ETF liquidity and why it matters

How easy is it to buy and sell ETFs?

In our last ETF Lab we looked at the unprecedented opportunity within fixed income to employ a tax loss harvesting strategy. This week we turn our focus to several opportunities on the equity side to help your clients harvest tax savings.

Tax loss harvesting is a method in which an investor realizes losses by selling securities that currently have a fair market value that is lower than its cost base. This strategy applies only to non-registered accounts.

If you’re planning on selling an investment at a loss to offset it against capital gains, for this year or any of the last three years, you must do it before year-end. You will typically need two business days for the transaction to settle, so be sure to trade your ETFs/mutual funds/stocks by December 28, 2022.

When an investment is sold at a loss, and an identical investment is purchased either 30 days before or after the loss was realized, Canadian tax laws will deny the loss.

To avoid the superficial loss rules investors can add a similar but not identical investment in their portfolio. For example, an ETF typically can be purchased with the same exposure as another ETF provided it tracks a different index.

Significant losses in some equity markets potentially provides investors an excellent tax loss selling opportunity. As one example, see the potential tax savings on rotating out of ZEA – (BMO MSCI EAFE Index ETF) into QDX – (Mackenzie International Equity Index ETF).

Please note this is for demonstration purposes only. Actual tax savings will depend on the individual. Please consult a tax expert. This demonstration is only relevant to securities/funds held in non-registered accounts that have lost value. Source: Bloomberg; price return as of October 31, 2022

Below is a small selection of individual stocks that are down significantly YTD. To offset realized capital gains investors can sell out of stocks, which are trading at a lower price than their adjusted cost base, and rotate into a single, diversified broad market index ETF. Investors can then re-enter some or all these positions after 30 days or remain invested in the ETF.

Broad market index ETFs can be effective instruments in a tax loss selling strategy, as they can help investors stay invested and help crystallize losses. As we showed last week, investors can potentially rotate from one index ETF to another, provided these ETFs track different indices.

For a full list of potential tax loss selling opportunities and/or to find out more about any of the ETFs listed above please contact your Mackenzie sales coverage.

Source: Mackenzie Investments; as of November 4, 2022

Source: Mackenzie Investments; as of November 4, 2022

As Mackenzie Investment’s Co-Head of Fixed Income, Konstantin Boehmer, has argued (Did someone say 5.5%? | LinkedIn), yields in some areas of fixed income are starting to look attractive and provide a reasonable buffer against the risk of higher rates.

For instance, Canadian aggregate fixed income and Canadian short term fixed income yields today offer a very different level of buffer than just 10 months ago:

Source: Bloomberg, Mackenzie Investments; as of October 31, 2022

Source: Bloomberg, Mackenzie Investments; as of October 31, 2022

As fears of slowing growth and financial stability increase, Konstantin also points out that investors today remain underweight in fixed income “relative to both their own history and expectations”. Investors looking for comprehensive, actively managed ETF solutions to help navigate these uncertain markets can consider the ETFs below:

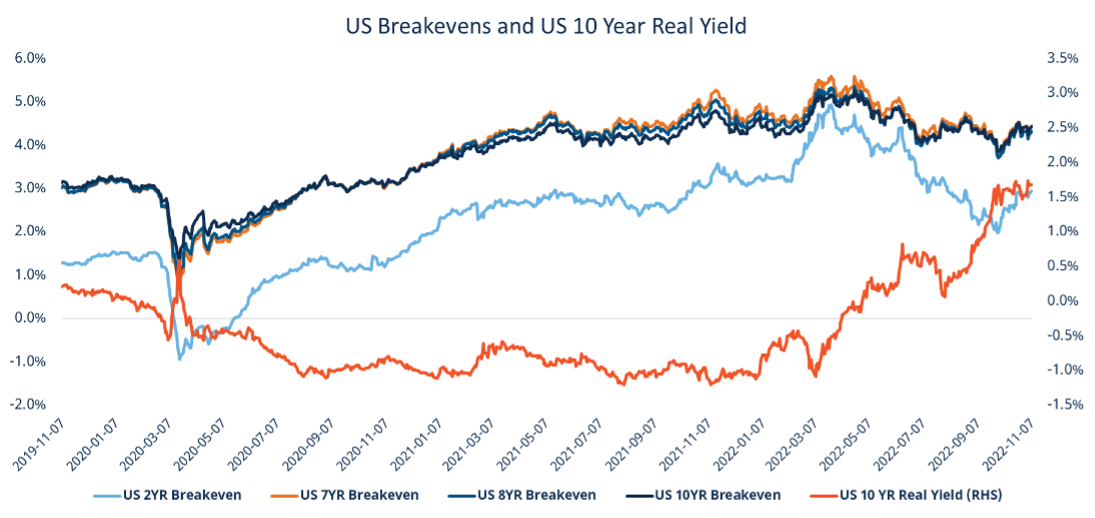

Since peaking in early April, US breakeven inflation rates have been coming down throughout 2022. However, as the calendar turned to October US breakeven rates bounced off their lows while real rates remained flat.

Source: Bloomberg, Mackenzie Investments; as of November 7, 2022

Source: Bloomberg, Mackenzie Investments; as of November 7, 2022

This short-term move doesn’t yet signal a trend change but is a good reminder of the possibility of future upside surprises in inflation.

QTIP – (Mackenzie US TIPS Index ETF (CAD-Hedged)), which tracks a diversified portfolio of US TIPS, has an annual management fee of 0.15%. Our view is that investors can consider a long-term strategic allocation to QTIP due to its potential to provide equity risk diversification, protection against upside surprises in inflation, and income.

To learn more about US TIPs and what impacts their performance see our Q&A piece: Treasury Inflation-Protected Securities (TIPS) - Q&A on performance and distributions 2020-2022

How easy is it to buy and sell ETFs?

Source:

1: Retail investors take shelter in cash after stock market rout | Financial Times

2: Source: Bloomberg, Mackenzie Investments; as of November 7, 2022

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors. Commissions, brokerage fees, management fees, and expenses all may be associated with ETF investments. Please read the prospectus before investing. The indicated rate[s] of return are the historical annual compounded total returns as of November 4, 2022 including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 4, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of the investment fund or asset allocation service or returns on investment in the investment fund or from the use of the asset allocation service. Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.