Written by the Mackenzie Fixed Income Team

Key positioning

- Global bond yields were dramatically lower in November as inflationary pressures eased in developed economies. Markets have openly questioned the ‘higher for longer’ interest rate regime in developed economies despite caution from policy makers.

- In Canada, consumers continue to digest the implications of interest rate hikes as unemployment hovers above 5%. Policy makers remain focused on the balance between a deteriorating economy and their stated mandate of bringing inflation in-line with a 2% target.

- In the U.S., inflation remains above target as overall economic data has cooled. The fiscal considerations that drove yields higher recently abated.

- We continue to see value in select Emerging Markets due to attractive yield levels and a history of effective inflation management.

- From a total return basis, short term corporate bonds remain attractive given a yield-to-maturity of more than 5%.

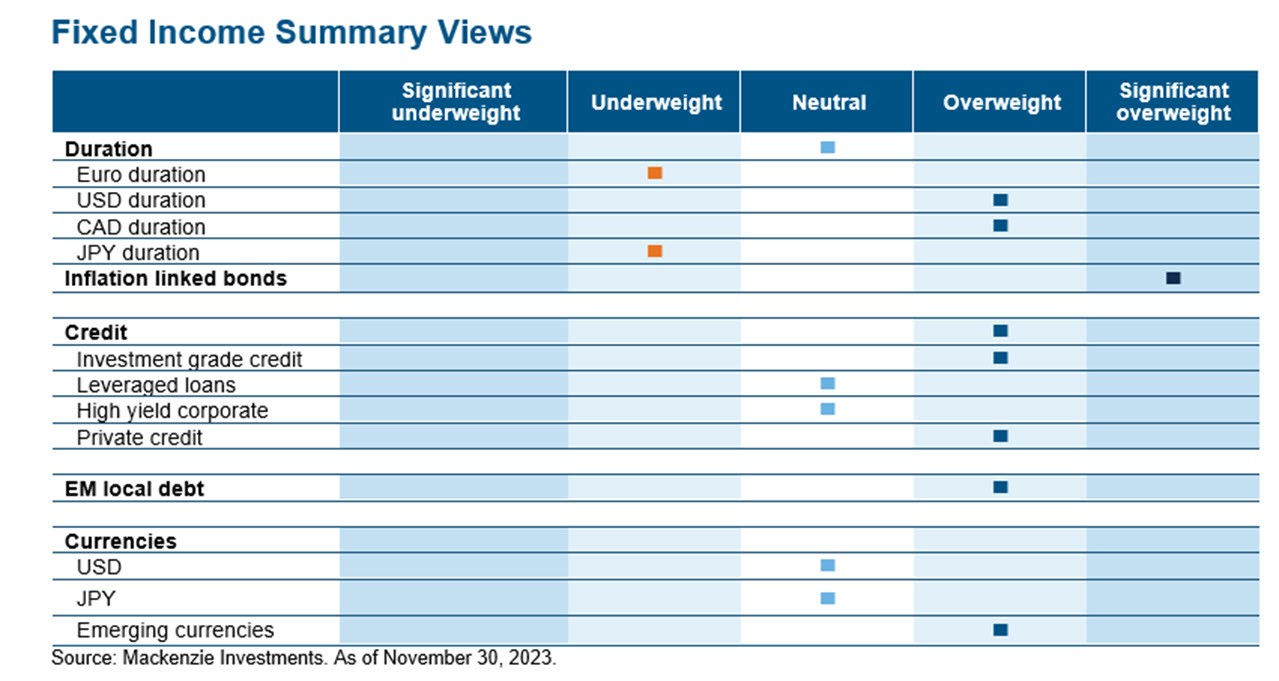

Current positioning and notable changes

Macroeconomic environment

Policy tightening is very likely at its end in Canada as it appears we have arrived at the terminal rate. Investors have begun to look to a pivot away from the higher for longer monetary policy regime and expect to see policy easing in 2024. Following two consecutive interest rate increases over the summer months, the Bank of Canada (BoC) paused at consecutive meetings in September and October. The market does not expect any change to policy at the bank’s next meeting in early December. Investors will look to BoC governor Macklem’s commitment to curbing inflation amidst dampened economic activity – recent quarterly GDP proved negative. The market largely believes that the BoC will ease policy towards the latter half of next year.

The Federal Reserve seems poised to preserve the soft economic landing many thought would elude policy makers. Economic data suggests price growth is slowing and inflation has now likely peaked. The Fed’s “inside-out” strategy - hikes at one meeting and pauses at the following – has now concluded as the market believes that there are no further hikes on the horizon. In fact, the market now prices in interest rate cuts for 2024, which in our view is entirely within the realm of possibilities. The dialogue around a recession has largely been silenced. Investors will look to comments from Governor Powell in early December to gain insight into decision making going forward.

The European Central Bank (ECB) continues to have a more difficult task than its North American counterparts as inflation remains sticky despite a decline in energy prices. Growth remains weaker across the board on the eastern side of the Atlantic. This dilemma puts European policy makers in a very difficult situation. That said, the ECB has made a notable shift in tone from hawkish to neutral. Markets have priced in interest rate cuts for the first half of 2024.

Duration

We remain neutral overall on duration and continue to express this positioning is a somewhat nuanced fashion across the globe. We expect to continue to see heightened volatility in government debt yields. Despite higher yields in longer maturities in North America we remain patient when considering adding broad long duration exposure given fiscal risks. We continue to hold a significant overweight position in Treasury Inflation-Protected Securities (TIPS). We have a bias to a steeper treasury curve over the medium term.

