Highlights

- Canada has officially become one of the first targets of Trump’s trade war, getting hit by 25% tariffs on non-energy goods imports, and 10% tariffs on energy imports.

- The Trump administration has broad discretion in applying temporary tariffs on Canada, but their lasting power is uncertain.

- A no-holds-barred US-Canada commercial war would mean lower growth, deep Bank of Canada rate cuts, and a sub-$1.50 Canadian dollar.

In the first Trump protectionist crusade of 2017-2019, Canada was an afterthought to other targets like China and Mexico. This time around, Canada has been singled out by Trump, both in his public pronouncements and his actions. Trump’s “advisors”, often quoted anonymously in media, generally have a more nuanced view on the Canadian trade threat, but the President has been unequivocal in his attacks.

Part of the reason Canada has been in Trump’s crosshairs is its vulnerability to presidential discretion. Given Canada shares a border with the US, Trump can easily use emergency powers to unilaterally tax its exports. Illegal immigration and drug trafficking are more believable as pretexts for emergency tariffs on Canada than on e.g. Europe. These “emergency” pretexts make it harder for US courts to strike down the presidential tariffs on Canada, or the World Trade Organization to cry foul.

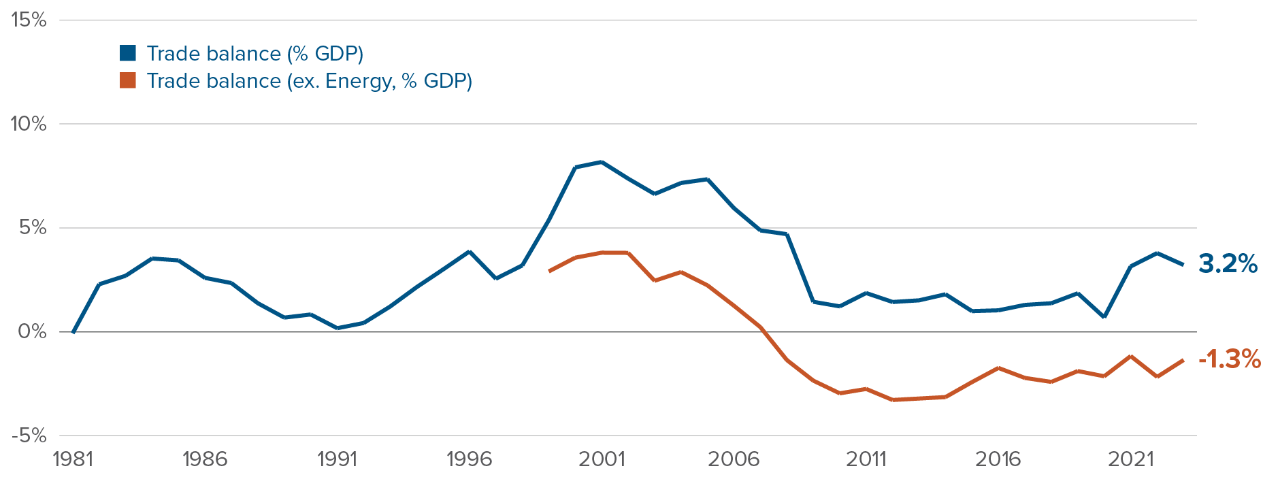

Canada’s trade surplus with the US — Canadian exports to the US minus Canadian imports from the US — is much larger today than in Trump’s first mandate. After averaging around 1% of Canadian gross domestic product (GDP) for most of the 2010s, it surged to 3.8% in 2022, before inching down to 3.2% in 2023. We forecast the 2024 number to come out close to 3.5%. This new, higher plateau for Canada’s trade surplus with the US is explained by rising oil prices, a relatively weak domestic Canadian economy, and general US dollar strength.

Canada’s US trade surplus possibly at a new, higher plateau

Canada’s trade surplus with the US (goods and services, % of Canadian GDP)

Source: Statistics Canada

Source: Statistics Canada

While Trump won’t like this new persistent trade deficit with Canada — a Canadian surplus is a US deficit — it is tiny from a US perspective. While Canada’s surplus with the US amounts to around 3.5% of Canadian GDP, it makes up only around 0.2% of US GDP. In contrast, the US bilateral deficit with China will likely come out to around 1.5% of US GDP for 2024, once the data is released. Plus, China’s economic policies blatantly distort the trade account, artificially pushing up China’s surplus with the US. The US can quibble with some Canadian policies aimed at unreasonably boosting exports or restricting imports, notably when it comes to metals (steel and aluminum, especially) and agricultural products. But China is, and should be, a more obvious target.

