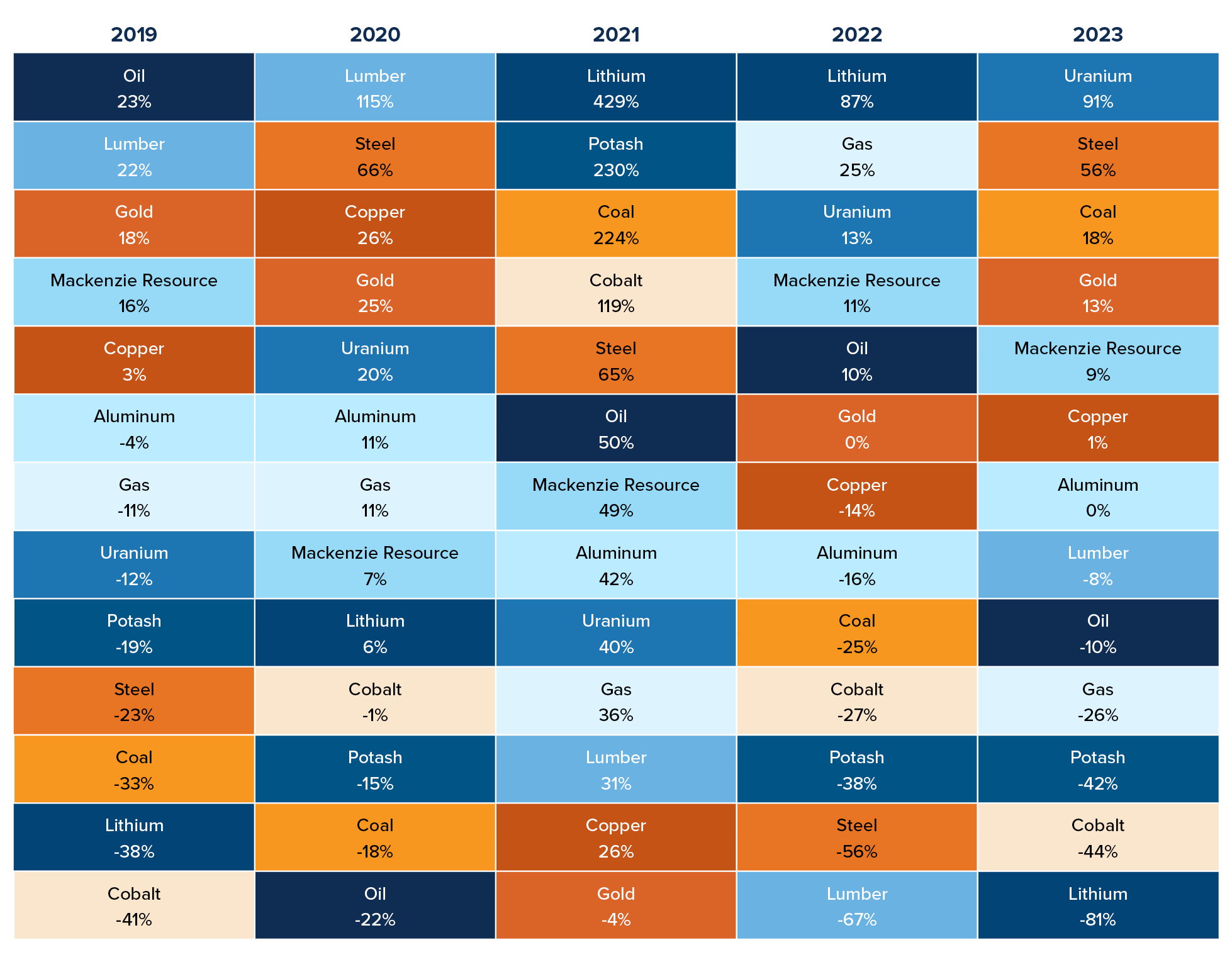

The case for investing in resources is an intriguing one. Who wouldn’t want to invest in an uncorrelated asset class with the potential of hitting the jackpot? For example, if you invested in lithium in 2021, you could have earned a staggering 429% on your investment that year, and a cool 87% in 2022. Easy game, right? Only if our crystal balls would have worked a little better! In addition, the rapidly evolving macroeconomic and geopolitical landscape appears supportive of resources. Here’s why:

• The energy transition is highly resource intensive, shifts the demand for all forms of energy and requires the electrification of society.

