From the desk of the Mackenzie Global Equity & Income Team Q4, 2024

Mackenzie Global Dividend Fund

Highlights:

- The re-election of Donald Trump could have significant implications for markets and the global economy, with potential new tariffs and policies impacting trade and economic stability. The market is adapting to a de-globalizing world, but the specifics of Trump’s policies will be crucial in determining their impact.

- The Federal Reserve cut interest rates in November and December, while geopolitical tensions and shifting monetary policies influenced markets. The US was the best performing region, supported by steady economic growth, whereas Europe struggled with political instability and weakening consumer confidence. Japan saw improvements in consumer spending and business investment.

- The strategy focuses on high-quality companies with strong financials and appropriate valuations and will maintain this disciplined approach amidst ongoing technological change, geopolitical uncertainties, and economic risks.

As we close the books on the final quarter of 2024, global markets presented a mixed bag of performances, influenced by shifting monetary policy expectations and ongoing geopolitical tensions. The Fund returned +4.6% (after fees) in the fourth quarter, which lagged the MSCI World benchmark return of +6.3% (in CAD). We can accept this sort of absolute return over a three-month basis, and our underperformance is mainly a function of not having enough of the best performing sectors (Consumer Discretionary +15.8%, Communication Services +13.6%, and Information Technology +11.4%), and higher exposures in some of the weaker areas (Materials -8.8%, Healthcare -5.7%, and Consumer Staples -0.4%). Financials (+10.7%) also advanced, benefitting from the steepening yield curve. Materials were hurt due to concerns over China’s subdued demand for commodities, and Healthcare stocks were pressured by regulatory uncertainty following Robert Kennedy, Jr.’s nomination to head the US Department of Health and Human Services. Regionally, the US was the best performing region, supported by steady economic growth and resilient employment. The Federal Reserve cut interest rates in November and December but hinted at a potential pause in the rate-cut cycle due to persistent inflation, alarming bond markets and driving yields higher. While there is no lack of speculation in terms of what the impact will be with Donald Trump and the Republican party back in control, as of right now the US is supported by a reasonably strong economy. Europe was weighed down by ongoing political instability and weakening consumer confidence. The Bank of England and the European Central Bank also cut rates, while the Bank of Japan kept rates unchanged. Japan held up reasonably well as both consumer spending and business investment improved. China struggled with deflationary pressures despite ongoing fiscal and monetary stimulus.

