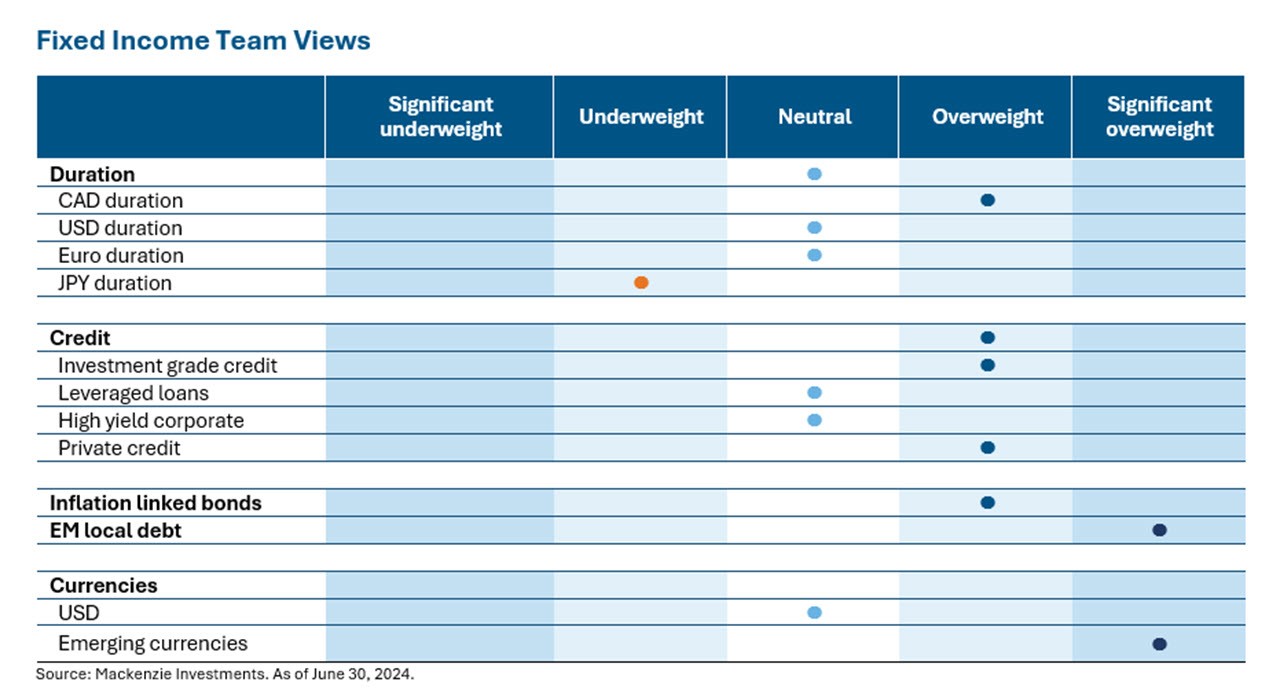

Fixed Income Team Views

Central Bank Watch

US Fed (Fed)

Treasuries rallied as US inflation – headline and core, surprised with a lower than forecast print of 3.3% and 3.4% respectively, boosting rate cut hopes. The Fed’s preferred inflation gauge, Core PCE, met forecasts at 2.6% for May, keeping alive expectations that interest rates could fall faster than policy makers forecast. While progress on inflation was encouraging for the Fed, it decided to keep the policy rate unchanged, maintaining a restrictive monetary stance until further evidence of sustainably lower prices is observed. Near the period end, the rising likelihood of a second Trump administration led yields higher, as investors anticipate policies to increase deficits and inflation.

Bank of Canada (BoC)

The BoC reduced its policy rate by 0.25%, becoming the first G7 central bank to lower rates as Governor Tiff Macklem cited increased confidence in inflation nearing their 2% target and suggested that further rate cuts could follow if inflation continues to slow, though at a gradual pace. Bank’s decision has already pushed the difference between BoC's policy rate and that of the Fed to match the highest levels seen since the Great Financial Crisis, and front-end bond yields display a similar story. A surprise spike in inflation at 2.9% for May complicates the bank's plans for consecutive rate cuts, highlighting ongoing consumer price pressures.

