As rates moved higher in Canada investors poured money into cash alternative assets such as GICs and high interest savings account ETFs (or HISA ETFs). HISA ETFs in 2022 and 2023 alone attracted over $15.5 billion in net inflows, taking this category’s assets under management (AUM) to just under $21 billion.1

However, regulatory developments earlier this year and a rate cut from the Bank of Canada have helped make ultra-short duration bond ETFs increasingly more attractive as a cash alternative in investor portfolios. Year-to-date HISA ETFs have seen close to $1.3 billion in net outflows, while ultra-short duration bond ETFs have attracted just over $1.3 billion.2

The rise of cash

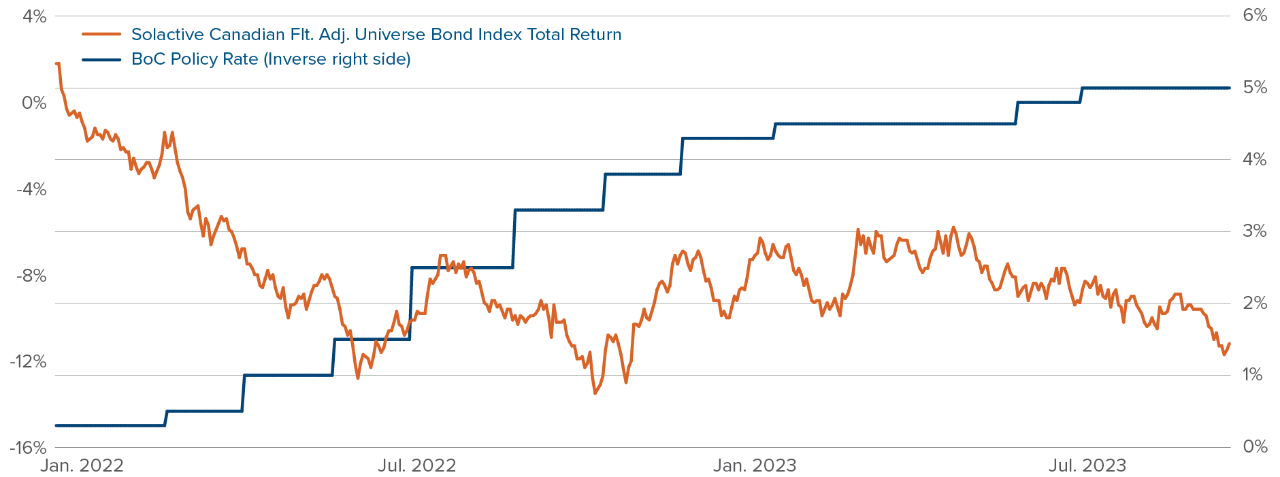

Starting in March of 2022, the Bank of Canada raised its benchmark overnight lending rate from 0.25% to a cycle high of 5%. Typically thought of as the safe part of client portfolios, bonds were battered during this period. The Solactive Canadian Float Adjusted Universe Bond Index, an aggregate measure of the overall Canadian bond market, was down -12.8% from January 1, 2022 to September 30, 2023.3

Source: Bloomberg, as at September 30, 2024.

Source: Bloomberg, as at September 30, 2024.

It’s no surprise in this background that investors searched for alternatives as stocks and bonds declined in tandem throughout 2022.

Two asset classes in particular attracted significant inflows in Canada: GICs and high interest savings account ETFs (or HISA ETFs).

Where are we now?

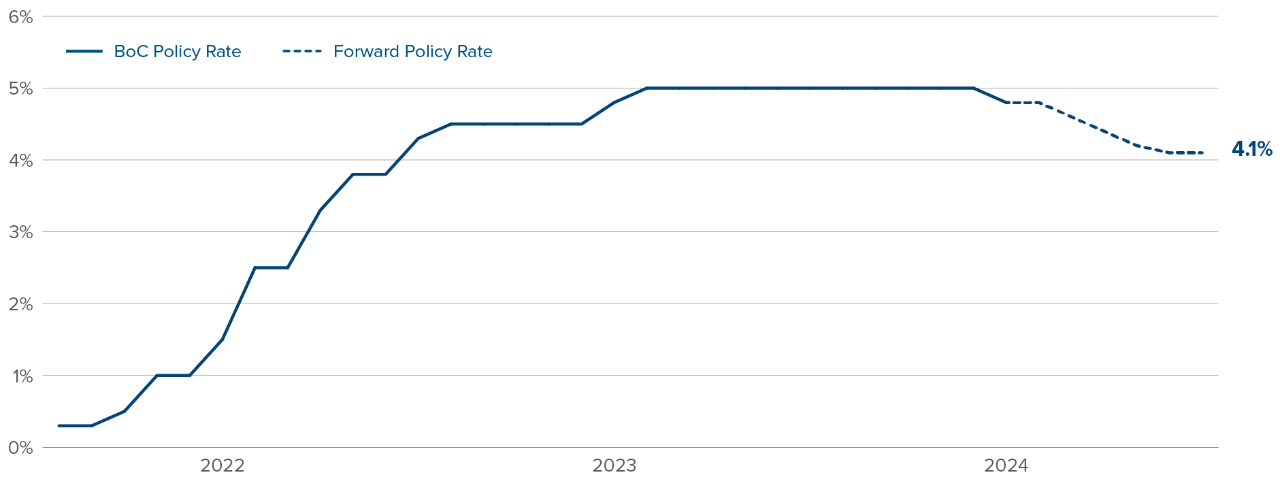

In early June of this year, the Bank of Canada cut its policy interest rate from 5% to 4.75%. The market is also continuing to price in further rate cuts in the months ahead.

