Highlights

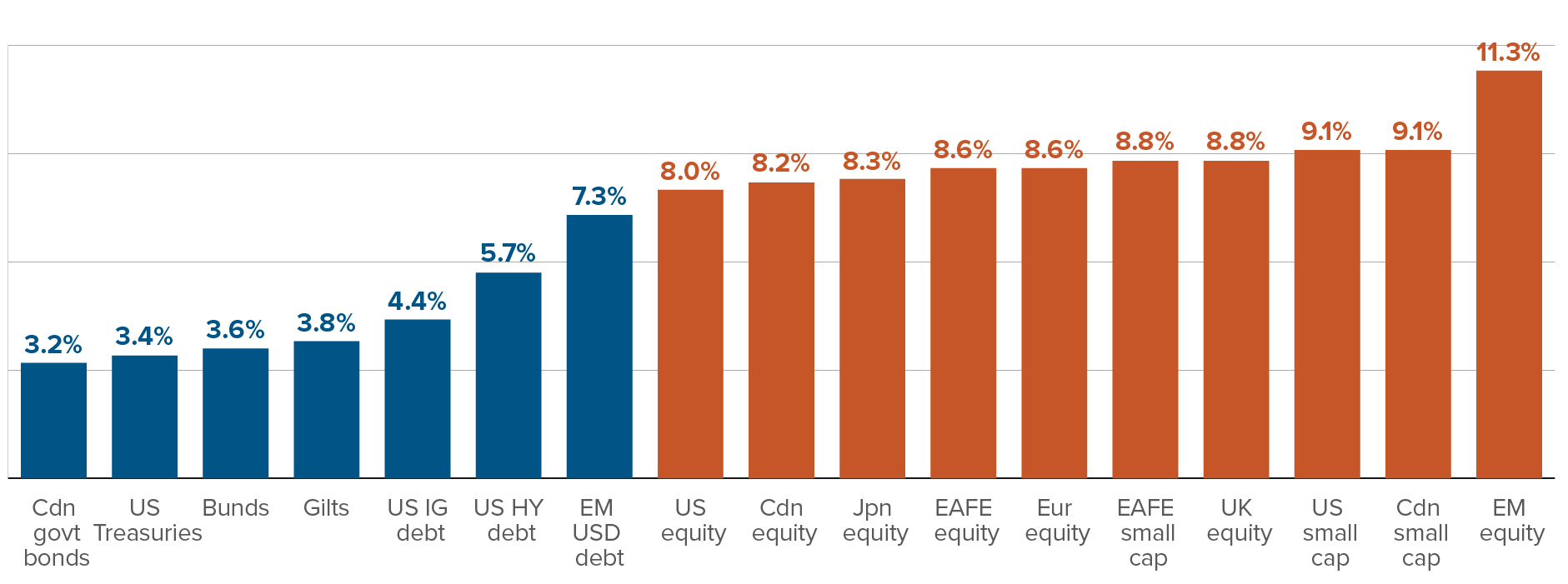

- Many of our favourite assets can be found outside of North America, including EAFE stocks, European bonds and the Japanese yen.

- International equities, bonds and currencies are riding on solid momentum after a strong end to 2023, and should benefit from promising macro catalysts ahead.

- Taking a longer-term view, Canadian and American assets generally have lower expected returns than their international counterparts.

International assets had a solid end to 2023, as expectations of US Federal Reserve (Fed) interest rate cuts caused the US dollar to lose ground and international stocks to rally. Plus, even though financial headlines in November and December were focused on the Fed’s change of tone, and not the European Central Bank or Bank of England, European bonds actually outperformed US Treasuries in the fourth quarter, even on a hedged basis (i.e., ignoring the tailwind of an appreciating euro and pound). For 2023 as a whole, international assets had a more-than-respectable showing, although US tech was the indisputable star of the show.