European Central Bank (ECB)

The ECB lowered its key interest rate by 25bps to 3.75%, but provided little guidance on future rate cuts, stating that decisions will continue to be based on incoming data. However, the May inflation print of 2.6% and Q1 wage growth of 5.1% has caused the market to be concerned about the depth and cadence of the ECB easing cycle as the council members continue to remain data dependant without committing to a particular rate path.

Bank of Japan (BoJ)

Japan’s consumer inflation rose 2.8% in May, staying above the bank’s 2% target for more than two years, adding to market expectations for interest rate increases from the Bank of Japan. In a step towards tightening, the BOJ decided to reduce its government bond purchases and will detail the plan at its July meeting. BOJ Governor Kazuo Ueda indicated that interest rates could rise next month, contingent on economic data. Japanese government bond yields have been gradually rising since the BoJ decided to end negative interest rates and abandon its control over bond yields in March. The wide gap in interest rates between Japan and the U.S. has led to material weakening of the yen to levels last seen in Dec’86.

Emerging Markets (EM)

Appetite for EM local debt weakened amid volatile FX in high yielding LATAM countries led by election result surprises. However, sustained gains will likely require stronger signals of US disinflation and Fed rate cuts. Our exposure to South African government bonds contributed as bonds rallied on improved market sentiment towards the country as a government of national unity and cabinet were formed. However, weaker MXN currency weighed on LATAM exposure as the unexpectedly strong election result for the Morena-led coalition has increased the risk of a wave of market-unfriendly legislation during political uncertainty.

Duration and Curve Positioning

While the Canadian economy has been steadily slowing over the past year, the U.S. has only recently shown signs of weakness. Canadian inflation has decreased more rapidly, and its housing market remains vulnerable, with shorter mortgages coming due amid ongoing economic strain. Diverging risks should lead to diverging policies. While back-to-back cuts are uncertain, continued deterioration in the data could prompt the BoC to defy expectations and signal a significant opportunity in Canadian fixed income. We prefer our exposure to Canadian investment grade corporates on the front end of the curve amid relative valuations and potential capital gains. We prefer the US treasuries over Canadian federal bonds at the very long end of the curve in anticipation of a potential spread tightening while clipping higher yield in the process. Emerging market central banks have limited capacity to cut rates when developed market central banks continue to remain restrictive. This policy divergence can weaken local currencies against the U.S. dollar, leading to inflation that some economies are particularly sensitive to. With rising geopolitical tensions globally in the face of elections, we have actively derisked our open emerging market exposure in Mexico with currency hedge, while we continue to expect lower bond yields. We exited our UK gilt holdings due to the potential resurgence of inflation, driven by rising wages and service prices. In the higher yielding space, we prefer allocations to utilities, consumer stapes, telecommunications, healthcare, and credits where the risks are adequately rewarded. As part of our risk management toolkit, as corporate credit valuations remain expensive, we utilize CDX options to hedge the risk of widening credit spreads.

Investment Grade Corporates (IG)

Risk assets remain well bid with equities rising during the quarter and credit spreads remaining depressed. Credit spreads as measured by the CDX indices are close to all time lows. Volatility continues to fall as investors sell volatility under the assumptions of either a soft landing or, more and more, no landing at all. The combination of credit + vol levels is at an all time low. Despite the continued strong corporate bond issuance supply Canadian corporate bonds returned ~1% for the month driven by positive funds flow into the fixed income sector and a supportive monetary policy regime. In contrast, US corporate bond returned 0.64% during the same period.