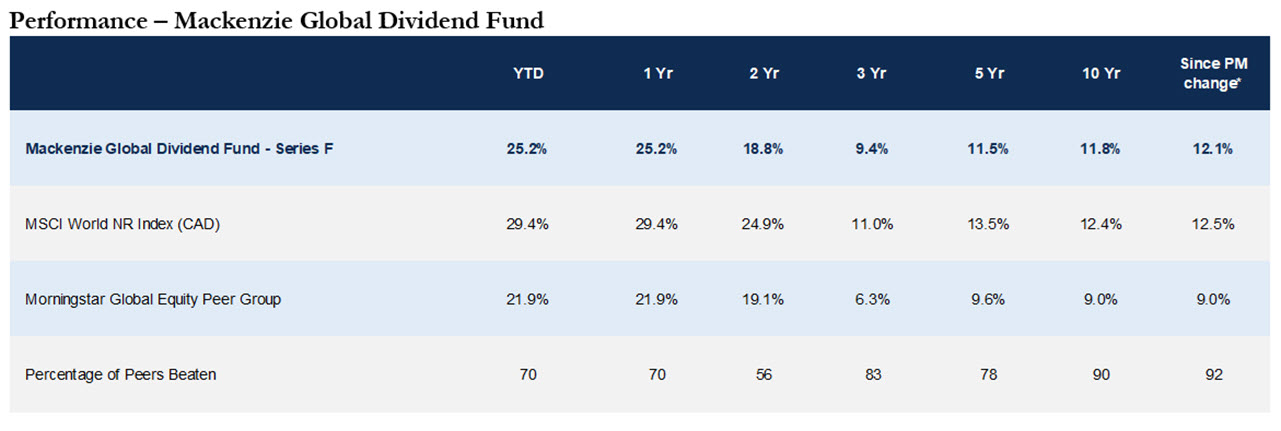

For the entire year, the Fund returned just over +25% (net of fees) vs the MSCI index +29%. While there were obviously a number of puts and takes throughout 2024 (for those interested please refer to our Q1, Q2, and Q3 commentaries), it really came down to how much exposure one’s portfolios were exposed to the “Magnificent Seven” i.e. Apple, Microsoft, NVIDIA, Amazon, Meta Platforms, Alphabet and Tesla. We are and have been systematically underweight this collection of companies, most notably NVIDIA (+195% in 2024) and Tesla (+77%). We have not been completely absent – we have owned Microsoft and Apple over 10 years and Amazon and Alphabet going on four years. But we are acutely aware of the role these companies have played in both our returns and global benchmarks. We will only continue to own these companies if we feel we are paying an appropriate price based on our assessment of the company’s competitive moat, its quality of business, and its long-term growth prospects. We reserve the right to change our mind (and position size) if any of these aspects of the company were to shift. We will not make decisions based on what we call “arbitrary analysis” i.e. making an investment call based on its weight in an index or just because it’s gone up (note: the two are connected). The reason we are willing to own a company at 30x earnings today compared to under 20x earnings a decade ago is simple: our analysis indicates it is a better business that is growing faster with higher margins and has an even more entrenched competitive position. If and when that changes, we will adjust our investment view and portfolio positioning accordingly. This is the case for every investment we have, whether it’s 5 basis points in our benchmarks or 500 basis points.

In 2024, there were elections in 64 countries around the world, with approximately 4 billion eligible voters casting more than 1.6 billion ballots. But there was none more consequential than the US election held on November 5th. The re-election of Donald Trump may not have been as surprising as the 2016 results, but it could have more significant implications for markets and the global economy. The market appears less concerned this time about an escalating trade war, as the global business community has already adapted to tariffs, sanctions, and other disruptive policies over the past eight years. Investors and the public have become more familiar with protectionist ideas, and the economy and society have adjusted to a “de-globalizing” world. But this time around might be different, and Trump has clearly shown signs of being even more…emboldened. The devil will be in the details. Assume Trump’s tariffs are not a bluff, and the US introduces a 15% tariff on everything imported from China, Canada and Mexico (as a start). Will it be applied broadly or be much more surgical? What will be the macroeconomic impact and the response/retaliation from the countries involved? A universal tariff in conjunction with cutting the corporate tax rate would be a first-time policy mix. It has never been tried before because the US runs such a large trade deficit and could result in the most disruptive of economic forces: stagflation.

For the better part of 80 years consumption and production went up together until 2000. Then China joined the World Trade Organization (WTO). Almost immediately industrial production in developed economies – and particularly the US – declined as corporations were happy to outsource their manufacturing capacity to China. The resultant influx of cheap goods benefited consumers enormously but at the expense of manufacturing industries. The hollowing out of US industrial production drove up rural unemployment and poverty rates. The gap in divergence between consumption and industrial production grew. The Trump administration is attempting to close that gap. They hope to repatriate supply chains and strong-arm companies to invest in domestic production. They can no longer just be importers and sellers. He hopes to create jobs for people by deporting undocumented immigrants. How this will all be accomplished without causing an inflation spike remains to be seen. Automatically increasing the cost of imported goods via tariffs and restarting domestic production capacity at a higher cost than what is currently realized in China and other developing nations is not deflationary. Additionally, it is estimated that immigrants make up 10-20% of the labour force that goes into crop production, construction and housekeeping services. Assuming companies will find able-bodied American citizens to fill those jobs, will they be at the same hourly rate as the workers they are replacing? These are the questions that remain unanswered as of today.

Tariffs, cost cuts (DOGE), deregulation, oil and gas production (“drill baby drill!”), deportation, tax cuts, crypto, medical freedom, and agency purchase: the incoming US administration has set an aggressive agenda. The market will react positively to some, and negatively to others. How it all works out is anyone’s guess, but we suspect it will be a volatile year. Given this complexity, a top-down approach to investing will be even more unreliable than before. Our investment strategy remains consistent, focusing on high-quality companies with superior financial metrics and appropriate valuations. Amidst ongoing technological, geopolitical, and macroeconomic risks, we will continue to position the portfolio to navigate these uncertainties as best we can.

What contributed positively to performance?

Broadcom (AVGO) is back in the top performer category after the company revealed in its quarterly update increased confidence that the addressable market for their three custom silicon customers will be $60bn to $90bn by 2027 based on updated roadmaps. While we appreciate this is a wide variance it is significant when you consider that Broadcom posted total revenues of $52bn in 2024. The addressable market could rise even further if Broadcom wins the additional two hyperscaler customers that it currently does not supply to. Meanwhile, Broadcom’s software business is being aided by the continued integration of VMware and continues its steady, albeit unspectacular growth while its non-AI semiconductors are poised for recovery. Putting it all together we believe CEO, Hock Tan and team will continue generating shareholder value as they have done for the last two decades.

