Highlights

- The Canadian economy has been flirting with a recession for the past year, severely underperforming peers.

- Even once short-term weakness abates, Canada faces the prospect of low long-term economic growth.

- A weaker Canadian dollar would both jump-start the economy and nudge Canada towards sustainable long-term growth.

US presidential candidate Donald Trump recently bemoaned the strength of the US dollar, suggesting a weaker greenback would be beneficial to the US economy. His pick for Vice President, J.D. Vance, has gone as far as advocating for a forced devaluation of the US dollar. We haven’t seen US government intervention in exchange rates since 2011.

While an overvalued US dollar is distorting the global economy to some extent, it’s hard to argue that it has prevented the US economy from thriving. The US economy has outperformed every other major economy in the 2020s. It recovered faster than peers from the COVID-19 shock and has grown above potential for the past three years, seemingly undisturbed by surging Federal Reserve (Fed) interest rates.

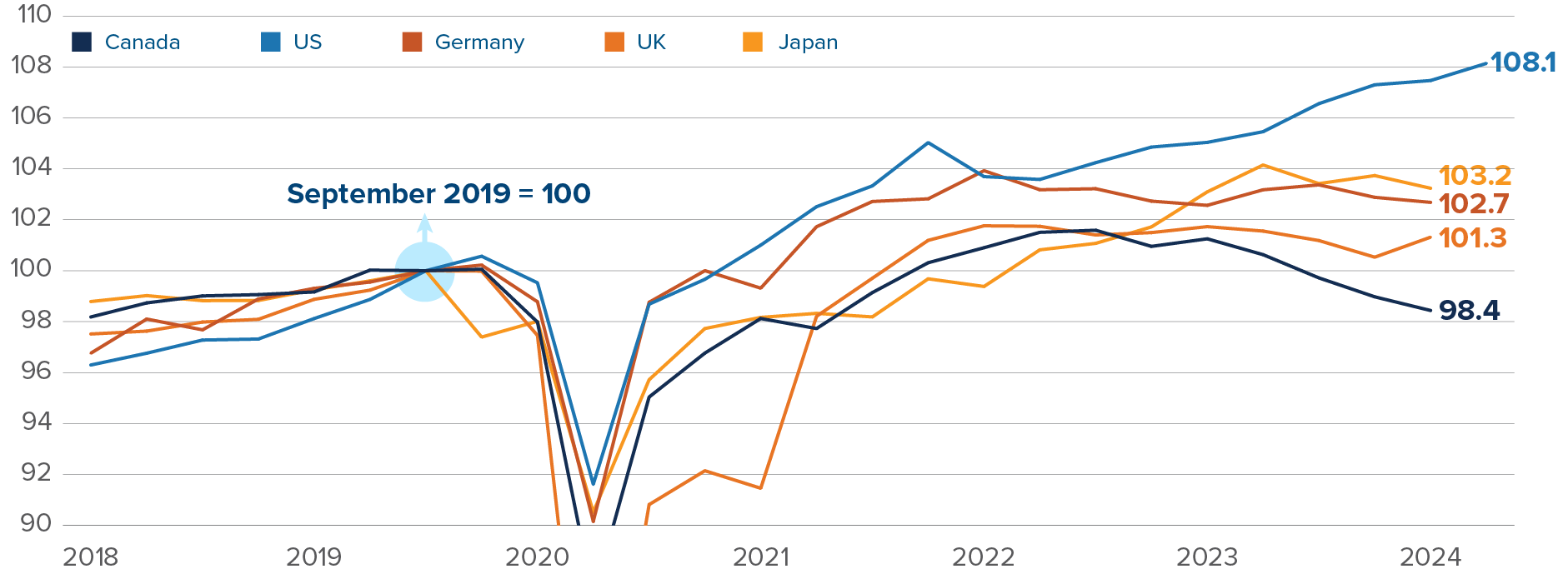

In contrast, the Canadian economy’s performance over the past few years has been shoddy. Following a spurt of high inflation in 2022, Canada has been flirting with a recession for the past year. But the economic malaise in Canada is deeper than a few quarters of GDP stagnation. Our Budget 2024 preview showed that while population aging was the culprit behind sluggish Canadian GDP per capita growth in the 2010s, the post-COVID languor has more troubling roots. Real GDP per prime-age resident (25 to 54-year-olds), which adjusts for the effect of population aging, is 1.6% below its 2019 level. Even Germany and the UK, both rocked by an energy crisis and political turmoil in the post-COVID era, have seen their per capita production grow over that period.

