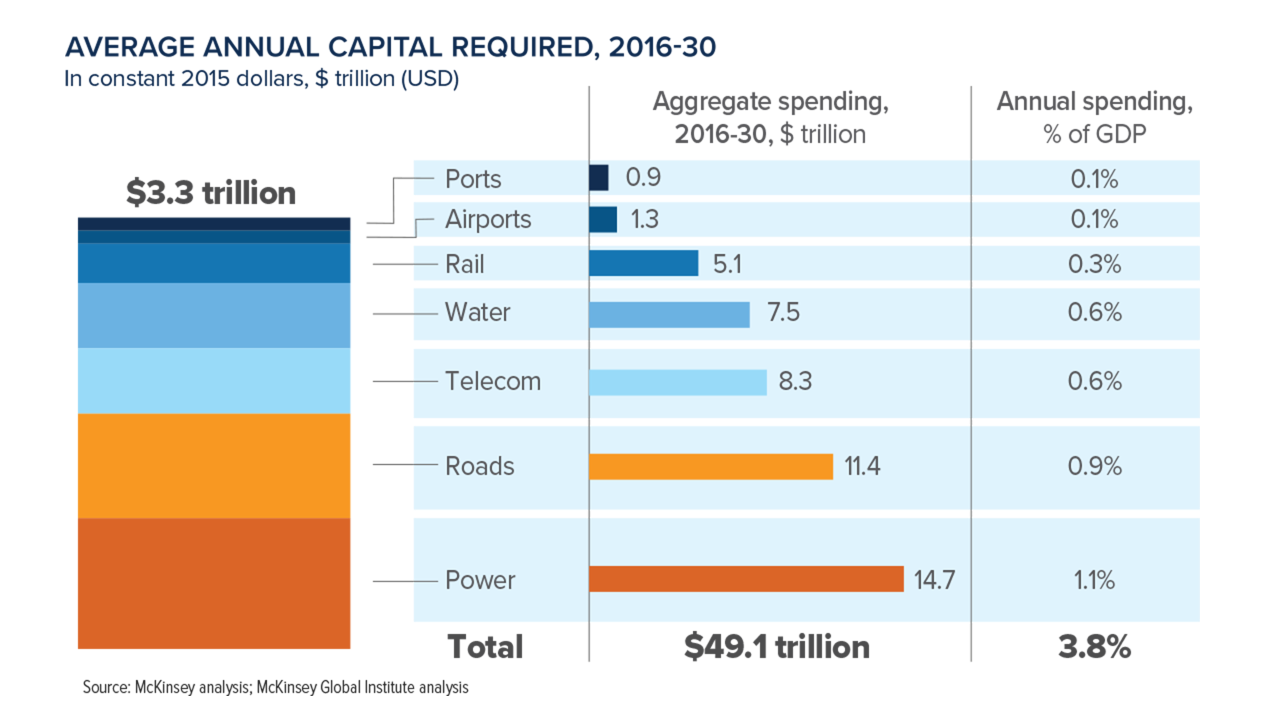

- US$3.3 trillion4 – the estimated annual capital required globally to upgrade critical infrastructure needed for societal advancement, and governments are increasingly providing incentives to facilitate this through private partnerships.

Private Markets Outlook

Strong tailwinds propel private market investor demand

In our first Mackenzie Northleaf Private Markets Outlook, Northleaf experts share their views on where they see opportunities and growth in the near future.

To read the full private markets outlook, along with insights into how these investments may fit into an investor portfolio, please click the download button below.

Private markets have long been a source of enhanced alpha, uncorrelated returns and diversification. Yet they remain a largely untapped opportunity for individual investors. With an increasing number of private companies and a shrinking public market, Northleaf expects to see continued need for capital in private markets and an exciting time for investors to play a part in the growing opportunity.

Private Equity

Investor appetite for mid-market secondaries continues to grow

- 2x asset class growth – global private equity AUM has grown significantly over the past decade from about US$5 trillion in 2013 to approximately US$10 trillion today.

- Secondaries as liquidity solution – as many PE Funds are holding their private equity investments for longer, investors are increasingly looking to the secondary market to help manage portfolios, freeing up cash flow to pursue new opportunities, rebalance exposures and manage risks.

- 278% increase in transactions1 – the expected growth in secondary deal flow through the end of 2024 from 2016. As private market assets grew over the last decade by about 15% annually, Northleaf expects the secondary transaction volumes to continue that trend upwards.

Private Credit

Private credit to benefit from attractive yields

- Capitalizing on tightening bank regulations – between the outcomes of the global financial crisis in 2007 and the more recent regional banking challenges in the US, stricter banking regulations are fueling demand for more private credit lending deals as borrowers still need capital to grow their businesses.

