While worldwide investing offers a great opportunity set, the reality is that a large portion of Canadian investors' portfolios are allocated to North American equities. US equity market share of the global stock market increased significantly over the past few years, driven by a growth of the market-cap footprint of a handful of companies (the “Magnificent Seven” stocks) that pushed the concentration to a level that has not existed to this extent before.

Exposure to international equity is an opportunity to balance the risk, reduce a portfolio’s reliance on a few companies and broaden exposure to a wider array of economic and market forces across regions and sectors that can complement the large US exposure.

Why international equity?

• Low correlation benefit

Correlation between international and North American equities:

Source: Morningstar, International equity: MSCI EAFE Index. US equity: S&P 500 Index. Canadian equity: S&P/TSX Composite Index (since common inception: Feb 1977). As at August 31, 2024.

Because of the low correlation between international and North American equity, they don’t always rise and fall in sync with each other. Diversifying with international investments may help investors lessen the impact of volatility across the board.

As illustrated in the chart below, an increase in allocation to international equity lowers volatility up until an optimal allocation of around 30 to 40%.

Annualized volatility - adding international exposure

Source: Morningstar, International equity: MSCI EAFE Index. US equity: S&P 500 Index. Canadian equity: S&P/TSX Composite Index (since common inception: Feb 1977). As of August 31, 2024.

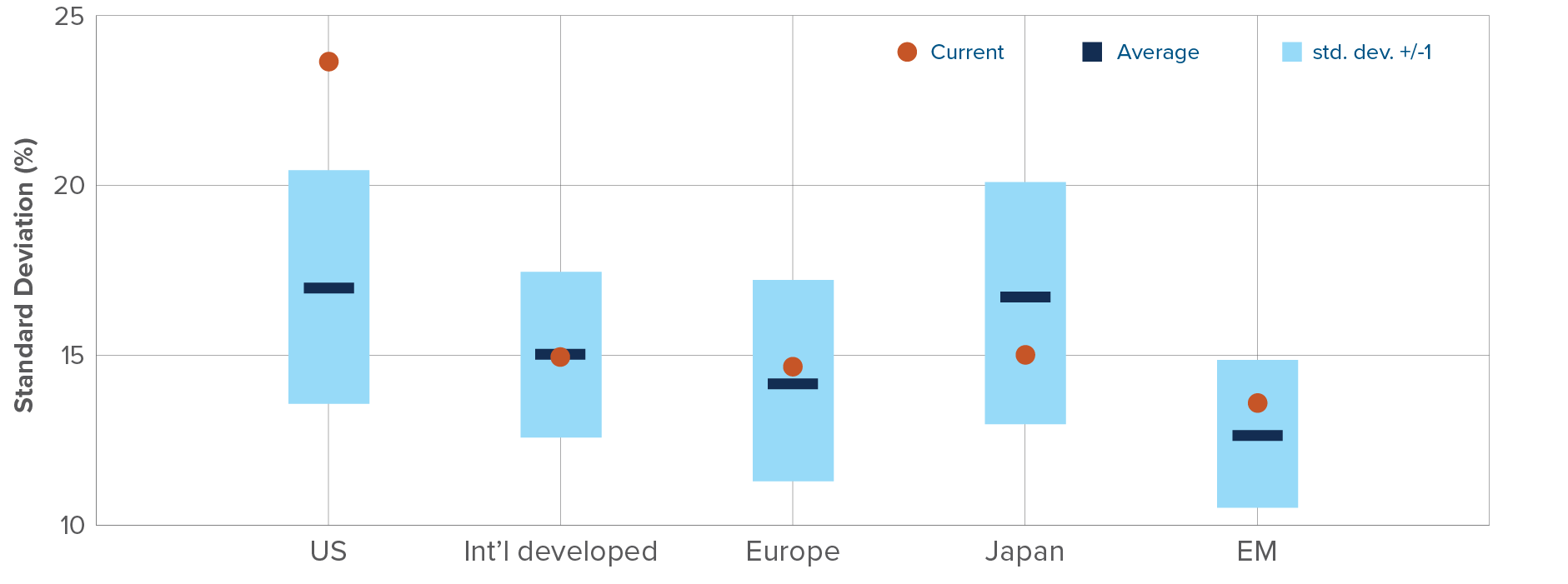

• Valuation

Non-US stocks are priced at a much lower valuations relative to their US counterparts, both in absolute terms and relative to their history. This provides a timely opportunity to take advantage of a potential reversion to the fair value because, typically, valuation reverses as market conditions stabilize and investor sentiment adjusts.

Although these reversions to fair value may not occur over a short period, valuations do act as an anchor that gradually pulls stock prices toward their intrinsic value.

US valuations versus international developed market valuations

Source: Bloomberg, S&P 500 Index, MSCI EAFE Index, MSCI Europe Index, MSCI Japan Index and MSCI EM Index (20 years data). As at August 31, 2024.

• The prospect of a weaker US dollar

Federal Reserve entered a rate-cutting cycle that possibly will weaken the US dollar. Historically, a weak dollar has been associated with strong international equity markets for the following reasons:

- A weaker US dollar is favourable for non-US economies with debt obligations denominated in USD.

- Following US dollar peaks, local consumers outside of the United States have more purchasing power, and therefore spending.

Mackenzie International Equity ETF (MIQE) to capture the international opportunity

The ETF is managed by the Mackenzie Global Quantitative Equity Team that manages several investment options in long-only, long-short, extension and low-volatility strategies across regions, using a quantitative approach that combines robust research and risk management to enhance investment decision-making.

Why invest in this ETF?

- Diversify portfolio exposure by accessing international equities that allow investors to go beyond US-dominated portfolios.

- An attractive investment opportunity with the potential to capitalize on valuation spreads compared to US equities.

- An active fundamental quantitative approach leverages computing power and cutting-edge techniques to help identify the best opportunities across developed countries.

ETF managed by: Mackenzie Global Quantitative Equity Team

Arup Datta, MBA, CFA

SVP, Portfolio Manager, Head of Team

Nicholas Tham, CFA

VP, Portfolio Manager

Denis Suvorov, CFA

VP, Portfolio Manager

Haijie Chen, PhD, CFA

VP, Portfolio Manager

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of August 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.