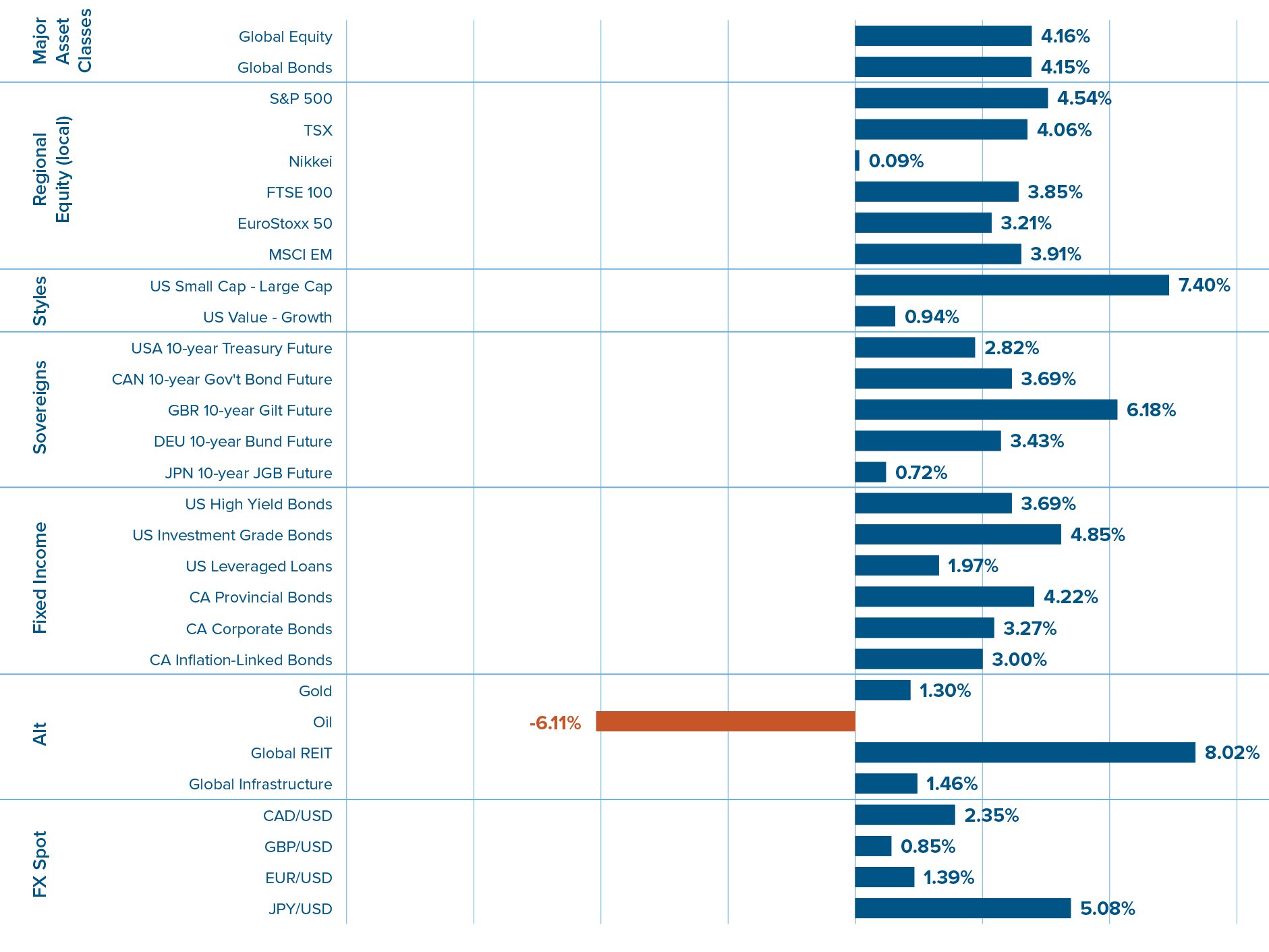

US assets weren’t outliers for Canadian investors in 2023

Asset returns in 2023 (hedged)

We expect this momentum for international assets to extend into 2024. At this time, many of our favourite assets reside beyond the borders of North America, including EAFE stocks, European bonds and the Japanese yen. Not only do international stocks and bonds generally have more attractive valuations than North American assets, but they should also benefit from promising macro catalysts ahead.