Bottom of the pack in per capita growth

GDP per prime-age resident (25-54 year olds)

Source: Bloomberg.

Perhaps Canada should be the one yearning for a weaker currency, not the US. Canadians often have the intuition that the Canadian dollar is undervalued, mostly because they fondly remember the parity days of 2011-2012. But the Canadian and global economic backdrops have changed greatly since USD/CAD hovered around parity 12 years ago. The combination of the mid-2010s fracking revolution in the US and a ratcheting down in China’s economic growth rate impacted demand for Canadian exports. Today, a sub $1.40 level on USD/CAD is not particularly cheap for the Canadian dollar.

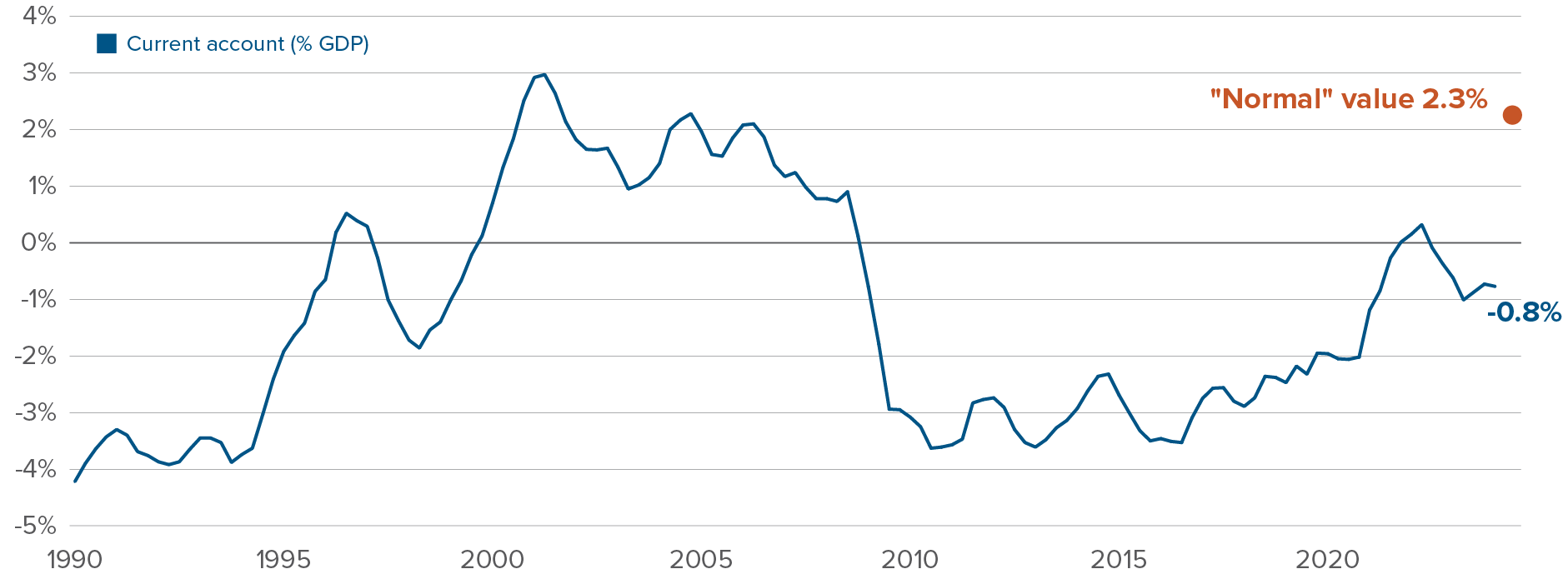

Canada is a net borrower to the rest of the world. In recent quarters, Canadians imported more than they exported, financing the gap by borrowing abroad. With the prices of oil, metals, and agricultural products generally well above their pre-pandemic levels, a commodity-exporting country like Canada should currently be running a current account surplus, not a deficit. A weaker currency would flip the deficit to a surplus. The International Monetary Fund estimates that based on external balance considerations, the Canadian dollar is overvalued by around 6% against its trading partners’ currencies.

A weaker Canadian dollar would flip the current account back to a surplus

Current account balance (% GDP), with IMF estimate of “normal”

Source: Statistics Canada, International Monetary Fund.

