The ETF Lab

ETF Spotlight: 2022’s Top Mackenzie ETFs: Infrastructure, Global Dividends and Canadian Equity

Most investors will likely be pleased to put 2022 in the rear-view mirror. As shown in this chart below from the FT, 2022 (thus far) has been among the worst years in terms of US stock and bond returns.1

What worked in 2022?

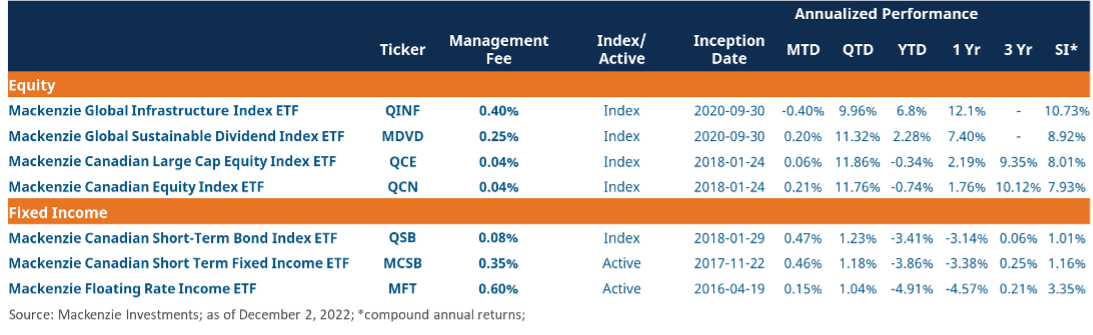

Looking below you’ll see the top performing equity and fixed income ETFs from Mackenzie Investments.

QINF - (Mackenzie Global Infrastructure Index ETF):

Higher inflation, rapidly increasing interest rates and fears about slowing economic activity pressured global equities in 2022. Infrastructure equities have features that can potentially help mitigate each of these risks.

Infrastructure equities typically own tangible assets that can provide stable cash flows that are often directly or indirectly tied to inflationary trends. The stability of these revenues allowed many infrastructure companies to take advantage of low interest rates to lock in cheaper financing for longer periods.2 Thus these companies may be less exposed to rising interest rates.

For more see our article: the unique advantages of infrastructure and how they can protect against inflation.

MDVD - (Mackenzie Global Sustainable Dividend Index ETF)

MDVD employs a multi-factor strategy to provide exposure to globally developed stocks which pay above average dividends. MDVD incorporates volatility and quality screens, which has helped MDVD outperform the MSCI World Index throughout the YTD volatility and provide superior risk-adjusted returns (see table below):

QCN - (Mackenzie Canadian Equity Index ETF) and QCE - (Mackenzie Canadian Large Cap Equity Index ETF)

As we enter 2023, investors looking to reduce their exposure to energy focused ETFs that have performed well over the past year can consider trimming these positions and rotating into a Canadian equity ETF that can still provide exposure to the Energy sector. For instance, over the past year the sector weighting for Energy in QCN and QCE has increased roughly 5% to 18.3% and 18.7% respectively.3

Fixed Income:

Below is where US rate expectations currently stand (on December 5, 2022):

Source: Bloomberg, as of December 5, 2022

Source: Bloomberg, as of December 5, 2022

Whether the market has fully priced in future rate hikes and whether the market has accurately timed future rate cuts is clearly up for debate. However, core fixed income is certainly more attractive today than it was to start 2022.

Consider the US 10 YR treasury yield on January 1, 2022, sat at just 1.51% and the market was pricing in just a 0.82% Fed Funds Rate by the end of 2022 (see below).

Source: Bloomberg, Mackenzie Investments; as of December 5, 2022

Source: Bloomberg, Mackenzie Investments; as of December 5, 2022

QSB - (Mackenzie Canadian Short-Term Bond Index ETF), which is Mackenzie’s top performing fixed income ETF YTD, had a YTM of just 1.4% to start 2022; whereas 10 months later QSB’s YTM is over 3x higher at 4.33%.

ETF News & Notes

Tax loss harvesting opportunities:

Despite the recent market rally, significant YTD declines across risk assets provides an opportunity to potentially offset other capital gains in a portfolio – ultimately lowering the tax payable for your clients.

The investment trade deadline for 2022 is December 28.4

For more on tax loss selling, best practices and potential opportunities see our resources on this topic below:

- Tax loss harvesting strategy in volatile markets

- The ETF Lab: Equity tax loss harvesting ideas for 2022 | Mackenzie Investments

- The ETF Lab: Tax loss harvesting ideas for 2022 | Mackenzie Investments

Canada ending the issuance of real-return bonds. What investors can do.

Earlier in November, the Canadian government announced that it would be ending the sale of Real Rate Bonds (RRB) - citing weak demand5. ETFs focused on this space will likely face a liquidity challenge that can potentially impact their performance.

Investors looking for alternatives in this space, please contact your Mackenzie wholesaling team for more information.

Difficulty in timing ‘the bottom’

As shown in the chart of the week, times of heightened volatility can also produce significant rebounds in asset returns, making perfectly timing a ‘market bottom’ near impossible.

2022 has been a challenging year thus far, however it’s important for long term investors to remember that volatility is a normal part of the investing process. The best course of action is often to remain invested, as history has shown some of the most severe intra-year declines still produced positive overall results. Look particularly at 2009 and 2020 in the chart below:

Source: Bloomberg. As of October 31, 2022 (returns of SPXT Index). 2022 data is YTD.

Source: Bloomberg. As of October 31, 2022 (returns of SPXT Index). 2022 data is YTD.

ETF Flows Update

- Fixed income ETFs continue to see strong inflows as yields decline and the Federal Reserve begins to signal a potential slowdown in the pace of rate hikes. Canadian aggregate fixed income index ETFs have attracted over $935M in inflows over the past 10 days.

- US corporates also attracted inflows, with QUIG - (Mackenzie US Investment Grade Corporate Bond Index ETF (CAD-Hedged)) pulling in ~$104M in the last week.

- US equity index ETFs continued to attract steady inflows in November in Canada, pulling in over $460M. The category has attracted over $5.1B YTD to end of November.6

Mackenzie ETF Top Performers

Source:

1: https://www.ft.com/content/c93f3660-821f-458b-ae0f-23ac05b8f03f

2: https://www.magellangroup.com.au/insights/how-inflation-proof-is-infrastructure/

3: Morningstar, as of November 30, 2022

4: Year-end tax strategies that you need to know (mackenzieinvestments.com)

6: Bloomberg, Mackenzie Investments; as of December 2, 2022

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors. Commissions, brokerage fees, management fees, and expenses all may be associated with ETF investments. Please read the prospectus before investing. The indicated rate[s] of return are the historical annual compounded total returns as of November 18, 2022 including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 18, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the investment fund or asset allocation service or returns on investment in the investment fund or from the use of the asset allocation service. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.