The ETF Lab

ETF Spotlight: Why now may be the wrong time to move to covered call bond ETFs

Covered call ETFs have been increasingly popular with many individual retail investors, due in large part to advertised high target distribution yields. Recently, we’ve seen covered call bond ETFs launched in Canada, similarly, attracting some individual investor attention.

This week, we examine these ETFs and why now may be exactly the wrong time to rotate out of traditional fixed income for covered call bond ETFs.

Revisiting the trade-offs with covered call ETFs

Covered call ETFs have several trade-offs that advisors should be aware of when considering allocating to these strategies in client accounts. Below, we summarize four considerations, which we explored in more detail in our previous spotlight: Considerations on covered call ETFs | Mackenzie Investments

- Total return trade-off: Investors in covered call strategies are potentially sacrificing longer term capital appreciation for short term cash distributions. Covered call equity strategies have tended to underperform similar strategies that don’t employ a covered call overlay over the long term.

- Higher costs: Because of the operational complexities of executing a covered call strategy, these ETFs typically come with much higher MERs and incur much higher trading expenses than more plain vanilla ETF strategies.

- NAV erosion: Because these ETFs pay a high monthly income, many ETFs in this space have seen their fund NAV decline, meaning investors over time may receive less dollar income unless the distribution yield also increases.

- Covered call ETFs also introduce several additional operational, tax and risk considerations, some of which we discuss below.

What about covered call bond ETFs?

In Canada, covered call bond ETFs have come to market generally writing out-of-the-money (OTM) calls on up to 100% of the portfolio or at-the-money calls on roughly 50% of the portfolio. Some ETFs in this space will also sell puts to boost yield further – which could potentially amplify losses in the event of steep declines in the underlying holdings.

Why now is not the time to trade away portfolio insurance

Just like covered call equity strategies, covered call bond ETFs trade away potential capital appreciation in return for income from call option premiums. However, for fixed income, this trade-off also alters the risk/return profile of one’s portfolio.

As shown below, often during periods in which equities declined significantly, bonds appreciated and helped cushion balanced portfolio returns.

Source: Morningstar, Mackenzie Investments

Source: Morningstar, Mackenzie Investments

A notable exception was 2022. At the start of 2022, the US 10 YR yield was just 1.63% and at that point the market was pricing the Fed funds rate to finish the year at just 0.82% - the Fed raised this rate to 4.50% and eventually to its current level of 5.50%.1

Clearly the yield environment today is very different from the start of 2022. Thus, the primary risk we see with allocating to covered call bond ETFs is that investors may end up trading away significant capital appreciation from their fixed income portfolio, potentially in an environment in which equity returns are also negative.

Consider that during the 2007-2009 equity selloff, long dated treasuries provided significant insurance for investors posting a +25% return during that period.2 Meanwhile, the CBOE TLT 2% OTM BuyWrite Index (which is designed to track the performance of a covered call strategy with a short TLT call option expiring monthly) returned just +5.6% over that period. Investors in that strategy would have sacrificed significant upside returns in their bond portfolio, just as US equities declined roughly -55% over that same period.3

Current fixed income environment

Today, the yield on an index of high grade corporate fixed income in the US is higher than the S&P 500’s current earnings yield.

Source: Bloomberg, Mackenzie Investments; as of October 23, 2023

Source: Bloomberg, Mackenzie Investments; as of October 23, 2023

Meanwhile, even ultra short-term government bond yields have surpassed the S&P 500’s earnings yield.

Source: Bloomberg, Mackenzie Investments; as of October 23, 2023

Source: Bloomberg, Mackenzie Investments; as of October 23, 2023

Today, many bonds are trading at significant discounts. For instance, the weighted average price for bonds in TLT (iShares 20+ Year Treasury Bond ETF) – a common underlying holding in covered call bond ETFs – is just $62.5.4 Overall, with where we are in the current rate cycle, investors may want to think twice about substituting their traditional fixed income holdings for covered call bond strategies.

ETF News & Notes

2023 year-end tax strategies handbook

Please see Mackenzie Investments’ 2023 year-end tax strategies that you need to know.

Below are two highlighted strategies from this handbook:

- Make your trades before the investment deadline: If you’re planning on selling an investment at a loss to offset it against capital gains for this year or in the last three years, you need to do it in 2023. You will typically need two business days for the transaction to settle, so be sure to trade your stocks/ETFs/mutual funds by December 27, 2023.