- Attractive returns – with base rates currently above 5%, senior secured loans to high-quality mid-market companies are generating a considerable return premium, strong capital preservation and lower volatility compared to public fixed-income options.2

- 275% asset class growth3 – of private credit assets under management over the last decade. Northleaf expects this to continue and will top US$2.7 trillion by 2028, highlighting significant opportunity.

Private Infrastructure

Demand for infrastructure assets set to soar

To read the full private markets outlook, along with insights into how these investments may fit into an investor portfolio, please click the download button below.

Explore our private markets offerings and resource centre

1Source: Evercore H1 2024 Secondary Market Review. Estimated FY 2024 transaction volume annualized based on H1 2024 stated volume.

2As of December 31, 2023. Source: Cliffwater Direct Lending Index: Senior Only (CDLI-S); Pitchbook/LCD. USD. Senior secured loans: Cliffwater Senior Direct Lending Loan Index (11.8%), Broadly syndicated loans index: Morningstar LSTA US Leveraged Loan Index (10.1%), High yield bonds index: S&P U.S. High Yield Corporate Bond Index (7.9%).

3Source: https://www.preqin.com/insights/research/reports/future-of-alternatives-2028

4Source: Source: McKinsey analysis; McKinsey Global Institute analysis, https://www.mckinsey.com/capabilities/operations/our-insights/bridging-global-infrastructure-gaps

For Use by Accredited Investors (as defined in National Instrument 45-106 –Prospectus Exemptions) and Investment Advisors Only. Issued by Mackenzie Financial Corporation (“Mackenzie”).

This content is provided to you on the understanding that, as an investment advisor or “accredited investor” (as defined in National Instrument 45-106 –Prospectus Exemptions), you will understand and accept its inherent limitations, you will not rely on it in making or recommending any investment decision with respect to any securities that may be issued, and you will use it only for the purpose of discussing with Mackenzie your preliminary interest in investing in Mackenzie Northleaf Global Private Equity Fund, Mackenzie Northleaf Private Credit Fund or Mackenzie Northleaf Private Infrastructure Fund (the “Funds”).

The information contained herein is qualified in its entirety by reference to each Fund’s Offering Memorandum (as it may be amendment or supplemented from time to time) (the “OMs”). The OMs contain additional information about the investment objectives and terms and conditions of an investment in the Funds (including fees) and will also contain tax information and risk disclosures that are important to any investment decision regarding the Funds.

These materials may contain “forward-looking” information that is not purely historical in nature, and such information may include, among other things, projections, forecasts or estimates of cash flows, yields or returns, volatility, scenario analyses and proposed or expected portfolio composition. The words “anticipates”, “assumes”, “believes”, “budgets”, “could”, “estimates”, “expects”, “forecasts”, “intends”, “may”, “might”, “plans”, “projects”, “schedule”, “should”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. The forward-looking information contained herein is based upon certain assumptions about future events or conditions and is intended only to illustrate hypothetical results under those assumptions (not all of which will be specified herein). Not all relevant events or conditions may have been considered in developing such assumptions. The success or achievement of various results, targets and objectives is dependent upon a multitude of factors, many of which are beyond the control of the investment advisor. No representations are made as to the accuracy of such estimates or projections or that such projections will be realized. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed.

Past performance is not necessarily indicative of any future results.

There can be no assurance the Funds will achieve their objectives or avoid incurring substantial losses. Performance may be volatile and may vary materially on a monthly, quarterly or annual basis, and over the course of a market cycle. The Funds are not intended as a complete investment program. The past performance information shown herein regarding Northleaf funds and Northleaf investment programs is general in nature and subject to various limitations. The performance of the Funds will differ from the performance of the underlying private assets. Such performance information is not included to indicate the future results that might be generated by the Funds or any of their holdings.

This material may not be reproduced or distributed, in whole or in part, except by authorized representatives of Mackenzie. By accepting receipt of this material, the recipient agrees not to duplicate or furnish copies of these materials or any information contained herein to any person other than their professional advisors. This presentation does not constitute legal, tax, investment or any other advice. Prospective investors should consult with their own professional advisors regarding the financial, legal and tax consequences of any investment. Certain information contained herein has been supplied by third parties. While Mackenzie believes such sources are reliable, it cannot guarantee the accuracy of any such information and does not represent that such information is accurate or complete. The information presented herein is current only as of the particular dates specified for such information, and is subject to change without notice. The Funds and their underlying funds and are subject to numerous risks. Please refer to the OMs for details of those risks. The Funds are only available to Canadian residents for tax purposes.