All that to say that it’s not particularly clear why Trump is targeting Canada, other than to satiate his imperialist bent. What is clear is that the new administration does have the power to implement significant tariffs on Canada, without going through Congress. On February 1, it used the International Emergency Economic Powers Act (IEEPA) to impose 25% tariffs on all non-energy goods imports from Canada, and 10% tariffs on energy imports. The same mechanism was used to tariff imports from Mexico (25%) and China (10%).

US president has a few potential paths to impose tariffs on Canada

Potential legal policy paths

Tool |

Mechanics |

Implementation delay |

International Emergency Economic Powers Act |

President declares state of emergency (drugs or immigration as pretext). Can unilaterally impose tariffs on "offending" country. Probably not a permanent "solution" for tariffs. |

Almost immediate implementation, but will be subject to legal challenges. |

Section 301: Unfair trade practices |

The US Trade Representative initiates an investigation. The investigation typically takes more than a year, but the pace was accelerated during the First Trump administration. |

6-12 months for the investigation; two weeks for implementation |

Section 232: National Security |

Labels all imports as "threats to national security". More likely to be used for universal tariffs than for Canada-specific ones. |

Unknown |

Source: Morgan Stanley, Bloomberg

While tariffs enacted under IEEPA are fast-acting, they are unlikely to turn out permanent. The president can bypass the United-States-Mexico-Canada Trade Agreement (USMCA) — and the US Congress — only in the case of an “emergency”. Trump’s emergency pretexts should eventually fade, especially if the Canadian government takes tangible steps to address illegal immigration flows and drug trafficking. Instead, the President would need to pivot to Section 301 of the Trade Act, uncovering unfair trade practices as a pretext for imposing tariffs, which would take at least a few months. It could also use a National Security pretext, which would be a clean avenue to impose tariffs on China, but less so on Canada, outside of specific industrial commodities.

Ultimately, the endgame for the Canada-US trade war is an acrimonious renegotiation of USMCA next year. Whether the current 25% tariff is a negotiation tool or a permanent target is a key question. If Trump can get buy-in from Congress Republicans, the era of free trade in North America might soon be over.

Although they initially include energy products (at a lower 10% tag), permanent US tariffs on Canadian exports would probably have a carve-out for oil. Trump and his team are acutely aware of the political salience of gasoline prices in the US. While US refiners could eventually replace Canadian oil, it would take half a decade to sort out the critical supply chains. In the shorter-term, tariffs on Canadian energy would inflate US gas prices. In the first few days of his presidency, Trump has already tried to use US geopolitical heft to compel allies to boost oil production. Penalizing Canadian oil production would be counterproductive.