European equities are cheap compared to both US and Canadian stocks, even after adjusting for sector exposures. Simply comparing price-earnings ratios between country stock indices, without considering the composition of those indices, doesn’t give a strong basis for investing. Some sectors justify higher valuations than others. Notably, earnings of technology stocks tend to grow faster and also be less cyclical than the earnings of stocks from other sectors. Hence, they naturally warrant higher multiples. The S&P 500 has one-third of its market cap in technology stocks, compared to less than one-sixth for the Eurostoxx, so we expect it to be more expensive on average. But not to its current extent. European stocks, especially those in the indices of countries like Italy, Spain, Germany and the UK, are appreciably cheap, even after neutralizing sectors. That cheapness relative to fundamentals explains why we expect European stocks to outperform US and Canadian stocks in the longer term.

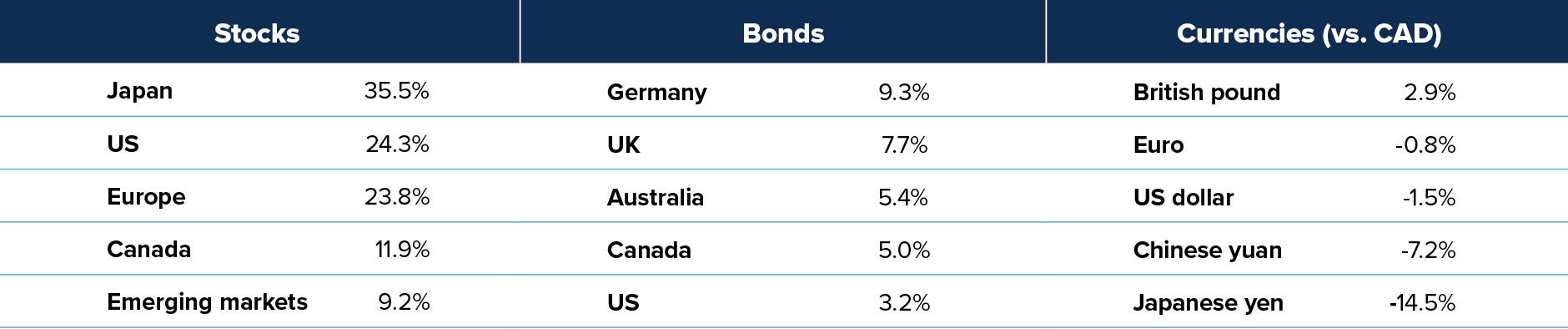

Cheaper valuations justify higher expected returns for European stocks than for their US and Canadian counterparts

Estimates of 10-year return expectations (hedged)

European stock markets should also benefit from two macro trends in 2024: China’s economic stabilization, and resilient global growth. China is a major source of demand for Europe’s largest companies: as a percentage of total sales, Eurostoxx companies sell twice as much in China as do S&P 500 companies. China’s economic struggles have weighed on European stocks’ fundamentals over the past two years, and that pressure should begin to ease somewhat in 2024. We don’t expect China’s economy to rebound, but we do see it stabilizing. While recent economic data in China has only been mildly encouraging, we’ve seen promising signs that China’s leadership is ready to take steps to extend support to struggling households, something it had been loathe to do before the fourth quarter of 2023.

European stock markets, concentrated in sectors like financials and industrials, are sensitive to global economic growth. We expect the global economy to remain resilient in 2024, buoyed by a still-hot US economy and a global loosening in financial conditions. By diversifying into European markets, Canadian investors can play this trend of resilient global growth, while reducing their exposure to a probable Canadian recession.

While we generally don’t favour government bonds at this time, there we also prefer to invest in Europe than in the US or Canada. Over the past two years, the European Central Bank raised its policy rate from zero to 4.5%, while the Bank of England hiked all the way to 5.25%. Neither economy can sustain rates at those levels. Both the eurozone and UK exhibit dismal productivity growth compared to the US, while, unlike Canada, they can’t count on high population growth to compensate for weak per-capita fundamentals. Core inflation in the eurozone and UK is still above target, but we expect it to drop to 2% over the coming months, warranting sizable interest rate cuts.

