The ETF Lab

ETF Spotlight: Mackenzie’s new fixed income ETFs

To meet advisor needs in building efficient and effective fixed income portfolios, we’re excited to be adding three new ETFs to our fixed income ETF suite.

Source: Bloomberg; Mackenzie Investments; *based on underlying holdings from each index as of October 24, 2023

Source: Bloomberg; Mackenzie Investments; *based on underlying holdings from each index as of October 24, 2023

Opportunity in fixed income today

Given the backdrop of attractive yields, falling inflation and peaking rates, the current environment for fixed income appears quite favourable.

Attractive valuation: Yields today in core fixed income appear attractive relative to what is offered in more volatile asset classes.

Source: Bloomberg. As of September 30, 2023.

Equity: S&P 500 TR Index, REIT: Dow Jones Equity REIT TR Index, Corp Bond: Bloomberg US Corp Index, T-Bills: Bloomberg US Treasury Bills Index, US Treasury: Bloomberg US Treasury Index

Source: Bloomberg. As of September 30, 2023.

Equity: S&P 500 TR Index, REIT: Dow Jones Equity REIT TR Index, Corp Bond: Bloomberg US Corp Index, T-Bills: Bloomberg US Treasury Bills Index, US Treasury: Bloomberg US Treasury Index

Potential tailwind for fixed income: Rate cuts are being priced in for 2024 in both Canada and the US. See below the current implied Fed funds rate, in which the market is currently pricing in just under 3 and a half rate cuts by end of 2024.1

Source: Bloomberg. As of November 6, 2023

Source: Bloomberg. As of November 6, 2023

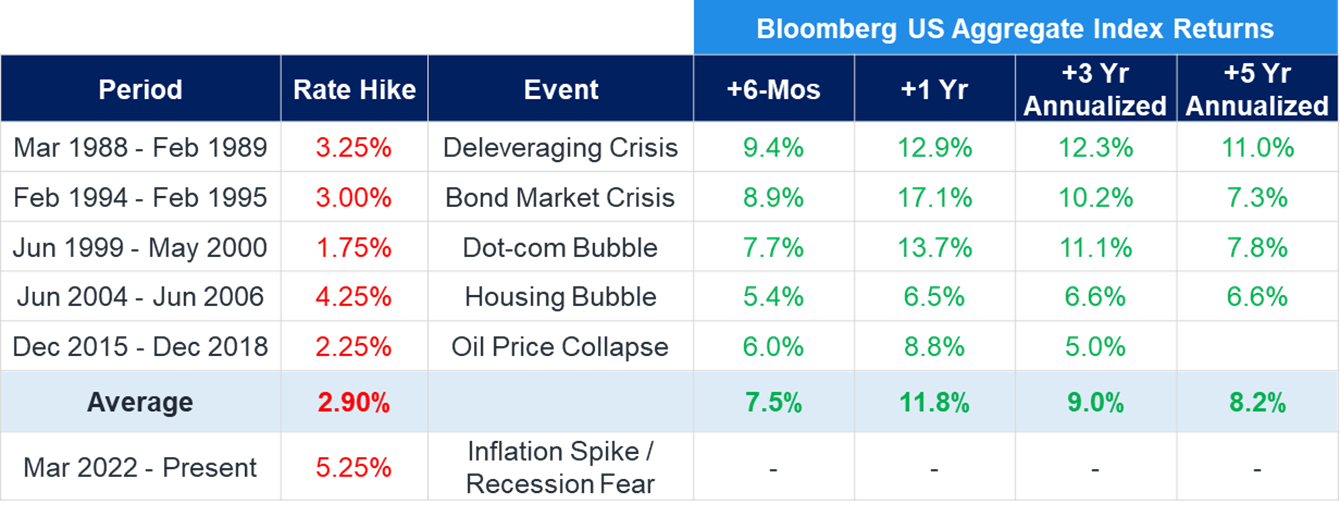

Whether or not rate cuts come to fruition, rates appear to have stabilized at their current levels. Following a pause after a series of rate increases, bonds have historically delivered positive returns.