• The onshoring/reshoring of supply chains in the aftermath of the pandemic and persistent geopolitical tensions require the rebuilding of manufacturing chains.

• Infrastructure investments are required to accommodate reshoring and immigration trends. This resource intensive buildout could be further exacerbated by decades of underinvestment.

Who invited volatility to the party?

But what happened to lithium in 2023? Down 81%. Clearly, while investing in resources is intriguing, it’s also not easy to do on your own, due to the inherent volatility in these sectors.

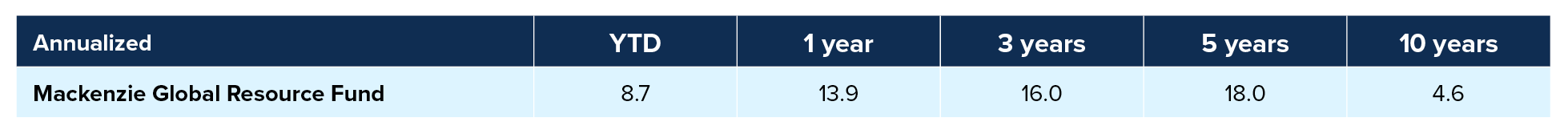

Mackenzie fund returns are annualized total returns including distributions, Series F, in USD. Reference commodities are Brent Oil, Lumber CME Futures, Copper LME Cash, Aluminum LME Cash, Gas Henry Hub 12mth Future, Uranium Spot UxC, Potash CFR Brazil, Lithium Carbonate (CNY), Steel US HRC/t, Coal Hard Coking Metallurgical Coal, Cobalt LME Cash.

Standard performance table (CAD) can be found at the end of the blog for reference.

In the above table we show the calendar year returns ranked from best return (top) to worst (bottom) for some of the most popular resource sectors. We see lots of volatility and no pattern of returns. Now let’s dive a little deeper into the numbers.

