Portfolio Manager Monthly Insights

Jason Miller, MBA, CFA

AVP, Portfolio Manager

Mackenzie Ivy Foreign Equity Fund

Grainger – An example of “Staying the Course”

Grainger has been an Ivy holding since late 2015. The company distributes millions of different maintenance, repair, and operations (MRO) products, ranging from earplugs to wiring harnesses to motors. These products are used wherever industrial activity takes place: factories, construction sites, apartments, offices, or hospitals. Grainger primarily sells these products online.

While Grainger has done well of late, the path hasn’t been smooth. Our ownership and the company’s results met challenges, especially at the outset. A constant that we looked to has been the cultural evolution of management and its adaptation to industry change. Although we often talk about “the path” for our companies, our investment in Grainger is not representative of the expected, but instead it is the “hoped for” that results from the combination of culture and quality at a company, along with patience and critical thinking on our side. Without question, luck – both good lately and bad a while back – played a role.

The attraction

At the time of purchase, Grainger’s financial results were exemplary. From 2003 to 2013, it had grown revenues and earnings per share (EPS) at 7% and 16% compound annual growth rates (CAGR), respectively. The return on invested capital (ROIC) was 38% at year end 2014. The share price had increased by 540% over ’03-‘13 versus the S&P 500 at 105%. We were attracted to the moat, steady growth, and counter-cyclical cash flow generation. Grainger’s competitive advantage versus a “mom-and-pop” distributor was enormous. The company’s growth had been driven by price increases alongside stock keeping unit (SKU), branch and geographic expansion, all of which were hallmarks of the era. Unfortunately, these drivers planted seeds that would ultimately exacerbate external challenges and necessitate re-building entire potions of the company.

The challenge

Within two years of our initial purchase, Grainger faced a set of issues that resulted in the shares underperforming by over 50%. The global economy slowed, mainly in industrial sectors due to growth declines in China. In addition, $50 oil prices negatively impacted US industrial activity. Fears about competition from Amazon reached peak levels. Most importantly, Grainger cut prices in response to market share loss.

Although the macro and Amazon effects were the headlines, the key issue was the price reductions and their cause. Price transparency was a theme during the decade. The internet, once a tailwind for Grainger, had turned into a headwind. Customers were balking at Grainger’s excessive prices despite the company’s high-quality service and delivery capabilities. The company was taking advantage of its market position by aggressively harvesting customer value. Customers were leaving to competitors with better websites, cleaner product assortments and lower prices.

Product breadth and assortment also became a problem. The addition of SKUs had initially satisfied customers and drove financial results. As Google’s dominance increased and customer demographics evolved, merchandising products online meant Grainger’s website was confusing and out of touch. It had to rebuild and rethink how it marketed and sold online. In some cases, it had too many SKUs.

The reboot

Much of the work was spearheaded by the company’s CEO, Don Macpherson, who knew a cultural reboot was necessary. Grainger needed greater technology acumen and a stronger performance culture – particularly one that paid more attention to customers.

There were several examples of this cultural and technological evolution, the first of which was Gamut. The company built Gamut as a second website and a research and development vehicle. Here, Grainger fine-tuned its website and brought in more sophisticated merchandising and data techniques to make it best-in-class. Using this, the company then rebuilt its entire Grainger.com website, going category by category in a process called re-merchandising. The tech refresh continued with Grainger disconnecting its legacy enterprise resource planning (ERP) software and building its own proprietary software for product and customer management. An example of Grainger’s improved technology use is enhancing customer information via satellite imagery to build a better picture of a factory, from how large it is to how many doors it has. A long-standing problem in the industry was that competing salespeople would carry local knowledge that some of Grainger’s salespeople might not have, so the company devised ways to use technology to improve its knowledge of customers to better understand their needs. Along the way, the company conducted A/B testing, which we view as a function of management prioritizing curiosity as an enabler. This powered improved returns on marketing, mainly in digital channels but also in more traditional channels such as radio and television.