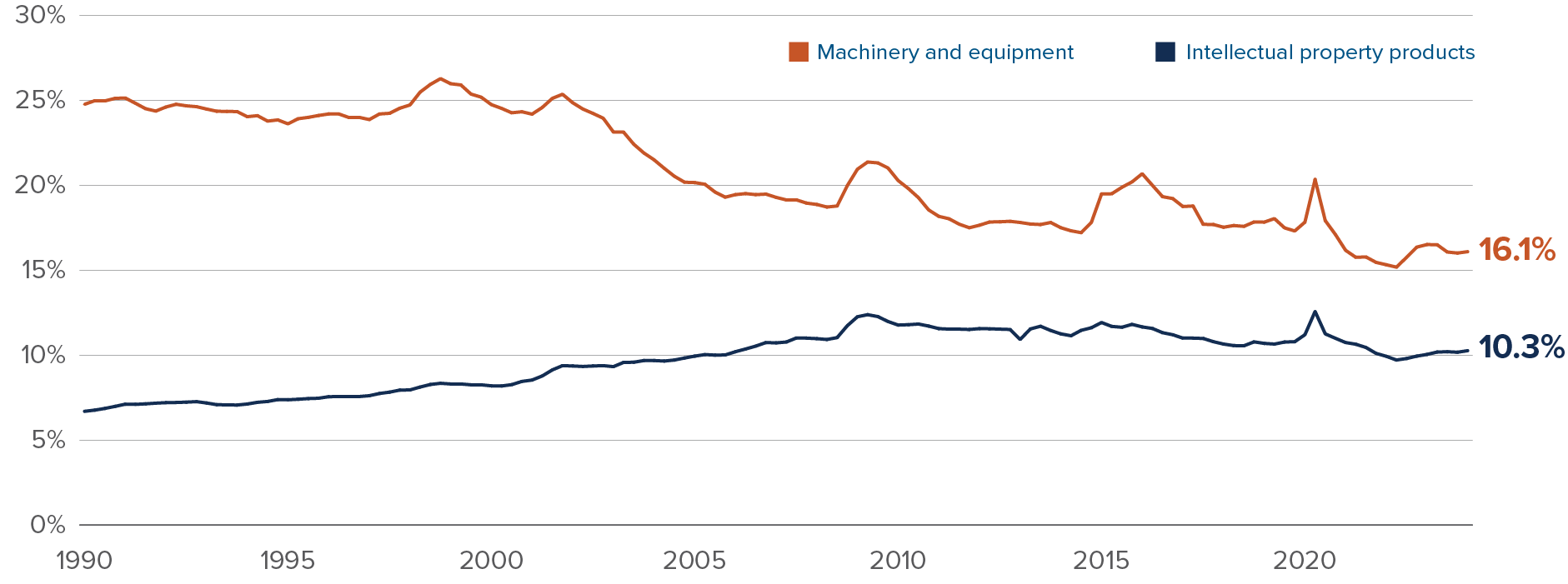

A weaker CAD could help rebalance the Canadian economy towards sustainable economic growth. Over the past decade, Canadian growth has become more and more dependent on debt-fuelled consumer spending. Inflows of foreign capital into Canadian real estate forced homebuyers to keep pace by ramping up borrowing. On the other hand, business investment faltered, as the oil and gas industry lost favour among investors, surging land prices pressured company profit margins and corporate regulation tightened. A weaker Canadian dollar would rebalance the economy away from “forced” consumption towards investment and exports.

A steady erosion in Canada’s ability to make things

Accumulated stock of capital as a % of GDP

Source: Statistics Canada.

A weaker CAD probably won’t require any explicit “weak dollar” policies from the government. We expect the Canadian dollar will weaken unprovoked. In our view, the Bank of Canada will cut rates without regard to the Fed’s actions, and we could see an interest rate spread of up to 2% between Canada and the US in 2025. This could send the USD/CAD exchange rate above the psychological $1.40 marker. And interest rates will stay lower in Canada than in the US over the next decade. Low productivity growth in Canada calls for lower interest rates in the long term. Plus, the Canadian federal government started tightening the budget just as recession risks emerged. This trend of lower budget deficits will probably persist for the rest of the 2020s, especially if the Conservative party forms the next government. Contrast that to the US, where the government is likely to keep running massive deficits, regardless of whether Democrats or Republicans win in November. This would force the Fed to keep rates high.

However, a few government policies could indirectly nudge the Canadian dollar towards lower exchange rates with other major currencies.