Source: Bloomberg, as at July 15, 2024; Canada overnight index swap implied rate.

Source: Bloomberg, as at July 15, 2024; Canada overnight index swap implied rate.

Now, as rates decline investors are beginning to reassess their cash allocations.

Regulatory developments for HISA ETFs

HISA ETFs primarily invest in deposit accounts at Schedule I Canadian banks. Unlike traditional savings accounts, HISA ETFs are exchange-traded, but lack government guarantees or deposit insurance.

In 2022, the Office of the Superintendent of Financial Institutions (OSFI) launched a review of banks’ liquidity adequacy requirements. After this review, OSFI announced an updated requirement for banks to classify HISA ETF deposits as wholesale deposits, rather than retail type deposits, which are viewed as more “sticky” and would carry a lower “run-off factor”.4 As a result, HISA ETF yields fell closer in line with the BoC overnight rate, a decline of between 0.20% and 0.50%.5

The lower yield profile, along with impending rate cuts, have spurred some investors to search for alternatives with similar yields and minimal interest rate risk.

Who doesn’t like a discount?

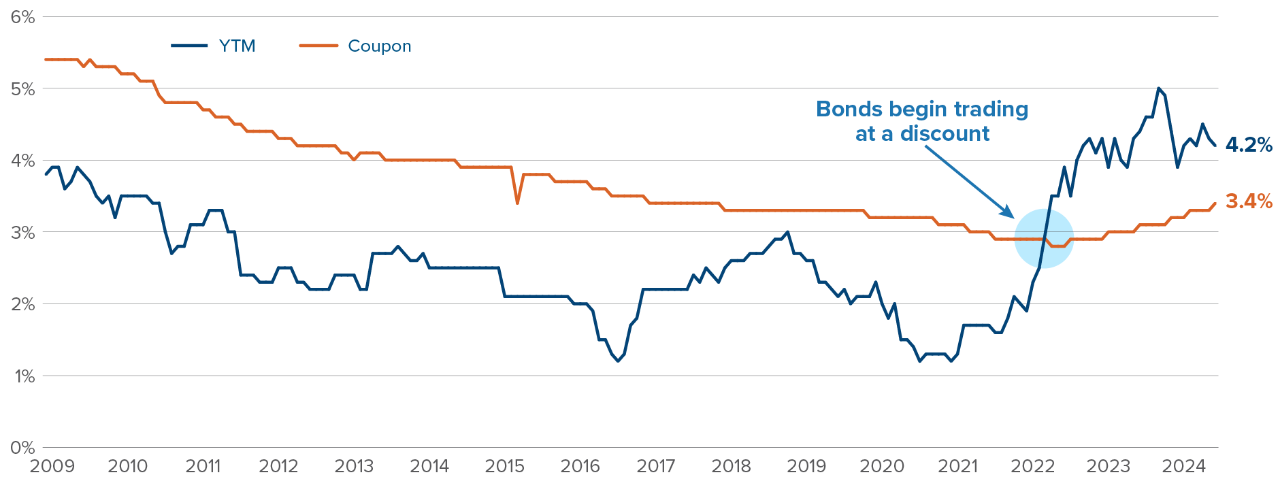

Because of the rapid rise in interest rates over the last couple of years, many bond ETFs are now trading at a discount. How can you tell if a fixed income ETF has bonds trading at a discount? Look at the ETF’s average yield-to-maturity (YTM) vs. its average coupon yield; if YTM is greater, the underlying bonds are trading at a discount, on average.

As an example, see below the change in historical YTM and coupon rate of a Canadian Aggregate Bond Index ETF. For more than a decade the bonds in this ETF were trading at a premium, but starting in 2022 bonds flipped to trading at a discount.

Source: Morningstar, Mackenzie Investments; as at June 30, 2024.

Source: Morningstar, Mackenzie Investments; as at June 30, 2024.

Why does this matter?

When a bond is trading at a discount, a portion of the return moving forward will be made up of capital gains, in addition to the coupon. This creates the potential for a more tax-efficient yield, as the yield on a bond ETF may be a mix of interest income and more tax-favourable capital gains.

In contrast, the yield from HISA ETFs and GICs will be treated entirely as interest income. For example, based on a YTM of 5.09% for an ultra-short duration bond ETF and a weighted average coupon rate of 2.02%, we can estimate an after-tax yield for this ETF of 3.19%, assuming a marginal interest tax rate of 53.5% and a marginal capital gains tax rate of 26.8%.6 A HISA ETF, in which interest income is taxed at the higher marginal interest tax rate, with a 4.71% gross yield would have an estimated after-tax yield of 2.19%.

To learn more on cash alternative ETF solutions talk to your financial advisor or read more on Fixed Income in Focus: Rethinking Cash Allocations | Mackenzie Investments.

Sources

1 Source: Bloomberg, as at July 5, 2024.

2 Source: Bloomberg, as at July 5, 2024.

3 Source: Bloomberg, as at September 30, 2023.

4 OSFI upholds 100% liquidity requirement for HISA ETFs to promote financial resilience (newswire.ca)

5 Review of Cash Alternative and Money Market ETFs in Canada, National Bank ETF Strategy Notes, February 28, 2024.

6 2023 Ontario marginal tax rates. YTM and coupon rate as at June 30, 2024.

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of June 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.