Midstream powerhouse Williams (WMB) performed well on the back of a solid quarter that saw a raise in 2024 guidance and reaffirmation of 2025 guidance. We continue to believe that Williams has unique positions in the Appalachian and Gulf of Mexico regions including its crown jewel asset, Transcontinental Pipeline, which transports roughly 1/3 of all US natural gas. As the largest interstate natural gas pipeline, Transcontinental spans nearly 16,000 kms through 13 states from New York to Texas, making it one of the most privileged assets in the world. Williams continues to prudently reinvest in its capacity behind a view on long term natural gas demand growth driven by rising global demand owing to electrification and US liquefied natural gas exports that are expected to double by the end of the decade

Amazon (AMZN) was a top performer during the quarter following strong quarterly results. Significant investments in logistics on the back of the COVID-19 pandemic led to negative free cash flow and this has now turned positive as it leverages those investments, lowers its cost to serve and thereby capture a growing share of retail sales in the US. In defiance of the law of large numbers, Amazon continues to grow its $600BN+ revenue base in the low double digits. Meanwhile, the $50 billion+ profit base is growing faster than revenues as margins continue to expand. We remain bullish on Amazon as e-commerce continues to gain share of consumer spending, while Amazon gains share within e-commerce. Amazon Web Services (AWS) has reaccelerated and remains the market leader in the trillion-dollar cloud market, while the $50 billion advertising business continues to shine to the upside. This was a $30 billion business only three years ago. Despite continued aggressive reinvestment into their business, we believe Amazon’s free cash flow will more than double over the next three years and it remains a top ten position.

What detracted from performance?

Coca-Cola’s (KO) shares pulled back in Q4, after reaching all-time highs the previous quarter, due to the general rotation away from defensive stocks amidst renewed excitement about economic growth. Coca-Cola owns five of the world’s top ten beverage brands including its namesake, with a commanding 45% share of the global carbonated soft drink market, providing it with significant competitive advantages in scale and distribution. Steady demand in developed markets along with product innovation and expansion in emerging markets provides a stable income stream that enables the company to continue its impressive history of having increased its dividend for over sixty consecutive years.

During the quarter, Glencore PLC's (GLEN UK) share price was pressured by delays in near-term cash returns and potential M&A activity in coking coal. The market focused on the likely delay of approximately US$1bn from the sale of its Viterra assets to Bunge, now expected in early 2025 instead of late 2024. This delay frustrated investors who anticipated these funds for capital returns. Additionally, potential acquisitions of steelmaking coal assets raised concerns about reduced cash available for shareholder distributions. Despite these issues, Glencore's Q3 2024 operational results met or exceeded forecasts, with steady earnings from the marketing division and recovery in core industrial volumes. Analysts remain positive about Glencore's medium-term cash generation potential, expecting momentum to return once the Viterra sale concludes and M&A activity is clarified. The company's commitment to disciplined net debt levels and its diversified commodity mix, particularly in "net green" metals like copper and cobalt, positions it well for future growth. The investment thesis remains intact, with long-term demand for green metals expected to drive higher price levels and cash flow.

The data results of the Cagrisema trial significantly impacted Novo Nordisk's (NOVOB DC) stock price in Q4 2024. The trial results, released in December 2024, were disappointing as they fell short of expectations. CagriSema, a next-generation obesity drug, led patients to lose 22% of their weight at 68 weeks, which was below the company's projection of about 25% weight loss. This led to a sharp decline in Novo Nordisk's stock price, which dropped by nearly 20% following the announcement. Investors had high hopes for CagriSema and while the results are objectively good from an efficacy standpoint, there was confusion over the drug trial design and the “miss” raised concerns about Novo Nordisk's ability to maintain a competitive edge in the obesity drug market. We still believe Novo Nordisk will be a major player in what will be a market that could exceed $100 billion over time but have position-sized our investment accordingly based on this recent setback.

What changes have we made to the Mackenzie Global Dividend Fund?

We initiated a position in AT&T (T), one of the world’s largest providers of wireless and internet services – marking the first Telco holding for the Global Dividend fund in over eight years. Historically, we were discouraged by the industry’s competitive intensity – high networks costs and phone subsidies led to lousy returns on capital. Today however, the industry has consolidated to three large wireless carriers who bundle both phone and internet services to retain customers. With the largest fiber internet footprint and a leading wireless business, we believe AT&T has the most compelling bundle to customers, and yet the stock is amongst the cheapest in telecom – while paying a 5% dividend yield.

