The ETF Lab

ETF Spotlight: International Equity Investing with ETFs

The outperformance of US equities, more specifically the vaunted ‘Magnificent Seven’, has been well documented. However, International equities, particularly European and Japanese stocks, have held their own over the past year.

Source: Bloomberg; as of December 31, 2023.

Source: Bloomberg; as of December 31, 2023.

This week, we’re looking at International equity ETFs and why investors may want to consider diversifying their portfolio beyond US and Canadian stocks in 2024.

Outlook for International (Developed Market) Stocks

As shown in the chart above, International Equity ETFs (hedged to CAD) outperformed unhedged ETFs over the past two years, largely due to a depreciating Yen.

Source: Bloomberg; as of December 29, 2023.

Source: Bloomberg; as of December 29, 2023.

While most developed market central banks are considering cutting rates in 2024, the Bank of Japan is looking instead to start hiking rates. That will trim the sizable interest rate gap between Japan and the rest of the world, and may help provide support for the Yen, and Japan’s bank stocks.

In Europe and the UK, stock valuations look attractive relative to the S&P 500, even when accounting for the difference in sector weightings.

Source: Bloomberg, Mackenzie Investments; as of December 31, 2023; US Large Cap Equities: Solactive US Large Cap CAD Index, International Developed Market Equities: Solactive GBS Developed Markets ex North America Large & Mid Cap CAD Index, Canadian Equities: Solactive Canada Broad Market Index.

Source: Bloomberg, Mackenzie Investments; as of December 31, 2023; US Large Cap Equities: Solactive US Large Cap CAD Index, International Developed Market Equities: Solactive GBS Developed Markets ex North America Large & Mid Cap CAD Index, Canadian Equities: Solactive Canada Broad Market Index.

The valuation gap was covered well in a recent piece by Mackenzie’s Multi-Asset Strategies Team on ‘Compelling prospects in international markets’. In this piece, the team states “cheap valuations justify higher expected returns for European stocks than for their US and Canadian counterparts”.

International Equity ETFs

QDX (Mackenzie International Equity Index ETF) and the CAD-hedged version QDXH provide diversified exposure to ~1000 stocks from Developed Markets globally (excluding US and Canadian stocks). If the US economy remains resilient, global growth surprises and central banks (particularly in Europe and the UK, which have seen softer economic data of late) deliver on rate cuts, this could help buoy international equities in 2024.

Canadian investors can position towards resilient global growth and away from a potential Canadian recession, by allocating to an ETF like QDX, which invests primarily in European, UK and Japanese stocks.

Source: Mackenzie Investments; as of December 31, 2023.

Source: Mackenzie Investments; as of December 31, 2023.

ETF News & Notes

Global Real Estate Investment Options

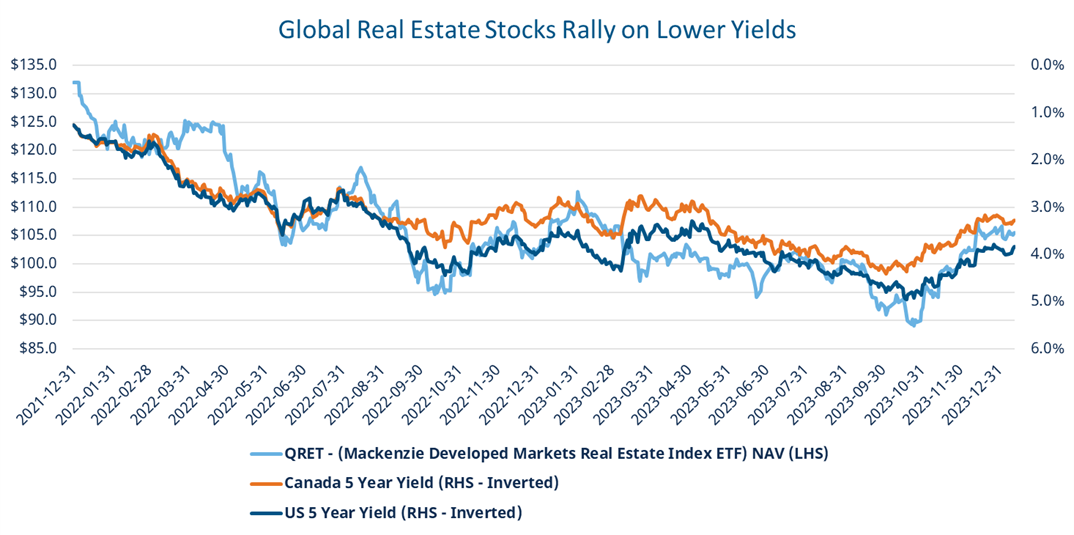

Global REITs, having been battered by the rate hikes in 2022/2023, may be poised for better returns as central banks consider rate cuts in 2024. Last quarter showed what the return potential looks like for a rate sensitive sector that has broadly underperformed the last couple of years. QRET (Mackenzie Developed Markets Real Estate Index ETF) was up +14.2% in Q4 as risk assets rallied on the back of declining bond yields.