- Further constraining foreign buyers in the Canadian housing market. Foreign capital is flowing to the unproductive real estate market, propping up the value of the Canadian dollar in the process.

- Building more homes. Canadian housing is an attractive asset for foreign investors because its supply is constrained. Build more of it, through a combination of up-zoning and government incentives, and the CAD-boosting speculative flows should abate.

- Tightening bank lending standards for mortgages. Mortgages are good business for banks, generally preferred to business loans. As a percentage of banks’ loan books, mortgages have increased steadily, today exceeding 50% in some cases. Canadian mortgages can easily be packaged into liquid securities and a chunk of them benefit from an explicit government guarantee. Rejigging the rules would cool speculation and lower real estate’s attractiveness for foreign investors.

- Run budget surpluses when times are good. When the Canadian economy was humming in 2021 and 2022, the federal government kept running budget deficits, recycling excess revenues into fresh spending. Keeping a more balanced approach to fiscal policy would likely reduce volatility in the exchange rate.

Some analysts have been pushing the narrative that the Bank of Canada won’t keep cutting rates because Governor Macklem is worried about the Canadian dollar depreciating. This greatly overstates how much the Bank of Canada cares about the Canadian dollar exchange rate. Canada’s currency floats freely, and both the government and the central bank are happy to let it do so. Governor Macklem would certainly prefer avoiding volatile changes in the Canadian dollar’s value. But he won’t really care about the level of the dollar — certainly not enough to prevent the Bank of Canada from forcing interest rates well below US rates, if that is what Canadian economic conditions warrant (they do!). In fact, a weaker Canadian dollar is a key ingredient in the recipe for jump-starting the Canadian economy.

Capital markets update

What we’ll be watching in August

August 8: Canada June jobs data release

- The Canadian economy shed 1.4k jobs in June. In particular, June marked a third straight month of job losses in the sensitive construction sector. The weak June jobs print crystallized odds of a rate cut at the Bank of Canada’s meeting on July 24.

- In our view, the Bank of Canada will progressively knock down interest rates until data can confirm that the Canadian economy is inflecting higher. A return to healthy job creation and a ticking down of the unemployment rate are at the top of the list to see a pause in the cutting cycle.

August 30: Canada Q2 gross domestic product

- Q2 GDP for the US came in above expectations a few weeks ago (+2.8%, +2.0% expected). Can Canada finally interrupt its string of GDP growth underperformance versus the US?

- Unfortunately, we are unlikely to see a real pickup in Canadian growth until the Bank of Canada rates are back around 3%. With the unemployment rate rising from 5.4% to 6.4% over the last 12 months, Canada is most likely in a recession. The federal government has decided to tighten the purse strings just when growth ground to a halt. As a result, only the Bank of Canada can jump-start the economy.

