Introduction

The fixed income market has recently garnered significant interest due to the global central banks reaching the zenith of their rate-hiking cycle after substantial rate increases. This has resulted in higher bond yields, which have become increasingly appealing to income investors. However, this has concurrently led to a compression in spreads across the credit spectrum. Spreads, in this context, represent a valuation measure of the added reward that an investor receives for assuming credit risk.

As portfolio managers, we evaluate risk-reward opportunities across the credit spectrum and have identified attractive opportunities down the capital structure of well-known and well-regarded domestic financial institutions and corporations in the respective Limited Recourse Capital Notes (LRCNs) and Corporate Hybrid structures.

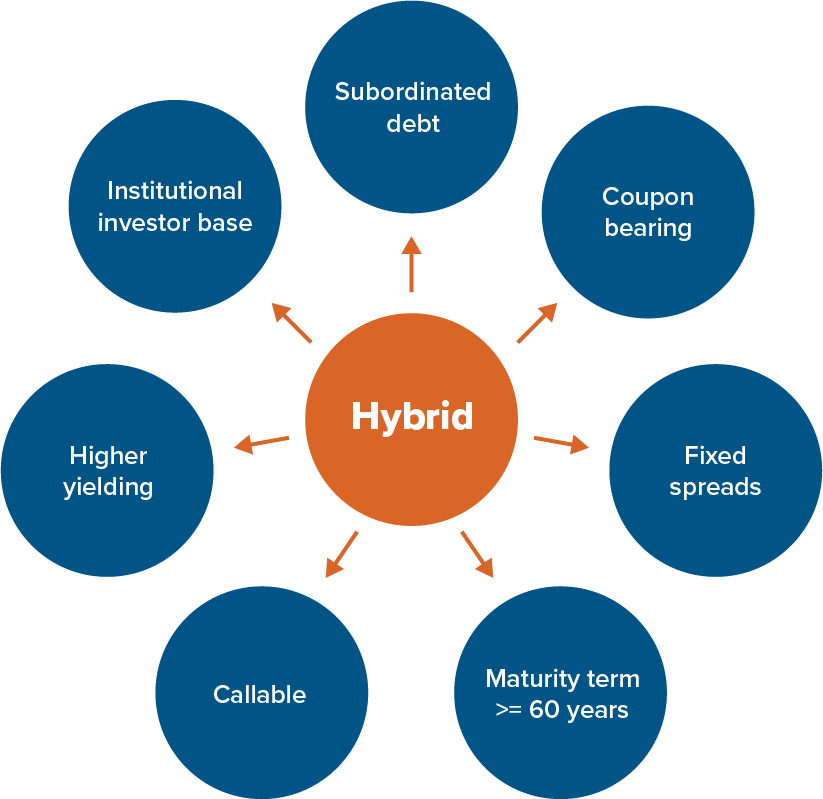

Understanding the “hybrid” structure

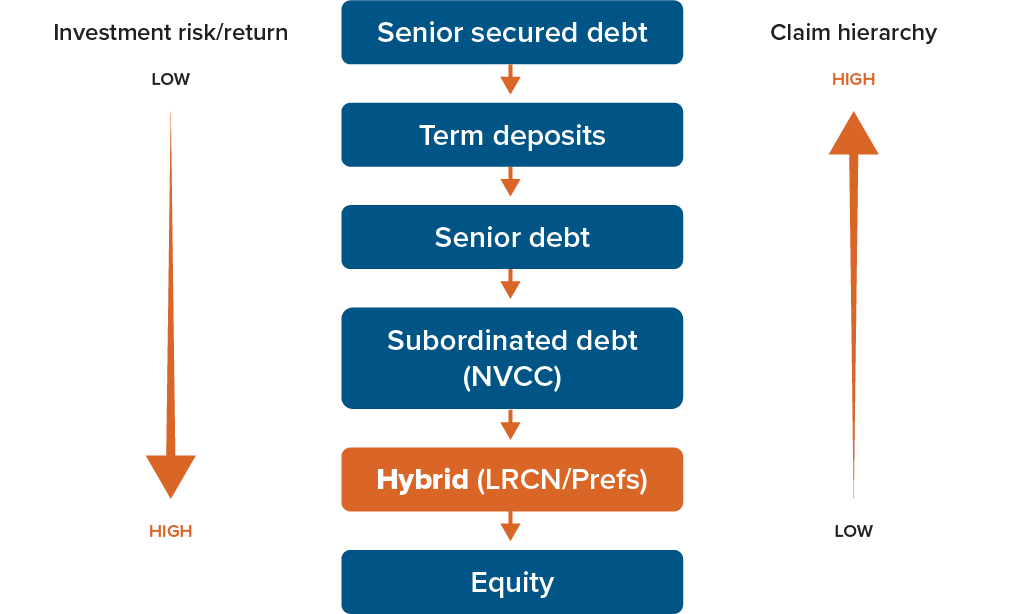

Hybrid bonds, possessing characteristics of both debt and equity securities, are subordinated debt instruments issued by financials and other corporations. These instruments are bond-like in the sense that they pay a pre-determined coupon structure, however in the unlikely event of financial distress, these securities run the risk of conversion to equity-like securities. Although the hybrids are usually rated two notches lower than the issuer’s senior unsecured rating, most hybrid issues still retain their investment grade rating.

Hybrid bonds are structured to be perpetual in nature and allow companies to augment their capital without adversely affecting their credit ratings. Furthermore, the securities offer tax-deductible interest payments, which is a cost-efficient strategy for refinancing callable, taxable, preferred shares.