Source: Bloomberg. As of September 30, 2023

Source: Bloomberg. As of September 30, 2023

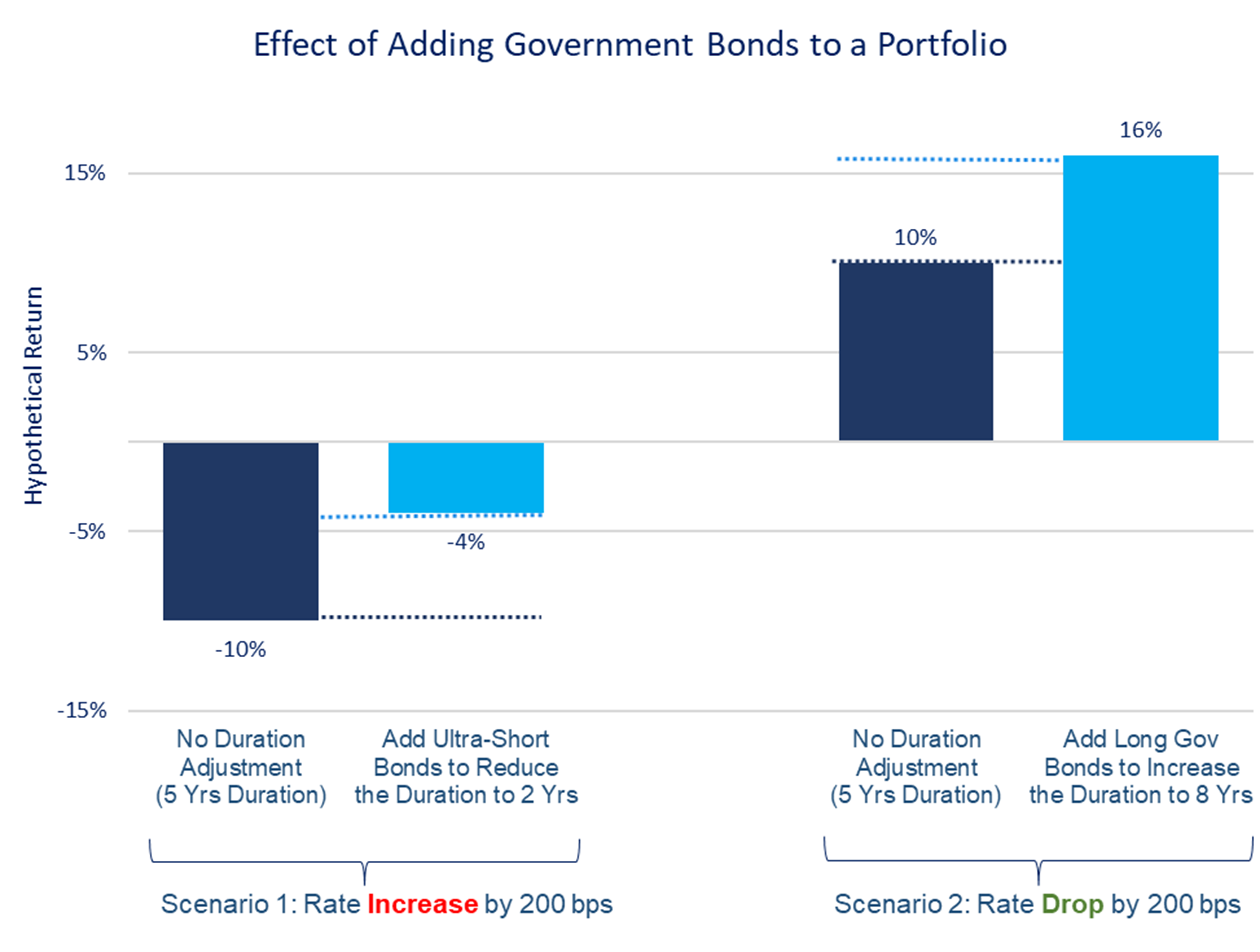

What is the role of government bond ETFs in a portfolio?

- Portfolio diversification: Government bonds’ negative correlation with equity implies that, under normal circumstances, they move in opposite directions. Such a negative relationship is desired to build a portfolio with lower volatility and a higher risk-adjusted return.

- Equity risk diversification: Because government bonds and equity tend to move in opposite directions during market downturns, government bonds can act as an equalizer to equity risk in a portfolio.

- Tools to manage duration risk: These fixed income index building blocks can be critical tools to help advisors manage duration risk in client portfolios.

For illustrative purposes only.

For illustrative purposes only.

Why consider ultra-short duration bond ETFs?

QASH – (Mackenzie Canadian Ultra Short Bond Index ETF) aims to provide exposure to both ultra-short Canadian corporate and government bonds for an optimal yield/risk combination.

Benefits:

- Attractive yield + low interest rate risk: As of October 31, 2023, the underlying index of QASH had a yield-to-maturity of ~5.48% and a duration of 0.48 years.2

- Liquidity: Unlike GICs, this ETF provides intraday liquidity, providing advisors flexibility to reallocate capital to higher risk assets as market dynamics change.