The result

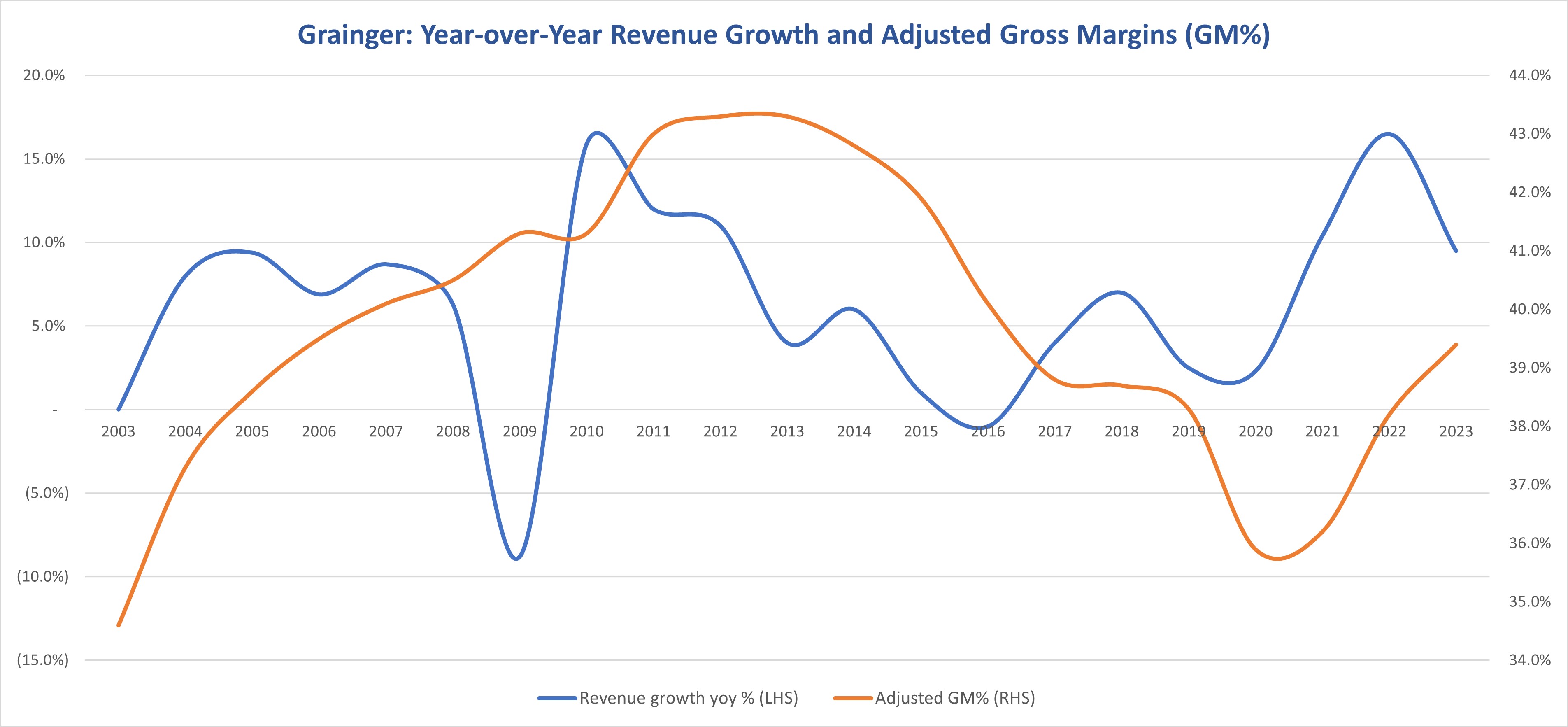

The result of this effort is evident across financial metrics, primarily organic growth and gross margins (GM%). During the 2000s, GM% increased steadily translating to EPS growth. However, the consequences came later with GM% declines and growth struggles throughout the mid 2010s. Post Grainger’s investments we’ve seen modest increases with the company de-emphasizing further GM% increases to remain competitive and drive growth.

In some respects, Grainger has transformed itself. While we didn’t directly predict much or any of this, our investment was premised on a business with strong competitive advantages, with a positive and reinforcing corporate culture in a resilient industry and a reasonable purchase price. When these characteristics are combined, we’d like to think things will work out. In rare and lucky cases like this, the results can be much stronger than expected.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of February 4, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.