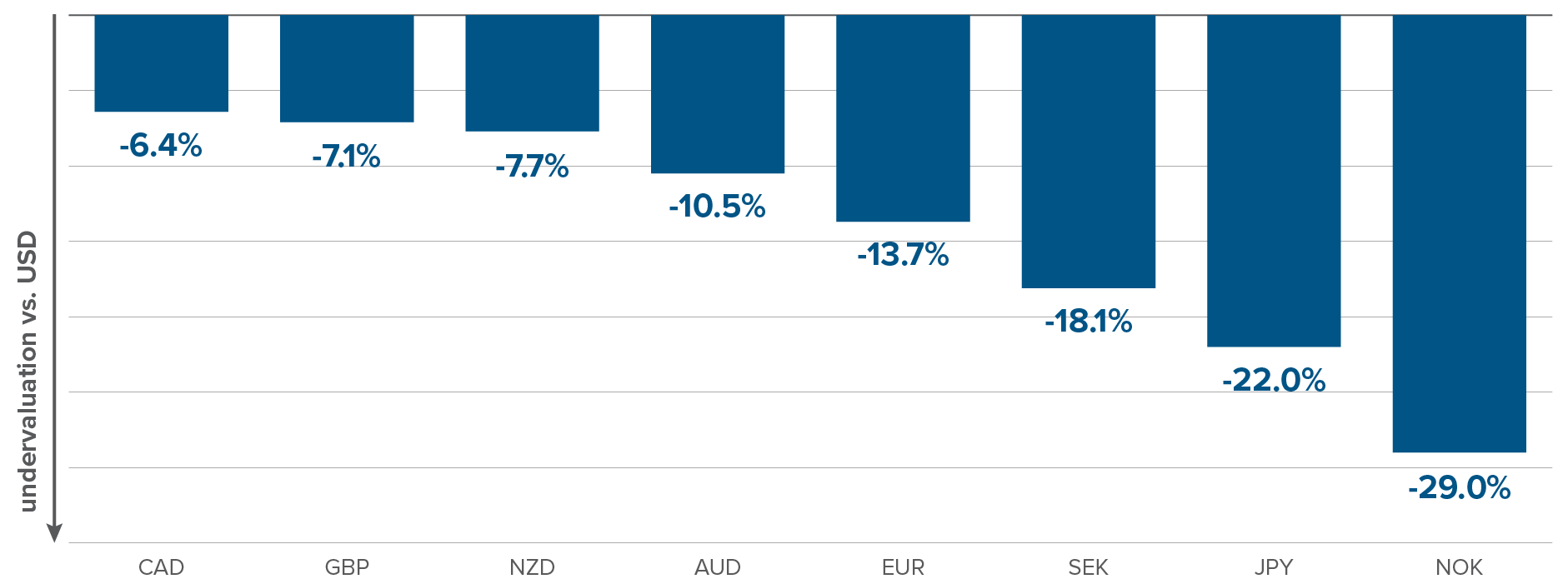

Canadian investors diversifying from US to international assets should also benefit from appreciating exchange rates. We expect the euro and, especially, the Japanese yen to gain versus the US dollar. Even after gaining at the end of 2023, both currencies are still well below our estimate of their fair value relative to the US dollar, as determined by long-term economic fundamentals.

The US dollar is the most overvalued of all advanced economy currencies

Long-term fair value vs. US dollar

While most developed market central banks have reached peak rates, with many preparing to begin cutting over the coming quarters, the Bank of Japan will start hiking rates in 2024. That will shrink the interest rate gap between Japan and the rest of the world, a gap that caused the yen to depreciate sharply in 2022 and the first three quarters of 2023, leaving it at a 30% discount to its fair value relative to the US dollar. The Bank of Japan’s (BoJ) upcoming exit from negative rate territory and scrapping of its cap on government bond yields should also be a boon to battered Japanese banks.

This is not the first time a multi-asset manager has predicted the advent of international assets. Many of these predictions turned out wrong, especially on the equities front as Canadian and, especially, US stocks outperformed international stocks over the past decade. But as the saying goes, past returns are not necessarily indicative of future returns. Valuations are attractive and investor sentiment has begun to shift, pushing us to look abroad for compelling prospects in international markets.