Source: Bloomberg; as of December 31, 2023.

Source: Bloomberg; as of December 31, 2023.

QRET (Mackenzie Developed Markets Real Estate Index ETF) has a weighted average dividend yield of 4% and invests in REITS/real estate development companies in developed markets globally.

When trading ETFs, keep an eye on the clock!

For ETFs that track markets outside of Canada, spreads on these ETFs tend to be tightest when the underlying market is trading. For Canadian listed ETFs tracking European equities, this would be roughly 9:30 - 11:30am EST time.

For US equities, advisors should be aware of US holidays that impact US markets, but not necessarily Canadian markets. For instance, January 15, 2024, was Martin Luther King Jr. Day and thus US markets were closed. Therefore, the spreads on US equity ETFs trading in Canada were wider on average that day than usual.

Finally, remember to avoid trading, if possible, in the first and last 15 minutes of the day. In the first few minutes after the market open an ETF’s underlying securities may not have all started trading. In this case, the market maker cannot accurately price the ETF, potentially leading to wider spreads.

As we approach the market close, market participants seek to limit their risk. With fewer market participants willing to make markets, spreads can widen.

Join us for our upcoming webinar February 6th, 2024

Following the most rapid increase in policy rate in decades, the fixed income market is now home to a vast opportunity set. Join us for diverse insights on how to reconstruct your fixed income allocation in the current rate environment. Get practical insights and a deep understanding of how to use tactical fixed income plays. Registration link below:

ETF Flows Update

A few more highlights to cover off 20231:

- The total ETF AUM in Canada closed out the year around it’s record high of ~$383 billion. This reflects a roughly 18.9% compound annual growth rate over the last seven years.

- Canadian ETFs added around $4.2 billion in net flows during December, bringing the YTD flows to $38.6 billion.

- The recent ETF flows momentum amplified the delta relative to Mutual Funds in Canada: since 2019, ETFs have had larger inflows than Mutual Funds YTD in 2023 and in 4 out of the last 5 calendar years.

Mackenzie ETF Top Performers

1 Source: Morningstar, Mackenzie Investments; as of December 31, 2023

FOR ADVISOR USE ONLY. No portion of this communication may be reproduced or distributed to the public as it does not comply with investor sales communication rules. Mackenzie disclaims any responsibility for any advisor sharing this with investors.

Commissions, brokerage fees, management fees, and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns, including in share or unit value and reinvestment of distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any securityholder that would have reduced returns. Exchange Traded Funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This should not be construed as legal, tax or accounting advice. This material has been prepared for information purposes only. The tax information provided in this document is general in nature and each client should consult with their own tax advisor, accountant and lawyer before pursuing any strategy described herein as each client’s individual circumstances are unique. We have endeavored to ensure the accuracy of the information provided at the time that it was written, however, should the information in this document be incorrect or incomplete or should the law or its interpretation change after the date of this document, the advice provided may be incorrect or inappropriate. There should be no expectation that the information will be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise. We are not responsible for errors contained in this document or to anyone who relies on the information contained in this document. Please consult your own legal and tax advisor.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 6, 2023. There should be no expectation that such information will in all circumstances be updated, supplemented, or revised whether as a result of new information, changing circumstances, future events or otherwise.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.

The Mackenzie ETFs are not sponsored, promoted, sold or supported in any other manner by Solactive nor does Solactive offer any express or implicit guarantee or assurance either with regard to the results of using the Indices, trade marks and/or the price of an Index at any time or in any other respect. The Solactive Indices are calculated and published by Solactive. Solactive uses its best efforts to ensure that the Indices are calculated correctly. Irrespective of its obligations towards the Mackenzie ETFs, Solactive has no obligation to point out errors in the Indices to third parties including but not limited to investors and/or financial intermediaries of the Mackenzie ETFs. Neither publication of the Solactive Indices by Solactive nor the licensing of the Indices or related trade mark(s) for the purpose of use in connection with the Mackenzie ETFs constitutes a recommendation by Solactive to invest capital in said Mackenzie ETFs nor does it in any way represent an assurance or opinion of Solactive with regard to any investment in these Mackenzie ETFs.