In Japan, we maintain a short position in Japanese Government Bonds (JGB) across funds as a medium-term macro trade based on the idea that the Bank of Japan’s (BoJ) yield curve control policy is keeping JGB yields artificially low. We have taken some profits on our short JGB position as 10yr JGB yields continue to drift higher as policy makers weigh adjustments to long standing yield curve controls.

Global and emerging markets

Global bonds recorded positive returns over the month as the Bloomberg Global Aggregate Index appreciated materially during November. Government debt rallied across the curve, the long end outperforming, as markets anticipated a pivot from central bank policy makers. Demand for risk-on assets also surged during the period. Emerging markets (EM) fixed income performed in line global bonds during the period, local currency effects detracting from performance. We continue view EMs as attractive, albeit on a more selective basis. With early, substantial, and aggressive interest rate hikes, Emerging Markets have seen a more rapid and significant reduction in inflation compared to developed markets. YTD our Funds continue to benefit from the performance here.

Investment grade corporates

Investment grade bonds in Canada appreciated over the month, posting an excellent month of returns as yields fell across the spectrum. Corporate debt narrowly outperformed government bonds, provincial bonds were the best performing sector overall. Long-term bonds dramatically outperformed short and mid-term maturities. The new issue market remains well supported by investors.

In the U.S., corporate bonds gained value as credit spreads narrowed slightly, lower rates the primary driver of strong performance. Investor’s appetite for fixed income assets remined strong as corporate bonds continue to see inflows with a preference for short-term solutions.

We belief that investment grade bonds continue to demonstrate strong credit fundamentals despite moderately tighter spreads. From a total return basis, short term corporate bonds present a compelling value proposition, particularly in a falling rate environment.

High yield bonds

November saw high yield credit post positive returns as spreads narrowed slightly. Duration exposure the primary contributor to performance. As the narrative around a soft landing continues to build, the team remains mindful of the potential impacts on this segment of the market. Corporate balance sheets are generally in favourable positions as leverage remains at low levels and interest coverage metrics remain in good shape. While we wish to capture current attractive yields, we have a bias to higher quality issuers in the high yield space. We are the positioned to avoid cyclical and consumer focused sectors, favoring instead defensive areas of the market such as utilities. At this point in the cycle, active management – sector allocation and individual security selection – are critical.

Leveraged loans

Loans did not participate fully in the duration driven broad market rally but appreciated slightly as risk-on assets performed well. YTD the asset class has gained over 11%. Performance remains driven by high coupons with over 75% of YTD returns coming from coupons. Only 4 of the 74 sub-sectors in the LSTA benchmark recorded a negative return in November. Lower rated loans outperformed in the month.

Bond stories

Investment Grade – Duration Outperformance

After a long stretch of weakness for Investment Grade corps since early 2022, the asset class notched a phenomenal 5.6% total return for the month of November, driven largely by the sharp move in treasuries. With duration being the main driver, higher quality names which underperformed throughout the year, sharply outperformed with AAAs returning 6.7% compared to A rated bonds returning 5.5% for the month. This is ended up being a meaningful tailwind for high quality investment grade names that we accumulated last year, such as Microsoft, Apple, and Alphabet.

Looking ahead, we continue to have strong conviction in this subsector of the investment grade universe due to 1) High convexity providing positive expected value absent a ‘target’ on the direction of interest rates, 2) strong price appreciation potential, 3) virtually no credit risk.

High Yield – GTN 7 05/15/27 and GTN 5 3/8 11/15/31

Gray is a television broadcast company in the U.S. that owns and/or operates four affiliate TV stations and digital properties in 113 TV markets. We consider Gray to have the highest station quality among its peers, with its stations ranked 1st in 80 markets and 1st or 2nd in 100 markets. This tends to translate into better core advertising trends that its peers and also leads to outperformance in presidential election years. Next year's election is expected to bring in record levels of political ad spending and should drive a much-needed acceleration in deleveraging for Gray.

Leverage has been stuck at over 5.0x since their acquisition of Meredith’s local media business in 2021 and has weighed on spreads this year. However, we’ve seen Gray as offering some of the best value in the high yield media sector and as a result have it as a key overweight position. As focus has started to shift to next year and the tailwind that the election year is likely to provide, the market has bid up Gray bonds, and we see more room for them to run higher.

Leveraged Loan – NielsenIQ - INDYUS TL B 1L USD

NielsenIQ is a global provider of critical retail measurement data, services, and analytics to large enterprise retail and consumer packaged goods (“CPG”) customers. In the month of November, NielsenIQ rallied higher as market participants anticipated relief ahead from rate hikes, which reduces pressure on consumer wallets and lead to CPG companies reversing the sales and marketing pullback trends. This was further supported by NielsenIQ’s Q3 earnings at the end of November which showed continued strength in its operations.

It announced in the quarter that it successfully renewed all 13 of its top contracts at 100%+ retention, implemented successful price increases, made headway in its expansion initiatives into new verticals, and is ahead of plan on its new and enhanced user interface rollout. Revenues in the quarter grew by 2% while EBITDA grew by 4% year-over-year, showing margin expansion despite inflationary pressures and moderating consumer spend. These factors combined contributed to the outperformance of the credit in the month.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of November 30, 2023, including changes in share value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in investment products that seek to track an index.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 30, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

All information is historical and not indicative of future results. Current performance may be lower or higher than the quoted past performance, which cannot guarantee results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Performance may not reflect any expense limitation or subsidies currently in effect. Short-term trading fees may apply.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.