- Diversification: Ultra-short duration bonds typically exhibit low correlation to equities and corporate bonds, helping to lower portfolio volatility and downside risk.

Why consider long government bonds?

As rates moved precipitously higher over the last two years, long duration bonds sold off significantly, with ZFL – (BMO Long Federal Bond ETF), for instance, down -28.5% over the last two years (on a price basis).3

However, as we discussed in our last piece, 'The ETF Lab: Why now may be the wrong time to move to covered call bond ETFs', long dated bonds often help buffer portfolio returns in periods of higher equity volatility. For instance, during the 2007-2009 equity selloff, when the S&P 500 Index fell ~55%, long dated treasuries provided significant insurance for investors posting a +25% return during that same period.4

Benefits of QLB and QTLT:

- Potential offset to equity risk: Long duration bonds typically exhibited low correlation to equities.

- Carry value and high/stable coupons: Bond prices are currently heavily discounted and set to recover as the yield curve further normalizes.

- Better tax outcome on distributions versus investing in US-listed ETFs: As we discussed in 'Tax optimization using Canadian-listed ETFs', advisors should be aware of the potential impact from additional foreign withholding taxes on US-listed ETFs held by Canadian investors. QTLT will invest directly in the underlying holdings.

- Tax-loss harvesting opportunity: See more in the next section on this potential opportunity.

For more information on any of these ETFs, please reach out to your Mackenzie wholesaling team.

ETF News & Notes

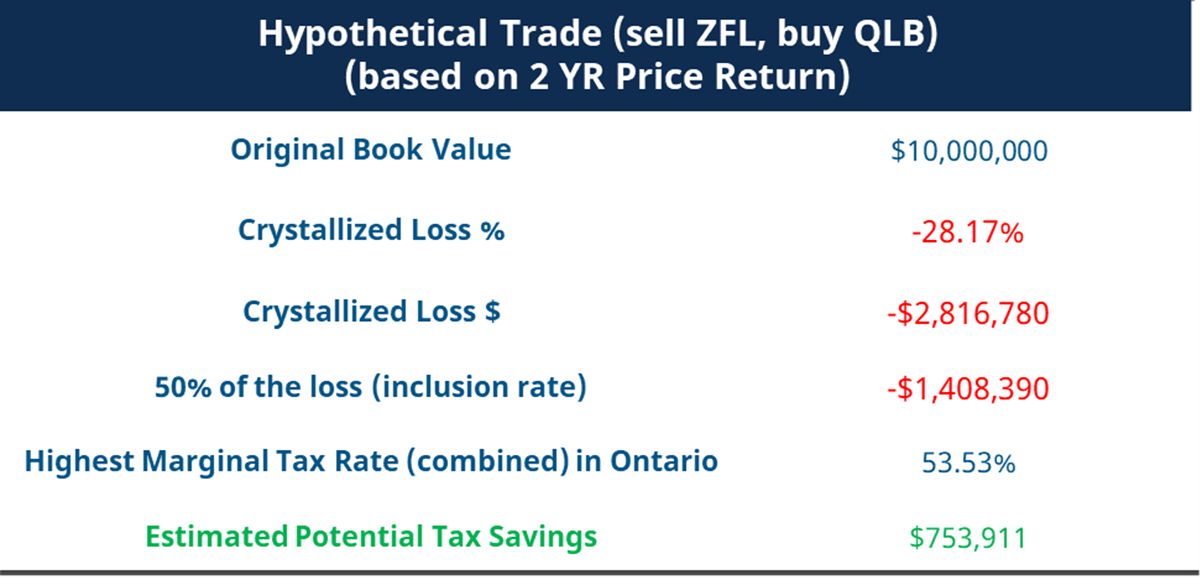

Tax-loss selling opportunity – long duration bonds

Losses (on a price basis) range from -28.2% to -36.8% over the past two years for the two long duration government bond ETFs shown below.5

Source: Bloomberg; as of November 6, 2023

Source: Bloomberg; as of November 6, 2023

These losses could potentially provide a significant tax-loss selling opportunity. As one example, see below the potential tax savings from rotating out of ZFL into an ETF offering a similar exposure, such as QLB – (Mackenzie Canadian Government Long Bond Index ETF).