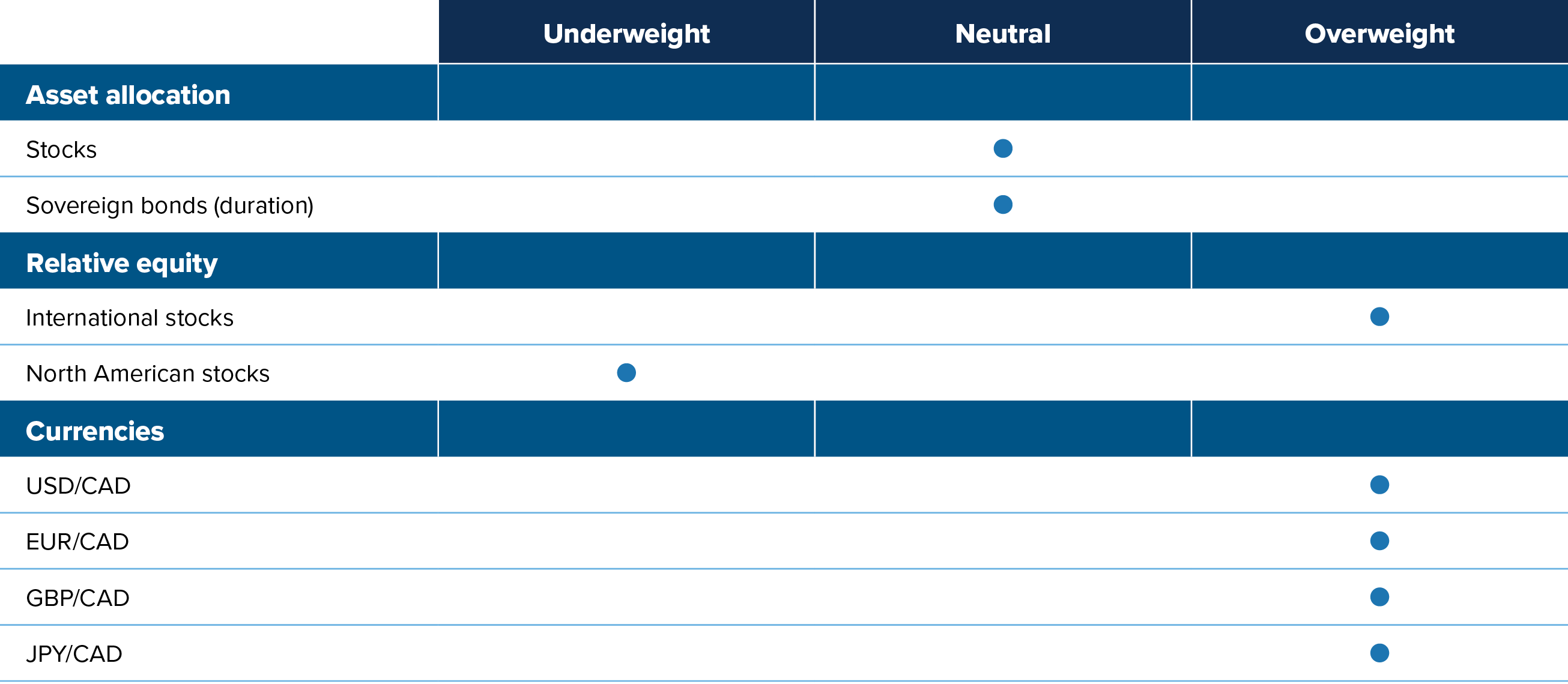

Multi-Asset Strategies Team’s investment views

Tactical summary

Note: The views expressed in this piece apply to products that are actively managed by the Multi-Asset Strategies Team.

Positioning highlights

Turning neutral on duration: We’ve mostly shied away from duration over the past few years. We preferred leaning into stocks for returns and saw US recession odds as overblown. We tweaked this view a few weeks ago, turning neutral on duration. In the Global Macro Fund, we added bond exposure through short-term two-year government bonds, betting on anticipated rate cuts by developed central banks.

Overvalued US assets: We generally don’t like US assets, whether equities or bonds. Not only do international stocks generally have more attractive valuations than North American assets, but they should also benefit from promising macro catalysts ahead.

Moving to rate-sensitive sectors: Health care stocks look less attractive going forward. The sector was one the best-performing in May, and the top positive contributor to our sector strategy. But we closed that position towards the end of May, with signs of deteriorating fundamentals starting to worry us. Analyst forecasts have turned down sharply. Plus, macro signals are favorable to more rate-sensitive sectors like real estate, which is now one of our favorite sectors, while health care is our second least-favourite sector as of the end of July.

Canadian landing: The macro situation in Canada is much more dire than in the US. The Canadian economy has an argument for the worst-performing economy in the first half of 2024. The job market is deteriorating quickly, especially when adjusting for working population growth and government hiring. We have been adding to our short Canadian dollar position, already one of the largest bets in the Mackenzie Global Macro fund.

Commodity-exporting EM currencies: Commodity-exporting EMs are well situated to outperform in this macro environment. Their budgetary and external balances have improved amid high global nominal growth and high commodity prices. Their central banks started raising rates much earlier than the rest of the world. As a result, they have generally reached the end of their tightening cycle, reducing the risk of overtightening into a recession. But the level of rates remains high, offering positive carry over most other currencies. On the other hand, we hold a negative view on the currencies of Asian EM countries. Their external positions have severely deteriorated, and their interest rates are relatively low.