High Yield Bonds (HY)

High-yield bond yields and spreads decreased 11bp and increased 2bp in June to 8.03% and 351bp, which are 21bp higher and 26bp lower year-to-date, respectively. The HY Bond Index posted a gain of +0.93% in June, with BBs (+1.08%) outperforming Single Bs (+0.88%) and CCCs (+0.65%). Industries that outperformed in June include Autos (+1.39%) and Food/Beverages (+1.35%) and underperforming were Telecom (-0.32%) and Retail (+0.34%). While duration contributed to returns, a benign US CPI report, softer economic data, political turmoil in France, and Fed DOTS support a view of delayed but not necessarily shallower easing cycle. We remain cautious and extremely selective looking at opportunities in the riskier credit space. Additionally, the narrow credit spreads indicate an unfavorable entry point for taking on significant credit risk.

Leveraged Loans (LL)

The US Leveraged Loan Index gained 0.35% in June benefitting from higher base rate led coupon clipping, yet the weakest month since October and down from 0.94% in May. The riskiest CCC rated loans gained 0.66%, outperformed both single-B and double-B loans. Overall returns were detracted from a decline of 0.40% in secondary prices. The average spread to maturity widened slightly to 430 bps, although this year’s massive repricing wave has translated into YTD spread compression. We reflect our neutral view on loans as we see a good opportunity to receive higher coupons & favour higher quality loans in the current economic cycle.

Bond stories

Investment Grade – Canadian Western Bank

Canadian Western Bank (CWB), ninth-largest Schedule I bank by assets, focuses on general commercial lending, equipment financing, commercial mortgages, and real estate project financing, catering to a niche market of middle-market clients. The announcement of National Bank's acquisition of CWB represents a transformative development for both institutions, confirming our CWB investment thesis of strong organic growth and geographic diversification. This all-share transaction, valued at ~$5 billion, underscores CWB's strong franchise and market position, enhancing its credit profile by integrating with National Bank's larger, more diversified platform. Pending regulatory approvals and shareholder consent, the acquisition is expected to close by the end of fiscal 2025, potentially leading to positive implications for CWB's credit ratings, currently under review by Morningstar DBRS. The transaction is viewed favorably for CWB's stakeholders, offering enhanced operational synergies and broader market access, positioning the combined entity to capitalize on growth opportunities across Canada's diverse economic landscape. As a result, spreads tightened materially across the CWB capital structure, representing a significant contributor to performance in the month of June.

ESG - Kloeckner Pentaplast

Klockner Pentaplast is a global leader in high-barrier protective packaging, well positioned with relatively proactive green credentials and exposure to better valued and stable healthcare end markets. In April 2024, Kloeckner Pentaplast bonds had a tumultuous time due to the spillover effect from Altice and Ardagh Packaging Liability Management Exercises (LME) that surprised the market, leading to rumors of a potential LME transaction for the company that were later proven to be untrue. Despite the volatility, we maintained an overweight position due to the company’s market leadership, non-discretionary demand trends, and sponsor support. In June 2024, the company’s 1Q24 earnings call reaffirmed 2024 guidance and confirmed a “regular way” refinancing would be undertaken in the future rather than an aggressive LME transaction. Management highlighted volume recovery driven by product innovation and advances in sustainability. As a result, the bonds surged another 10 points, reaching their YTD high and outperforming the broader market in June.

High Yield Bond – KIK Custom Products Inc

KIK Consumer Products is a top manufacturer of household cleaning and pool treatment products, offering items such as bleach, cleaners, fabric softeners, and trichlor-based spa treatments. The company produces national brands and private label products for customers such as Costco, Dollar General, Family Dollar, Walmart, and Home Depot. In 2021-2022, the company faced significant earnings deterioration due to high-cost inflation, increased investments for facility rebuilding, and higher interest expenses. Recognizing these issues as transitory, we strategically initiated a position in 2023 at a price level around $90. Our conviction was rewarded as the company’s profitability improved over the past year, leading to a recapitalization transaction that called the bonds at $102.5 in June 2024, representing a significant appreciation in the price of the bonds.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of June 30, 2024, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of June 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.