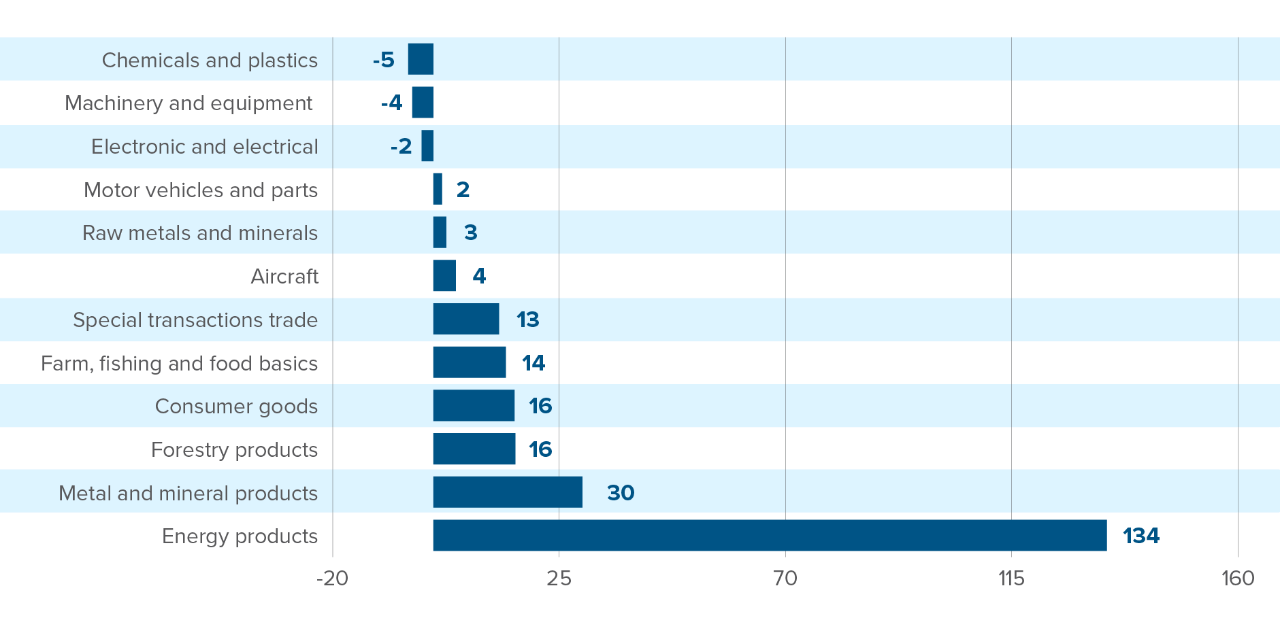

Energy products make up the bulk of Canadian net exports to the US. In fact, Canada’s best negotiation tool might be restrictions on its energy exports to the US, rather than retaliatory import duties. But such restrictions would further weaken the Canadian dollar and anger Alberta, making it an unlikely policy decision in our view.

The US is now a net global exporter of oil. But it still imports it from Canada.

Canadian net goods exports to the US, by category (billions of CA$)

Source: Statistics Canada.

Source: Statistics Canada.

When it comes to forecasting any of Donald Trump’s actions, it is wisest to channel Socrates. “All we know is we know nothing” about the path of tariffs. Trump made a complete volte-face in his spat with Colombia last week, going from threats of 50% tariffs to a deal with the Colombian president within 24 hours. The worse-case scenario for Canada, a years-long 25% across-the-board tariff on all goods exported from Canada to the US, with one-for-one retaliation from Canada, would mean around a 3% hit to Canadian real GDP, realized over the next few years.

That dramatic scenario would lead to significant hardship in some parts of Canada. From a total economy perspective, the impact of these tariffs on GDP over the next two to three years would likely be smaller than that of the 2014-2015 oil price shock. But, most importantly, we’d see slightly lower productivity growth in the very long term, a disaster for compounded future growth.

Preparing for the worse

Economic reactions to a permanent 25% tariff

Variable |

Impact |

Details |

Growth |

↓ |

Recession in 2025, and lower long-term productivity growth. Hundreds of thousands of job losses, but reversing quickly as Canada's economy reorganizes. |

Inflation |

? |

Assuming Canada retaliates one-for-one, we'd get an immediate jump in prices. But over a few years, it would result in lower inflation. Canada has not fully retaliated to US tariffs yet. If it doesn't, even the short-lived spike in prices would be limited. |

Bank of Canada rates |

↓ |

Rates would need to slide well below 2% to support the economy through the tariffs' impacts. We are confident the Bank of Canada would look through the initial price increase and focus on employment and growth. |

Canadian dollar |

↓ |

USD rises to $1.50 CAD, much higher if Canada does not retaliate one-for-one. |

TSX |

↓ |

Moderate losses in the Canadian market, concentrated in the Industrials and Financials sectors. |

Source: Author’s scenario. Illustration purposes only.

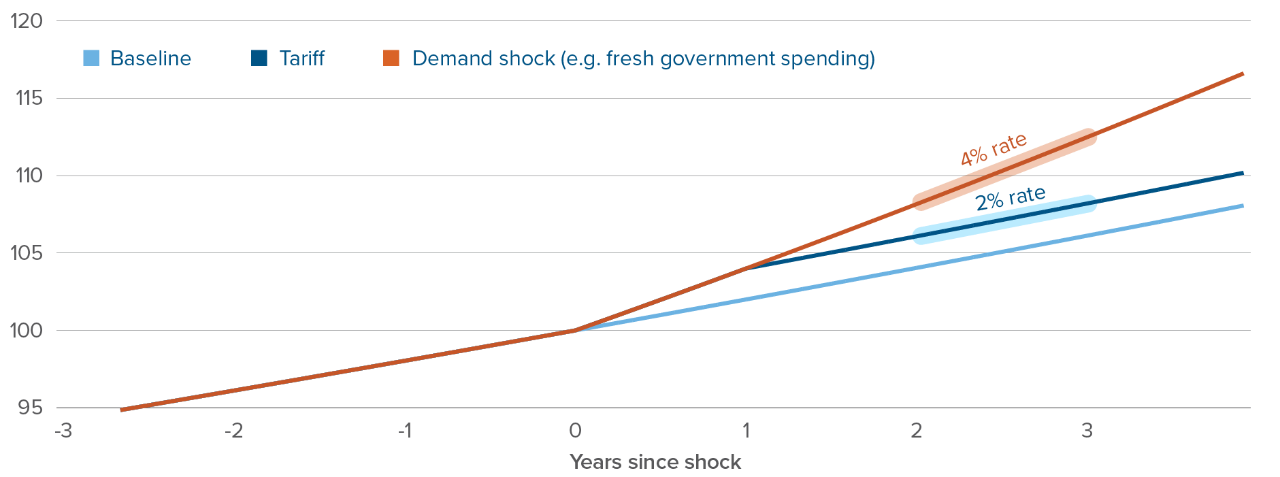

Last month’s commentary explained how in the US tariffs would not kindle an inflationary shock worth reacting to by the Federal Reserve. The same holds for Canada: if Canada retaliates one-for-one to US tariffs, prices will jump in Canada, but inflation likely won’t lose its anchor to its 2% trend. On the contrary, from excess productive capacity could emerge the spectre of deflation.

