The ETF Lab

ETF Spotlight: Asset allocation ETFs

Why is asset allocation important?

Studies have shown that asset allocation can account for up to 92% of the variation in a portfolio’s returns1. Consequently, Mackenzie’s asset allocation ETFs have been professionally designed to provide effective asset allocation in a single solution.

How advisors can use asset allocation ETFs in client portfolios:

- Help build a cost-effective core: These ETFs provide investors cost-effective exposure to thousands of underlying holdings.

- Cash equitization: Help reduce cash drag in your clients’ portfolios by drawing on the intraday liquidity offered by asset allocation ETFs.

- Simplify rebalancing: These ETFs are rebalanced regularly to maintain target exposures and risk levels.

- All-in-one solution: The Mackenzie suite of asset allocation ETFs provides embedded discipline and manages for operational complexity in executing an effective asset allocation strategy.

Mackenzie Investments’ asset allocation ETFs

Mackenzie Investments’ offers three asset allocation ETFs (MCON, MBAL and MGRW) that are tailored to your clients’ risk tolerance.

Source: Mackenzie Investments, weights shown are the target allocations, rebalanced quarterly;

*source: Morningstar as of October 31, 2022

Source: Mackenzie Investments, weights shown are the target allocations, rebalanced quarterly;

*source: Morningstar as of October 31, 2022

Since inception, Mackenzie’s asset allocation ETFs have posted competitive relative returns:

Source: Morningstar, Mackenzie Investments; period: September 30, 2020 – May 31, 2023

Source: Morningstar, Mackenzie Investments; period: September 30, 2020 – May 31, 2023

How do Mackenzie’s ETFs differ from other asset allocation ETFs?

- Annual management fee of just 0.17%

- Adjusting for Canadian home bias: Mackenzie asset allocation ETFs are the only asset allocation suite that provides exposure to both Canadian domiciled developed ex North America and emerging market local currency bonds.

Source: Bloomberg; as of May 31, 2023

Source: Bloomberg; as of May 31, 2023

- Diversification benefits: These unique asset classes can potentially help enhance diversification due to modest to negative correlation with Canadian equity and fixed income.

- Potential tax efficiency: All underlying ETFs within Mackenzie’s asset allocation ETFs are Canadian listed and obtain direct exposure to the underlying securities. For more information on potential tax inefficiencies for Canadians investing in ETFs that wrap US listed ETFs, read more here.

ETF News & Notes

Value in short term fixed income

Inflation in May for Canada came in slightly below expectations. While still well above the central bank’s target, inflation is now moving in the right direction.

As we’ve noted for several months, the yields today in core, investment grade short term bond ETFs are relatively attractive, given the limited interest rate risk in these ETFs. In fact, yields in these ETFs are higher than what was available in high yield funds just a year and a half ago.

Source: Bloomberg, Mackenzie Investments; as of May 31, 2023

Source: Bloomberg, Mackenzie Investments; as of May 31, 2023

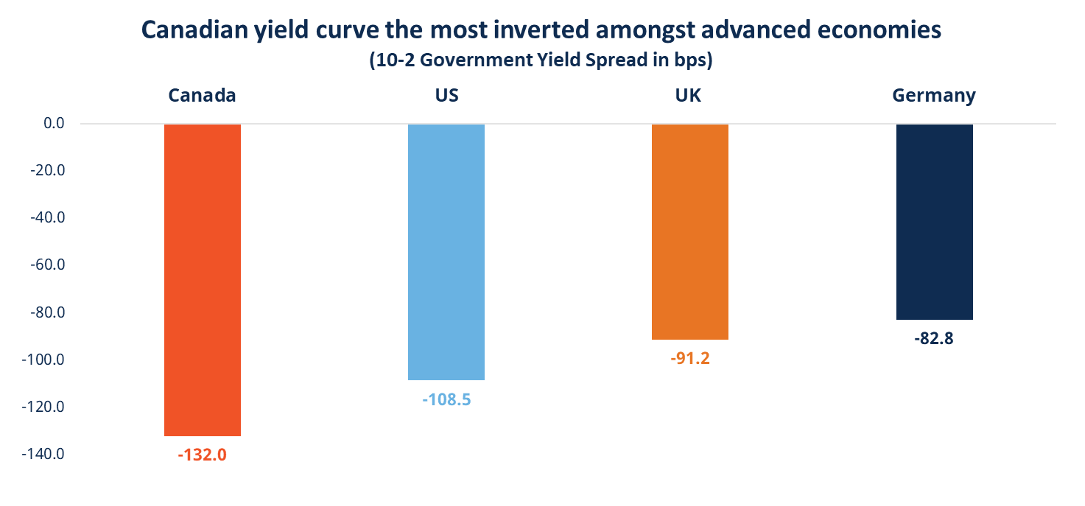

With the Canadian yield curve being highly inverted, and the added rate sensitivity of the Canadian economy, overall short term Canadian fixed income looks increasingly attractive.

Source: Bloomberg, Mackenzie Investments; as of July 3, 2023

Source: Bloomberg, Mackenzie Investments; as of July 3, 2023

2023 mid-year market outlook with ETFs

In our previous ETF Lab ("2023 mid-year market outlook with ETFs"), we covered several key themes we’re watching in the back half of 2023 and several ETF solutions worth considering in today’s uncertain macro environment.

Source: Mackenzie Investments; as of May 31, 2023

Source: Mackenzie Investments; as of May 31, 2023

For a more detailed look at Mackenzie’s outlook for the rest of 2023, be sure to read Mackenzie Investments' 2023 Mid-Year Market Outlook.

Understanding ETF series investments

In recent years, we’ve seen several ETF series launched in Canada. Prerna Mathews, VP of ETF Product Strategy at Mackenzie, breaks down the differences between these and standalone ETFs in her white paper: 'Understanding ETF series investments'.

ETF Flows Update

- ETF assets in Canada climbed to a new record of over $378 billion on the back of a week that saw strong asset returns and over one billion in net inflows.

- The asset allocation ETF category has consistently gained assets over the last several months. While inflows were more muted last week, this category has seen inflow every week this year and has over $18.5 billion in assets.

- Canadian fixed income ETFs remain in favour as investors begin to allocate back to core fixed income and duration. Year to date, Canadian aggregate fixed income ETFs alone have pulled in over $1.9 billion in net flows.2

Mackenzie ETF Top Performers

Source:

1: Brinson, Hood, and Brian D. Singer, 2012

2: Bloomberg, Mackenzie Investments, National Bank Canadian ETF Flows July 2023; all data as of July 4, 2023 unless otherwise noted

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors.

Commissions, brokerage fees, management fees, and expenses all may be associated with ETF investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns, including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of July 4, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.