Source: Bloomberg; price return as of November 6, 2023. For illustrative purposes only. Hypothetical performance is theoretical, is subject to risk, and cannot guarantee or assure future results. Hypothetical performance does not reflect actual client trading or the impact of material economic and market factors on the teams decision-making process for an actual client account. Hypothetical performance is based on certain assumptions that are based on the current view of Mackenzie Investments and could change without notice or prove to be incorrect. Different assumptions would produce different results. Performance results were prepared with the benefit of hindsight. Backtest data are shown before fees and taxes. Additional advisory fees, transaction costs (not included within the assumptions described herein), and other potential expenses are not considered and would also reduce returns. Actual results experienced by clients may vary significantly from the hypothetical illustrations shown. Backtest data are not included to indicate the future results that might be generated by Mackenzie Canadian Government Long Bond Index ETF or any of its components and readers should: (i) recognize that any future performance will likely be inconsistent with, and distinct from, that shown; and (ii) not base any investment decision solely upon this information.

Source: Bloomberg; price return as of November 6, 2023. For illustrative purposes only. Hypothetical performance is theoretical, is subject to risk, and cannot guarantee or assure future results. Hypothetical performance does not reflect actual client trading or the impact of material economic and market factors on the teams decision-making process for an actual client account. Hypothetical performance is based on certain assumptions that are based on the current view of Mackenzie Investments and could change without notice or prove to be incorrect. Different assumptions would produce different results. Performance results were prepared with the benefit of hindsight. Backtest data are shown before fees and taxes. Additional advisory fees, transaction costs (not included within the assumptions described herein), and other potential expenses are not considered and would also reduce returns. Actual results experienced by clients may vary significantly from the hypothetical illustrations shown. Backtest data are not included to indicate the future results that might be generated by Mackenzie Canadian Government Long Bond Index ETF or any of its components and readers should: (i) recognize that any future performance will likely be inconsistent with, and distinct from, that shown; and (ii) not base any investment decision solely upon this information.

OSFI imposed changes coming to HISA ETFs

Earlier this month, OSFI announced that high interest savings account (HISA) ETF deposits would be considered wholesale deposits with a 100% liquidity coverage ratio (LCR) runoff factor and a 0% available stable funding (ASF) factor. This decision indicates that the OSFI views these deposits as unsecured wholesale funding, the least sticky type of deposits, which can be taken away at any time. Deposit taking institutions should apply this treatment by January 31, 2024.

As a result, HISA ETF yields are expected to fall in line with the BoC overnight rate – an expected ~50 bps drop from current levels. This likely makes alternatives, such as ultra-short duration bond ETFs relatively more attractive.

ETF Flows Update

- Fixed income ETFs continue to outpace equity ETF flows, as high yields attract investor interest. Long duration bond ETFs have gained significant momentum in recent weeks, attracting ~+$251M in net flows in the last two weeks.

- National Bank recently noted that the Asset Allocation ETF category has quietly added ~$2.4B YTD and has total asset of $19.7B.6

Mackenzie ETF Top Performers

Source:

1: Bloomberg; as of Nov. 6, 2023

2: Bloomberg

3: Bloomberg; as of November 6, 2023; cumulative return over this period

4: TLT (iShares 20+ Year Treasury Bond ETF) used as a proxy; period: 2007-10-09 to 2009-03-09

5: Bloomberg; as of November 6, 2023

6: Bloomberg, Mackenzie Investments, National Bank Canadian ETF Flows November 2023; as of November 3, 2023

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors.

Commissions, brokerage fees, management fees, and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns, including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This should not be construed as legal, tax or accounting advice. This material has been prepared for information purposes only. The tax information provided in this document is general in nature and each client should consult with their own tax advisor, accountant and lawyer before pursuing any strategy described herein as each client’s individual circumstances are unique. We have endeavored to ensure the accuracy of the information provided at the time that it was written, however, should the information in this document be incorrect or incomplete or should the law or its interpretation change after the date of this document, the advice provided may be incorrect or inappropriate. There should be no expectation that the information will be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. We are not responsible for errors contained in this document or to anyone who relies on the information contained in this document. Please consult your own legal and tax advisor.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 8, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The Mackenzie ETFs are not sponsored, promoted, sold or supported in any other manner by Solactive nor does Solactive offer any express or implicit guarantee or assurance either with regard to the results of using the Indices, trade marks and/or the price of an Index at any time or in any other respect. The Solactive Indices are calculated and published by Solactive. Solactive uses its best efforts to ensure that the Indices are calculated correctly. Irrespective of its obligations towards the Mackenzie ETFs, Solactive has no obligation to point out errors in the Indices to third parties including but not limited to investors and/or financial intermediaries of the Mackenzie ETFs. Neither publication of the Solactive Indices by Solactive nor the licensing of the Indices or related trade mark(s) for the purpose of use in connection with the Mackenzie ETFs constitutes a recommendation by Solactive to invest capital in said Mackenzie ETFs nor does it in any way represent an assurance or opinion of Solactive with regard to any investment in these Mackenzie ETFs.