[1] Source: Brinson, Hood, and Brian D. Singer, 2012

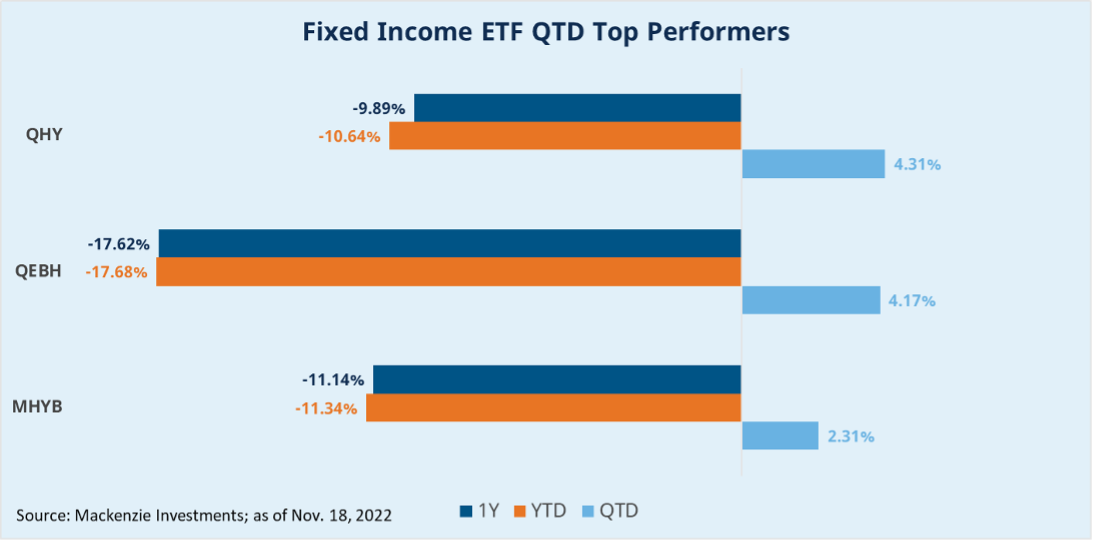

[2] Source: Bloomberg, Mackenzie Investments; as of November 18, 2022

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors. Commissions, brokerage fees, management fees, and expenses all may be associated with ETF investments. Please read the prospectus before investing. The indicated rate[s] of return are the historical annual compounded total returns as of November 18, 2022 including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 18, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the investment fund or asset allocation service or returns on investment in the investment fund or from the use of the asset allocation service. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Source: Morningstar, Mackenzie Investments; period: October 1, 2020 – October 31, 2022

Source: Morningstar, Mackenzie Investments; period: October 1, 2020 – October 31, 2022

Source: Bloomberg; as of October 31, 2022

Source: Bloomberg; as of October 31, 2022

Please note this is for demonstration purposes only. Actual tax savings will depend on the individual. Please consult a tax expert. This demonstration is only relevant to securities/funds held in non-registered accounts that have lost value. Source: Bloomberg; price return as of October 31, 2022

Please note this is for demonstration purposes only. Actual tax savings will depend on the individual. Please consult a tax expert. This demonstration is only relevant to securities/funds held in non-registered accounts that have lost value. Source: Bloomberg; price return as of October 31, 2022

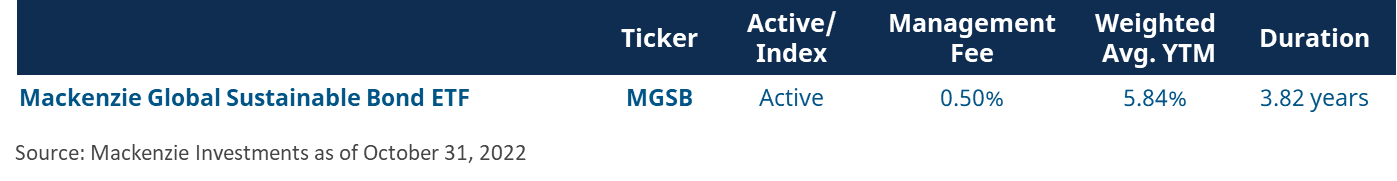

Source: Mackenzie Investments; as of October 31, 2022

Source: Mackenzie Investments; as of October 31, 2022

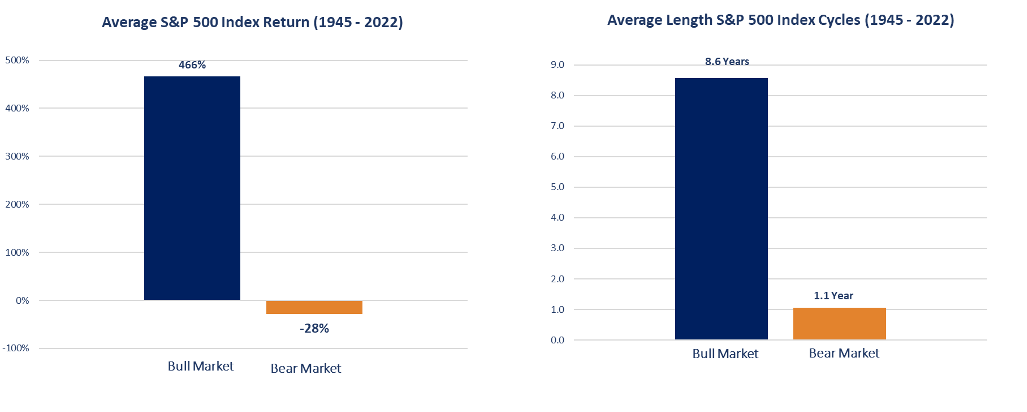

Source: Bloomberg. S&P 500 PR Index (SPX). As of October 31, 2022.

Source: Bloomberg. S&P 500 PR Index (SPX). As of October 31, 2022.