Capital markets update

What we’ll be watching in January

January 16: China 2023 Q4 GDP release

- Chinese GDP for the third quarter of 2023 came in above expectations (5.3% vs. 3.2% expected), bringing the government’s 5% growth target for the year within reach. Subsequent economic data for the fourth quarter has been mixed.

- Most interesting to us isn’t GDP growth itself, but its composition. Household consumption has been extremely weak since 2022, and we’ll be looking for early indications that recent stimulus measures are reaching consumers.

January 23: Bank of Japan decision

- Last month, the BoJ poured some cold water on the hopes of many (including us) that Japan’s negative interest rate regime would end in 2023. Expectations are now that rates will be raised above zero sometime in 2024.

- Absent a major upside surprise to the December CPI release, the January meeting will be too early for a rate hike. But Governor Ueda will likely drop hints of an upcoming regime change during his press conference.

January 24: Bank of Canada decision

- Canada has had some of the weakest economic data among developed economies in recent months, but inflation remains sticky. It will be interesting to see how the Bank of Canada (BoC) navigates this tricky macro backdrop.

- In our view, the BoC should cut rates in January, but will stay pat.

Emerging theme: Transitory disinflation?

The post-pandemic inflation surge led to a raging debate: was inflation transitory? In our view, it undoubtedly was not transitory. It did settle down, but it didn’t settle down unassisted. There was certainly a temporary component to inflation. Supply-chain snarls would have fixed themselves and Covid-wary individuals would have returned to work eventually, regardless of the policy response. But high-single-digit inflation in Canada and the US was also fuelled by a booming North American economy, record consumer spending and a run-up in inflation expectations. Without sharp tightening by central banks, we’d be entering 2024 with inflation elevated and unanchored.