- Trigger accrued losses before the year-end: For more on this topic, see our previous spotlight: Tax-loss harvesting opportunities for 2023 | Mackenzie Investments

Mackenzie’s asset allocation suite – 3 year anniversary

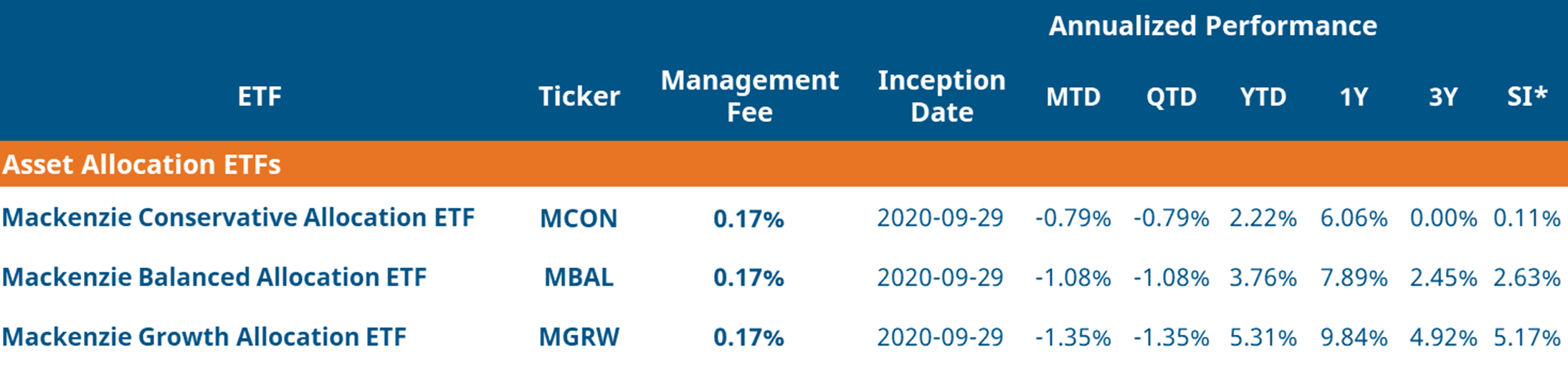

Mackenzie Investments’ offers three asset allocation ETFs (MCON, MBAL and MGRW) that are tailored to your clients’ risk tolerance. Target weights are shown below for these three ETFs that were first launched in September of 2020 and offer diversified access to thousands of underlying securities for an annual management fee of 0.17%.

Source: Mackenzie Investments, weights shown are the target allocations, rebalanced quarterly

Source: Mackenzie Investments, weights shown are the target allocations, rebalanced quarterly

For more on Mackenzie’s asset allocation suite and how advisors are using these ETFs in client portfolios, see our previous spotlight: Exploring Asset Allocation Solutions | Mackenzie Investments.

Source: Mackenzie Investments, as of October 23, 2023

Source: Mackenzie Investments, as of October 23, 2023

ETF Flows Update

- Fixed income ETFs continue to attract flows with investors adding $569M in the week ending October 20th. Canadian aggregate bond ETFs have attracted the most flows of late, while we’ve also continued to see investors attracted to both ends of the yield curve – with ultra short duration, money market funds and long dated bond ETFs also pulling in assets.

- This trend in fixed income ETFs is also present in the US, in which despite a YTD decline of -12% for the iShares 20+ Year Treasury Bond ETF (TLT), this ETF has attracted the 3rd most assets in the US totalling over $20.1 billion USD year-to-date.5

Mackenzie ETF Top Performers

Source:

1: Bloomberg; as of October 24, 2023

2: TLT (iShares 20+ Year Treasury Bond ETF) used as a proxy

3: Bloomberg; return period: October 9, 2007 - March 9, 2009

4: Bloomberg; as of October 18, 2023

5: Bloomberg, Mackenzie Investments, National Bank Canadian ETF Flows October 2023; as of October 20, 2023

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors.

Commissions, brokerage fees, management fees, and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns, including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of October 25, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The Mackenzie ETFs are not sponsored, promoted, sold or supported in any other manner by Solactive nor does Solactive offer any express or implicit guarantee or assurance either with regard to the results of using the Indices, trade marks and/or the price of an Index at any time or in any other respect. The Solactive Indices are calculated and published by Solactive. Solactive uses its best efforts to ensure that the Indices are calculated correctly. Irrespective of its obligations towards the Mackenzie ETFs, Solactive has no obligation to point out errors in the Indices to third parties including but not limited to investors and/or financial intermediaries of the Mackenzie ETFs. Neither publication of the Solactive Indices by Solactive nor the licensing of the Indices or related trade mark(s) for the purpose of use in connection with the Mackenzie ETFs constitutes a recommendation by Solactive to invest capital in said Mackenzie ETFs nor does it in any way represent an assurance or opinion of Solactive with regard to any investment in these Mackenzie ETFs.