Although structured as a perpetual security, the call feature and equity treatment increase the probability that the bond is repaid at the first call date, making it difficult to determine the actual maturity date. Coupon payments are reset every five years, making the potential reset spread an important variable to monitor to determine future coupons.

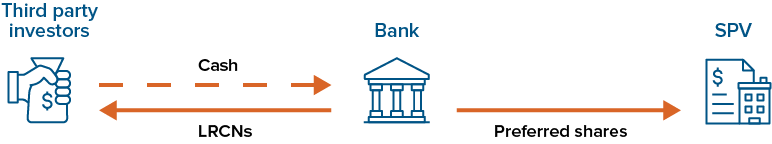

Limited Recourse Capital Notes (LRCNs)

These are hybrid structures issued by Canadian banks and financial institutions as part of the Additional Tier 1 (AT1) capital programs. The instrument is only marketable to institutional investors, replacing the retail-heavy preferred share market that suffered from a lack of liquidity. LRCNs have a minimum maturity term of 60 years with a periodic coupon reset every five years based on a fixed spread over five-year Government of Canada bond yield. In the event of default, the sole recourse for the LRCN holder is a claim on the preferred share held in trust (typically held by a special purpose vehicle or “SPV”) and has the same conversion feature to common shares if the regulator determines it to be non-viable and in need of a capital infusion.

Bank capital structure

Source: Mackenzie Investments

Source: Mackenzie Investments

LRCNs provide additional flexibility and diversification for companies to satisfy regulatory capital requirements, and moreover, reduces borrowing cost and improves net earnings because of the tax deductibility of coupon payments (versus paying preferred share dividends from after-tax income).

The issuer will only be permitted to call (redeem) the LRCNs in situations where the replacement capital cost is cheaper than the reset coupon. That said, Office of the Superintendent of Financial Institutions (OFSI) does employ a principles-based approach to evaluating call decisions, which means it will not deny a call decision if the cost differential is immaterial and will generally not proactively deny a call unless there is a significant concern with the issuer’s capital adequacy and/or liquidity.