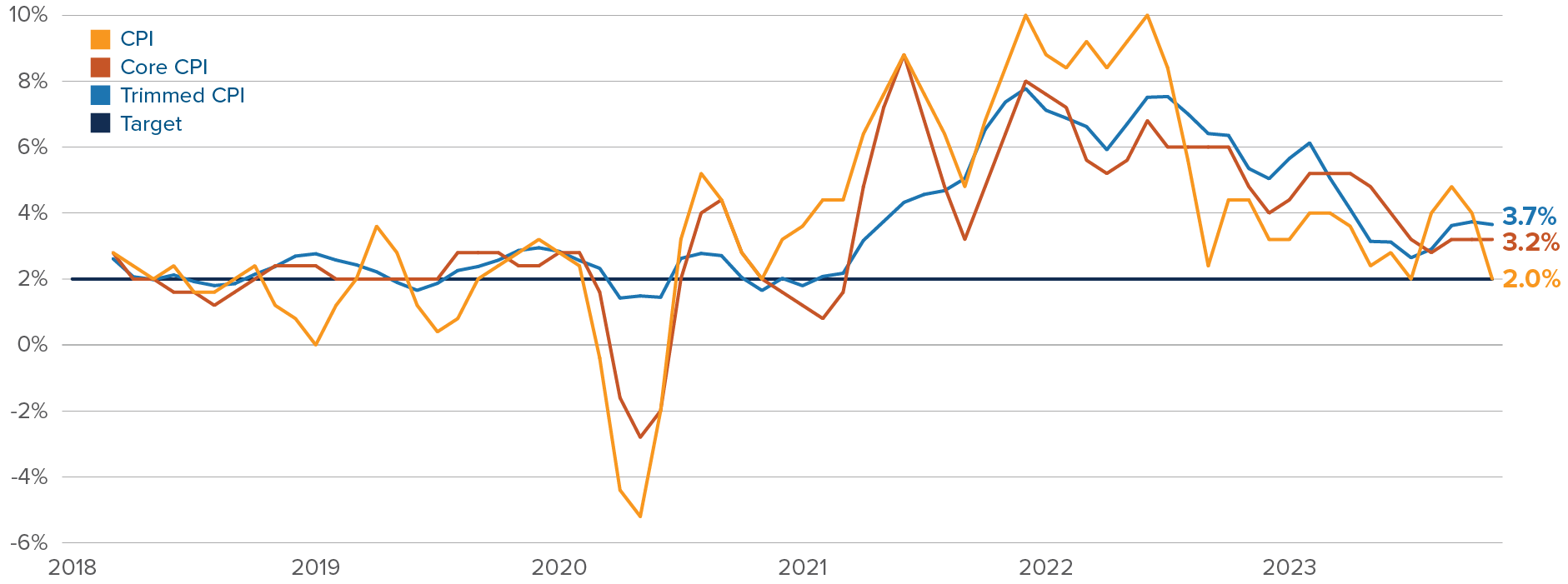

But are we now seeing transitory disinflation? In the past three months, average US CPI inflation was right on the Fed’s 2% target. Core and trimmed CPI are running at 3.2% and 3.7%, respectively, but not frighteningly above target. Plus, trimmed inflation tends to lag slightly, and the core CPI index should benefit from a drop in rent prices over coming months. Inflation in the price of services is still elevated, but recent job market data — slowing job growth, declining quits rate, sliding job openings — paints a picture of easing labour shortages. All are signs that the disinflation we’ve seen in the fourth-quarter headline CPI index might prove to be enduring, rather than transitory.

But there’s also a real risk of reignition. Not towards the high-single-digit inflation rates we saw in 2023, but towards a 3%-4% pace, consistent with an overheating economy. There is still excess demand in the job market, even if it has cooled considerably. Consumption has been resilient and consumer sentiment is improving quickly. China’s deflationary impulse might finally be over with fresh stimulus. But the biggest elephant in the inflation room is the US Treasury’s deficit spending. The government deficit for the first half of 2024 will likely hover around 7%, historically large in the context of a 3.7% unemployment rate. This deficit-financed spending will boost growth and fuel inflation, partly offsetting the cooling effect of the Fed’s monetary tightening.

CPI inflation at target, price problems over?