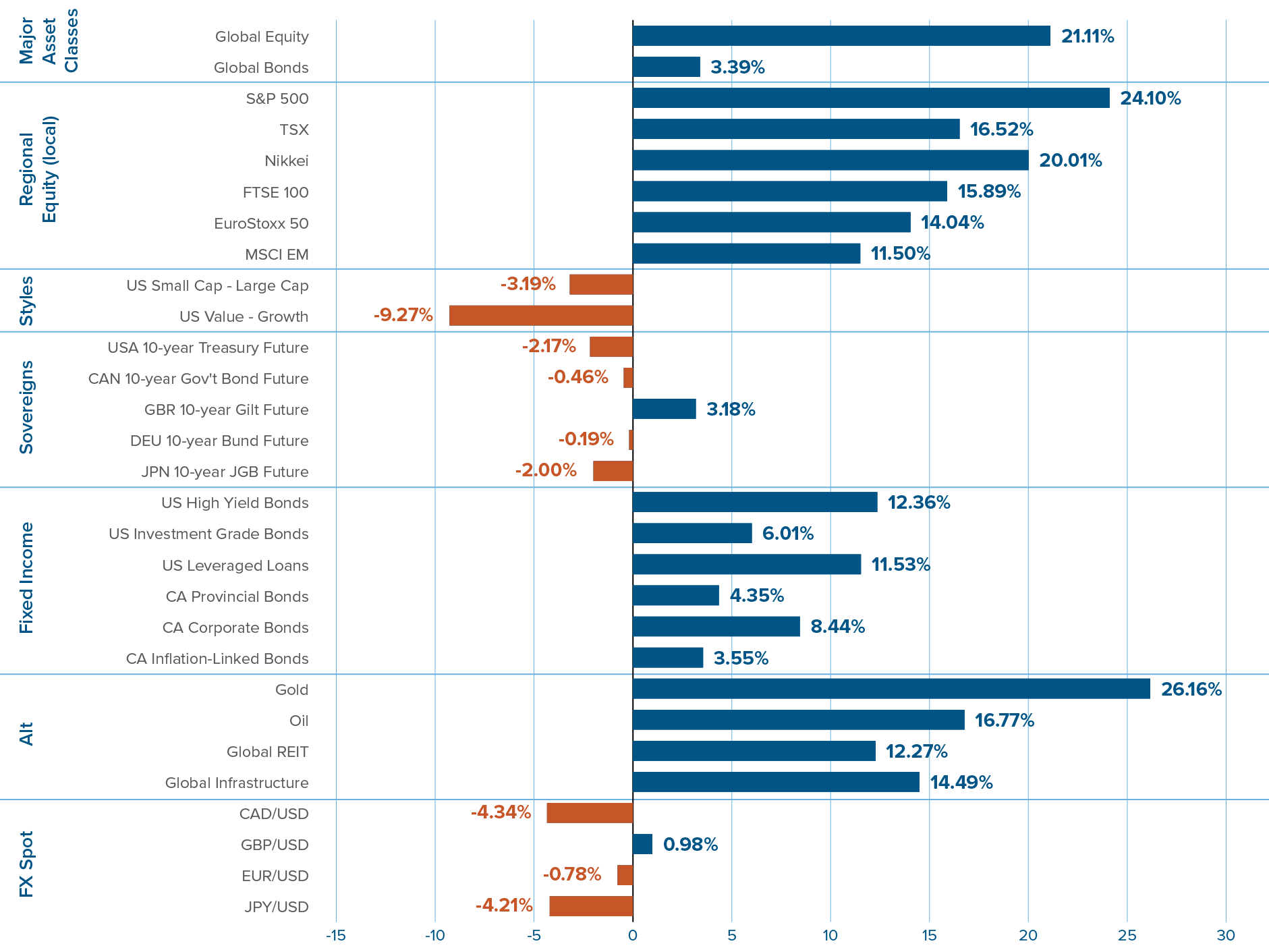

Capital market returns in July

Notes: Market data from Bloomberg as at July 31, 2024. Index returns are for the period: 2024-07-01 to 2024-07-31. In order, the indices are: MSCI World (lcl), BBG Barclays Multiverse, S&P 500 (USD), TSX Composite 60 (CAD), Nikkei 225 (JPY), FTSE 100 (GBP), EuroStoxx 50 (EUR), MSCI EM (lcl), Russell 2000 - Russell 1000, Russell 1000 Value - Russell 1000 Growth, USA 10-year Treasury Future, CAN 10-year Gov't Bond Future, GBR 10-year Gilt Future, DEU 10-year Bund Future, JPN 10-year JGB Future, BAML HY Master II, iBoxx US Liquid IG, Leveraged Loans BBG (USD), Provincial Bonds (FTSE/TMX Universe), BAML Canada Corp, BAML Canada IL, BBG Gold, BBG WTI, REIT (MSCI Local), Infrastructure (MSCI Local), BBG CADUSD, BBG GBPUSD, BBG EURUSD, BBG JPYUSD.