We initiated a position in Morgan Stanley (MS), a global financial services giant. Morgan Stanley is one of the largest wealth managers in the world, overseeing more than $5 trillion in assets under management. The company has focused on shifting its business towards asset management (now half of sales), given its consistent, fee-based income, while reducing reliance on more volatile trading and investment banking segments. That said, Morgan Stanley holds a prominent position as a top-tier investment bank where it excels in equity underwriting and M&A advisory – areas that are well below historical trend levels and expected to benefit from increased M&A activity driven by U.S. President-elect Trump’s promise of less regulation, lower corporate taxes, and broadly pro-business stance.

We established a position in Techtronic (669 HK) this quarter. Techtronic is the largest global handheld power tool manufacturer with core brands such as Milwaukee, Ryobi, and Hart. The company has grown revenues rapidly at 12% CAGR over the past ten years based on its leadership in power tool battery technologies, converting users to cordless power tools from corded, pneumatic hydraulic, and petrol power sources. The company produces new products on a common battery system, creating an ecosystem that results in higher user loyalty, as well as higher aftermarket battery revenues at higher margins. This flywheel effect has allowed the company to grow operating profits ahead of revenues at 15% CAGR over the past ten years. While Techtronic maintains its strengths in handheld power tools, the company has also made inroads on tackling new verticals such as outdoor equipment (lawnmowers), construction equipment, and protective gear, further expanding the company’s addressable market and future growth opportunities.

We established a position in Tokio Marine (8766 JP) this quarter. Tokio Marine is the largest Property & Casualty insurer in Japan and was originally founded in 1879. Tokio Marine as well as the overall insurance industry in Japan has improved significantly over the past several years as regulators have restored rationality to the industry. The company has grown profits at a ~13% CAGR over the past five years, outperforming some of the highest quality insurance companies in the world. A major driver of this profitable growth has been the company’s international businesses which focuses on niche specialty insurance lines and generates industry-leading combined ratios; these specialty insurance lines were built through disciplined acquisitions where Tokio Marine has generated an ROI of 21% on historical acquisitions. In addition, Japanese financials regulator (FSA) has mandated all insurers to sell down their cross-shareholdings – which would generate ~¥3.5 trillion in cash for Tokio Marine that can be reinvested in the business and returned to shareholders based on the company’s developed capital allocation framework. This along with a more profit-oriented industry is a key component of our thesis.

We initiated a position in VICI Properties Inc. (VICI), the world's largest casino REIT. VICI owns a portfolio of leading properties including the MGM Grand, Caesar’s Palace, and The Venetian – we believe this provides barriers to entry versus competitors. VICI’s portfolio is 100% leased, with 86% contractually recurring revenues, and pays a ~6% dividend yield today. With an investment grade balance sheet and what has proven to be a resilient business over time, VICI provides downside protection while providing optionality for future growth through M&A.

To make room for AT&T, we sold our position in ConocoPhillips. While we remain constructive on Conoco’s quality relative to other E&P’s, we are concerned that changes in White House philosophy could lead to higher energy production and consequently lower energy prices. We view AT&T and Conoco as businesses of similar quality, but AT&T trades at a lower valuation. In our opinion, the switch will increase portfolio yield and decrease portfolio valuation, without sacrificing on business quality. London Stock Exchange Group plc was replaced with Morgan Stanley. LSEG remains on the Dream Team, and we will be happy to revisit at a greater discount, but we felt the combination of more attractive valuation and better medium-term prospects warranted the switch. Pernod Ricard SA was sold as we consolidated our spirits position within Diageo plc, which has a more attractive geographic mix (more North America and less China). Building materials and chemicals company Sika AG was sold in favor of Techtronic Industries, which we felt offered more attractive risk-adjusted returns going forward.

Portfolio Management Team

Darren McKiernan, Head of Team, Senior Vice President, Portfolio Manager, Investment Management, Mackenzie Investments

Katherine Owen, Vice President, Portfolio Manager, Investment Management, Mackenzie Investments

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of December 31, 2024 including changes in security value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document includes forward-looking information that is based on forecasts of future events as of January 31, 2025. Mackenzie Financial Corporation will not necessarily update the information to reflect changes after that date. Forward-looking statements are not guarantees of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Some of these risks are changes to or volatility in the economy, politics, securities markets, interest rates, currency exchange rates, business competition, capital markets, technology, laws, or when catastrophic events occur. Do not place undue reliance on forward-looking information. In addition, any statement about companies is not an endorsement or recommendation to buy or sell any security.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

On July 26, 2013 the Mackenzie Global Dividend Fund changed its mandate from investing in equity and fixed income securities of companies that operate primarily in infrastructure related businesses to investing primarily in equity securities of companies anywhere in the world that pay or are expected to pay dividends. The past performance before this date was achieved under the previous objectives.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.