The Bank of Canada should not raise rates to counter a one-time jump in prices

Consumer price index under various shocks, 0=100

Source: Author’s scenario. Illustration purposes only.

Source: Author’s scenario. Illustration purposes only.

As such, the Bank of Canada should react to across-the-board tariffs by aggressively cutting its policy rate. A 25% tariff, even if imposed only temporarily, would cause a recession and significant job losses. Lower rates would be necessary to smooth the shock, with cheaper capital to finance a restructuring of the economy.

Bank of Canada officials have stated they wouldn’t react to the threat of tariffs. They would only adjust the policy rate if, and when, tariffs are implemented, and potentially only when their negative impacts begin to be reflected in economic data. That is not an unreasonable stance, given the uncertainty involved. But rate cuts take some time to fully affect the Canadian economy. It would be optimal to cut rates immediately down to around 2%, to foam the runway for tariffs. If the threat fizzles out, and the current tariffs get rolled back or softened, the Bank of Canada could simply reverse those extra rate cuts in 2026.

Multi-Asset Strategies Team’s investment views

Tactical summary

Source: Mackenzie Investments.

Note: The views expressed in this piece apply to products that are actively managed by the Multi-Asset Strategies Team.

Source: Mackenzie Investments.

Note: The views expressed in this piece apply to products that are actively managed by the Multi-Asset Strategies Team.

Positioning highlights

Neutral on duration: We’ve mostly shied away from duration over the past few years. We preferred leaning into stocks for returns and saw US recession odds as overblown. We still don’t expect a recession anytime soon, given the US government’s continuing deficits and the Federal Reserve’s eagerness to cut rates ahead of a contraction. But we also don’t see high risks of an inflation surge over the next few quarters, the ultimate risk for fixed income. Trade tariffs will cause prices to jump in the US, but are not an inflationary shock. Once the one-time effect on prices has passed, future inflation could be lower than without the tariffs, given trade wars could depress economic growth. Our bond exposure peaked in early January, but with bonds rallying during the month, we are now back down across the threshold to neutral.

Overbought global stocks: We are turning slightly bearish global equities, after stock market gains — without a coincident improvement in fundamentals — finally brought valuations to overbought levels. We still think economic growth will be solid and investor sentiment remains positive. But the growth in sales and profit margins required to justify current valuations is too ambitious for our taste.

Still bearish on the euro: In November, we closed our euro overweight. Financial market inflows have been turning into outflows in recent months, a bad omen for the euro. Plus, revised estimates of long-term euro fair value, using recently released macro data, suggests that the euro is less cheap than previously thought. Even with the euro underperforming most developed market currencies in the fourth quarter of 2024, it remains too expensive given the economic weakness and political risks in France and Germany.

Upside potential in small caps: Small cap stocks are not a bargain, but they are somewhat cheaper than large cap stocks across sectors, as our November Commentary outlined. Small caps’ window of outperformance is narrow: it requires both Fed rate cuts and a resilient US economy. But if the post-Covid economic overheating does resolve with a soft landing, the valuation gap between small and large cap could close quickly.

Canadian landing: The macro situation in Canada is much more dire than in the US. The Canadian economy has an argument for the most disappointing advanced economy in 2024. The job market is deteriorating quickly, especially when adjusting for working population growth and government hiring. US tariffs on imports from Canada will further weigh on medium-term growth. We like Canadian government bonds, but dislike Canadian stocks and the Canadian dollar. We’ve taken some gains in our short position in the Canadian dollar in 2025, but still expect it to underperform most other currencies globally.

Doubling down on European duration: Inflation rates have been pulling back in a synchronized manner across Euro area countries. In recent weeks, even solid-but-unimpressive economic indicator prints have been met with rallies in long-term rates, as markets price out the right tail scenario of an inflation spiral. At the other end of the spectrum, United Kingdom is less attractive.

Running from Industrials: Short-term prospects for the S&P 500 Industrials sector are dire. Informed investors have recently turned sharply against the sector. Plus, the economic environment might prove rough for industrial stocks in the first months of 2025. Tariffs on intermediate goods for US factory production could hurt margins. And markets are likely underestimating the risks of slowing global economic growth in the first half of the year. The industrial sector is one of our largest negative sector bets, along with materials, threatened by continued economic weakness in China.