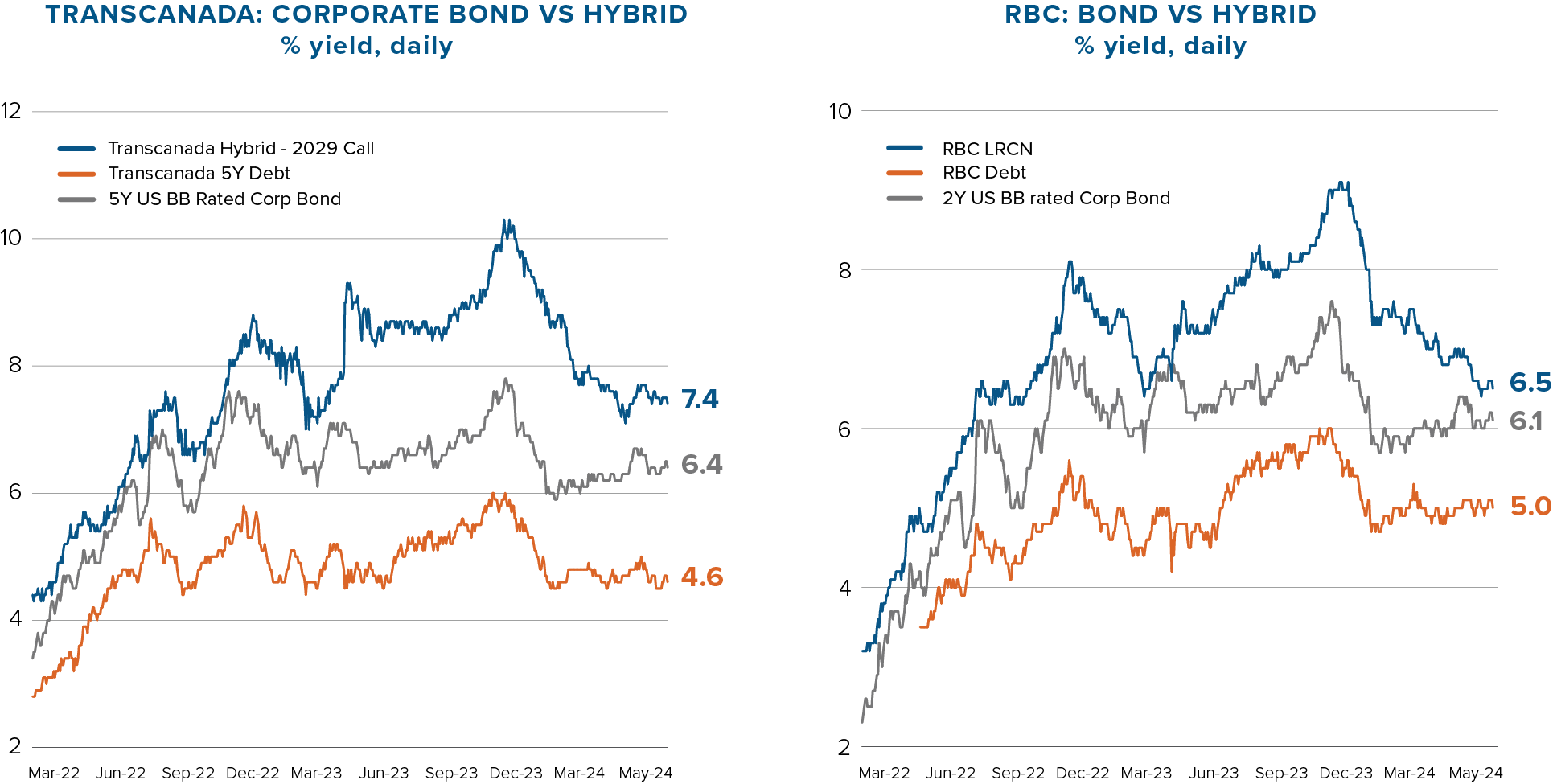

Given the distinct characteristics we have discussed so far, investing in Canadian hybrid bonds rewards investors with higher interest rates compared to traditional bonds which can lead to higher income and diversification for investors. As you can see in the below charts, investing in hybrid securities offers higher yields versus the same issuer’s secured debt and even against a non-investment grade bond.