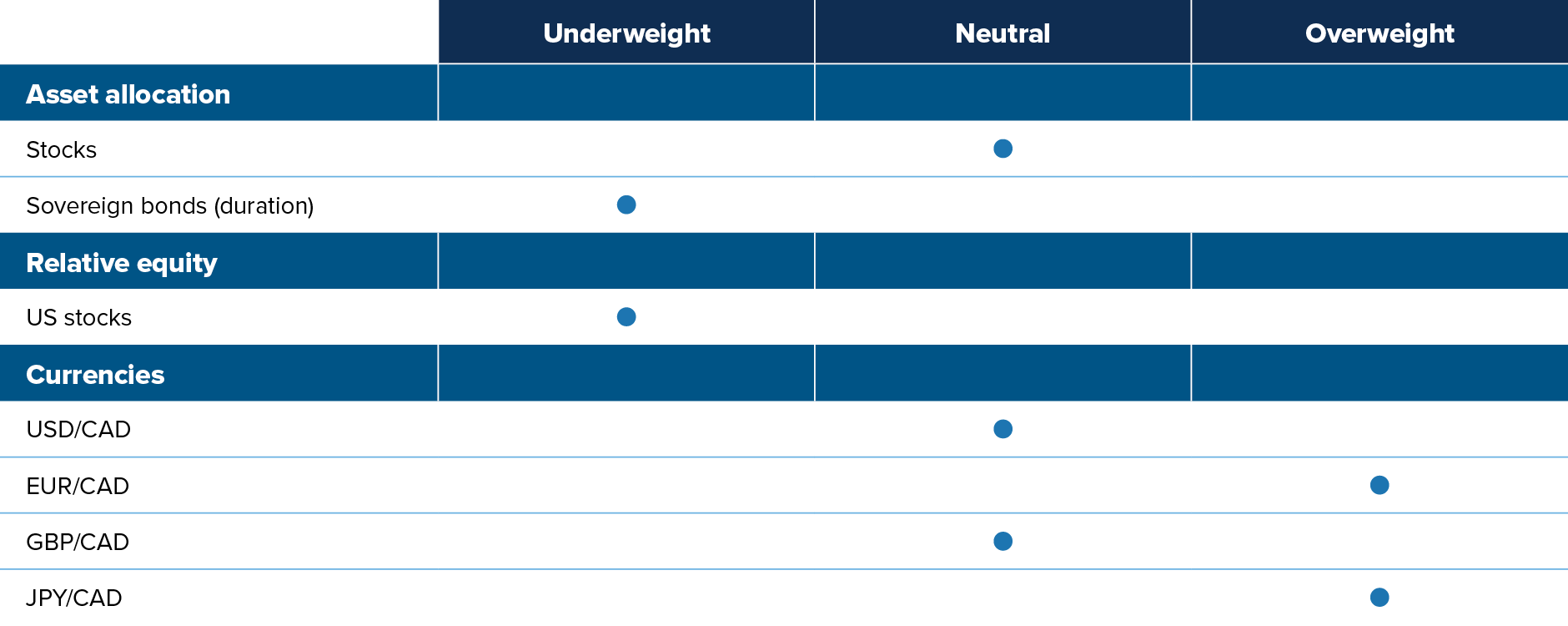

Multi-Asset Strategies Team’s investment views

Tactical summary

Note: The views expressed in this piece apply to products that are actively managed by the Multi-Asset Strategies Team.

Positioning highlights

Fed pricing reversal: We think the six Fed rate cuts priced in by the swap market for 2024 are a stretch. While the disinflationary trend is clear, we don't see inflation stabilizing at 2% over the next few months. We also think the Fed will err towards keeping rates tighter than what a classic monetary policy rule would suggest. FOMC members understand that the recent market action suggests financial conditions have loosened significantly in recent weeks, in effect substituting for rate cuts.

Overvalued US assets: We generally don’t like US assets in early 2024, whether equities, stocks or the US dollar, as covered at the beginning of this commentary. Within US equity markets, we have a preference for small-cap stocks: valuations are more attractive than large caps, and market sentiment is improving quickly. In terms of sectors, we like energy (cheap, positively exposed to our bullish view on oil) and dislike utilities (declining profitability, poor macro backdrop).

Canadian landing: The macro situation in Canada appears much more dire than in the US. Data has already started turning. A “Sahm Rule” for Canada, which uses changes in the unemployment rate to date recessions, is flashing red. With the unemployment rate rising from 5.7% to 5.8% in November, we’ve blown past the classic 0.5% US Sahm rule threshold, and we’re basically at the higher 0.7% threshold, more appropriate for Canada. We think the BoC should start cutting as soon as January, although it probably won’t do so before March. We dislike the Canadian dollar against most currencies.

Commodity-exporting EM currencies: Commodity-exporting EMs are well situated to outperform in this macro environment. Their budgetary and external balances have improved amid high global nominal growth and high commodity prices. Their central banks started raising rates much earlier than the rest of the world. As a result they have generally reached the end of their tightening cycle, reducing the risk of overtightening into a recession. But the level of rates remains high, offering positive carry over most other currencies. On the other hand, we hold a negative view on the currencies of Asian EM countries. Their external positions have severely deteriorated, and their interest rates are relatively low.

Oil market tightness: The physical oil market is tight, especially with the ongoing one-million-barrel-per-day Saudi production cut. In the absence of a global recession, which we don’t expect to occur anytime soon given the positive momentum in the US and the expansionary deficits from governments around the world, oil should remain undersupplied. A stabilization of the Chinese economy will trim risks around oil demand. Positioning is also constructive for the oil complex. For much of 2023, investors were expressing recession bets through short oil derivatives positions. These bets have been coming off, with room to run.

Japan policy divergence: The BoJ widened the tolerance band around its 10-year yield target by 25bps back in December 2022, and by an additional 50bps in July 2023, before adding flexibility around the band in October. With the yen still undervalued and core inflation sticking above 2%, the BoJ will likely tighten further in 2024. We are short Japanese government bonds in our Global Macro Fund. We also have a long discretionary position in the Japanese yen (versus both the euro and the US dollar) to take advantage of Japan policy normalization and the yen’s undervaluation. We like long JPY/EUR because (1) the yen is more undervalued than the euro, (2) the ECB has overtightened and (3) growth is already slowing in the eurozone while it continues to chug along in Japan.

Capital market returns in December