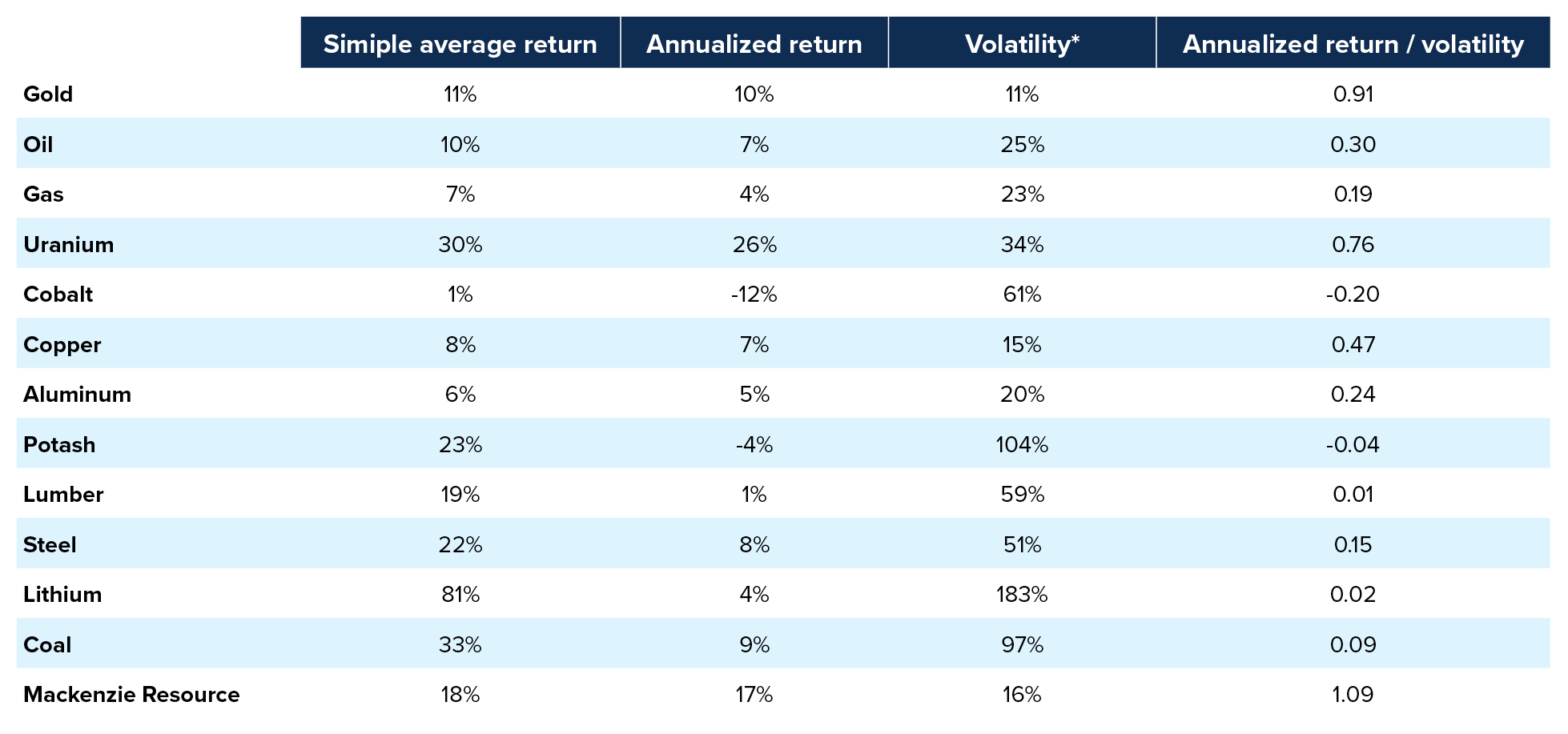

* Volatility is calculated by taking the standard deviation of the annual returns from 2019-2023.

* Volatility is calculated by taking the standard deviation of the annual returns from 2019-2023.

Notice anything odd with the return numbers in the table. The simple average and annualized returns can often be much different. This is especially true if there is a lot of volatility. Let’s again use lithium as an example. If you asked what lithium’s average return over the last five calendar years was, you could easily say 81% and not be incorrect. However, this is not exactly what you experienced. Rather, you returned about 4% a year for five years, while taking on 183% of volatility! When you divide the two, this means you only got 0.02% return per 1% of risk taken. In contrast if you invested in the Mackenzie Global Resource Fund, you would have experienced a 17% annualized return with a 1.09% return per 1% of risk — a much better ratio.

Investing in resources is hard

As we have shown, investing in resources can be difficult, and there is a lot of volatility. This could be a good reason to outsource your resource investments to an expert.

The resource sector provides distinctive alpha potential due to high idiosyncratic risk. Through active management, the Mackenzie Resource Team (the “Team”) invests in companies from the energy, materials and precious metals subsectors, allocated based on risk and opportunity indicators. This broad subsector diversification can offer lower volatility relative to narrow subsector exposures in energy, metals and gold ETFs. The Team has decades of active management experience in the resource sector, in-depth expertise and a track record of providing consistent returns.

Rock Solid Experience, rooted in science.

In 1978, Mackenzie Investments founded Canada’s first resource fund. Today, our Team builds on Mackenzie’s decades-long legacy, along with advanced degrees in mineral economics and petroleum engineering, and hands-on experience working in the mining sector to make informed decisions. Our background provides a deep understanding of the resource industry’s processes, impacts, risks, long-term growth potential and ultimately, what makes a company worth investing in.

The Team values companies through a:

Financial Analysis Lens:

- Sustainable free cash flow (FCF)

- Management’s wise allocation of capital

- Quantitative risk management overlay

Science & Engineering Lens:

- All members of the Team have science or engineering background

- Site visits worldwide

- Fundamental Analysis of future demand/price

Source: Mackenzie Investments, Morningstar. As at September 30, 2024. Results in CAD, gross of fees. Note 1: Risk-free rate: Canada T-Bill – 3 month. Note 2: Calculation benchmark: Respective mandate benchmark.

Source: Mackenzie Investments, Morningstar. As at September 30, 2024. Results in CAD, gross of fees. Note 1: Risk-free rate: Canada T-Bill – 3 month. Note 2: Calculation benchmark: Respective mandate benchmark.

Past performance is not necessarily indicative of any future results. The above performance figures do not reflect the deduction of investment advisory fees or the impact of other fees and expenses upon performance.

To learn more about the Team and investment solutions they manage, please visit the Mackenzie Resource Team.

Commissions, trailing commissions, management feesand expenses may all be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of September 30, 2024 including changes in unit value and reinvestment of all distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual fundsare not guaranteed, their values change frequently, and past performance may not be repeated.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of September 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.