Source: Mackenzie Investments, Bloomberg

Analyzing key “hybrid” risks

In addition to the normal investment risks associated with fixed-income securities, the high-income subordinated structures do inherently carry their own distinct risks.

Extension risk: The instruments are perpetual in nature and carry the risk of non-redemption on the specified call date. This results in investors enduring the consequences of an extended term (higher interest rate risk) and corresponding spread widening potential.

The risk is structurally higher in unrated hybrids, issuers downgraded to below investment grade and whose credit profile has significantly deteriorated, leading to wider spreads (credit risk).

We believe extension risk of corporate hybrids is low because they lose equity treatment at the first call/reset date. Issuers also understand that investors expect these instruments to be called on the first reset date, and disappointing market expectations would create reputational harm that would have repercussions for their cost of funding.

As investors, we analyze the terms and the reset spread to assess the extension risk of LRCNs. A higher reset spread could incentivize the issuer to call the bond earlier than expected, reducing the extension risk, and vice versa.

Coupon deferral risk: Hybrid bond coupons may be deferred (“equity feature”) at the option of the issuer and would compound without triggering an event of default.

On the other hand, LRCNs coupon payments are non-deferrable, meaning that if the issuer is unable or decides not to pay, the issuer cannot defer the payment and the LRCN would be converted into the preferred share (conversion risk), and the noteholder would lose the missing payment of the coupon. The deferral itself would not lead to a non-viability trigger, unless OFSI determines the issuers non-viability, after which the LRCN’s principal, plus accrued and unpaid interest, become due and upon non-payment, holders receive common shares of the bank, issued on conversion of the preferred shares.

Based on our fundamental credit analysis, we believe that the risk of coupon deferral is low, supported by the financial strength of the high-grade issuers in the marketplace.

Subordination risk: In the unlikely event of bankruptcy, the recovery rate for hybrids would be significantly lower, as hybrid capital is subordinate in the capital structure and ranks senior only to common equity.

Mackenzie Fixed Income investment outlook on hybrid bonds

Hybrid securities offer diversification benefits without compromising on overall credit quality, presenting an attractive rating arbitrage opportunity for investors. We have consistently expressed our positive outlook on hybrid bonds across our core plus, multisector, and corporate bond funds. This includes the Mackenzie Global Corporate Fixed Income Fund and Mackenzie Unconstrained Fixed Income Fund (also available as an ETF, MUB).

We are comfortable with the Canadian hybrid and LRCN structure and view it as an attractive alternative to the broad high yield universe, representing a more attractive risk-adjusted return profile.

We recognize the risk to the subordinated debt of financial institutions in a time of crisis but are confident in both the quality and structure of these instruments. The Canadian financial sector represents systematically important banks from both a domestic and global standpoint. After the Credit Suisse collapse in March 2023, the AT1 market experienced turmoil because of poorly structured instruments, raising investor fears that the bonds were riskier than previously understood. It is unlikely that we will see a similar failure in Canada, as the LRCN market in Canada provides a strong structure that would better preserve value for bond investors.

These views are augmented with rigorous fundamental credit analysis that seeks to identify companies with stability in earnings and strong free cash flow. Throughout the team’s analysis they will also assess company risks and asset values, to manage downside risk at all points during the credit cycle.

To learn more, speak to your Mackenzie sales team.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. This commentary is general in nature and cannot take into account the financial circumstances or objectives of any investor. As such, investors should consider their financial circumstances and objectives before making any financial decisions. Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund or ETF investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. This document includes forward-looking information that is based on forecasts of future events as of May 31, 2024. Mackenzie Financial Corporation will not necessarily update the information to reflect changes after that date. Forward-looking statements are not guarantees of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Some of these risks are changes to or volatility in the economy, politics, securities markets, interest rates, currency exchange rates, business competition, capital markets, technology, laws, or when catastrophic events occur. Do not place undue reliance on forward-looking information. In addition, any statement about companies is not an endorsement or recommendation to buy or sell any security.